Citigroup Inc. (Citi) is a leading global financial services company with over 200 million customer accounts and

Question:

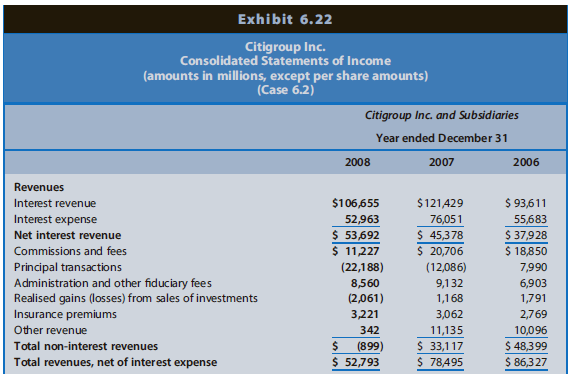

Citigroup Inc. (Citi) is a leading global financial services company with over 200 million customer accounts and operations in more than 140 countries. Its operating units Citicorp and Citi Holdings provide a broad range of financial products and services to consumers, governments, institutions, and corporations. Services include investment banking, consumer and corporate banking and credit, securities brokerage, and wealth management. Citi reported a net loss of $27,684 million, or $5.59 per share, in 2008. Exhibit 6.22 presents Citigroup's consolidated statements of income for 2006 to 2008.

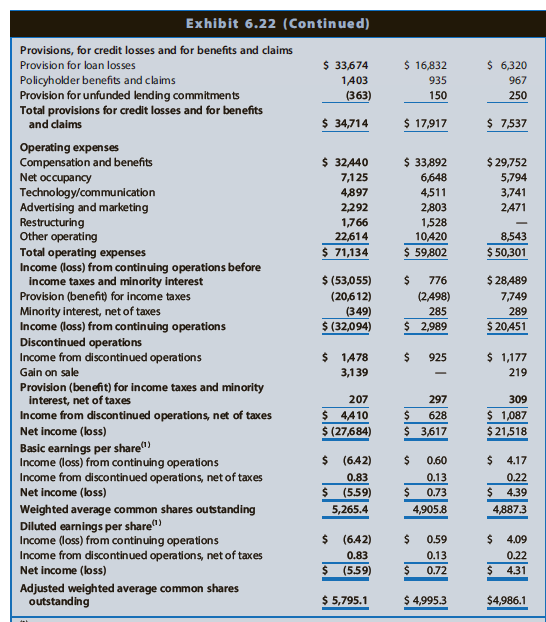

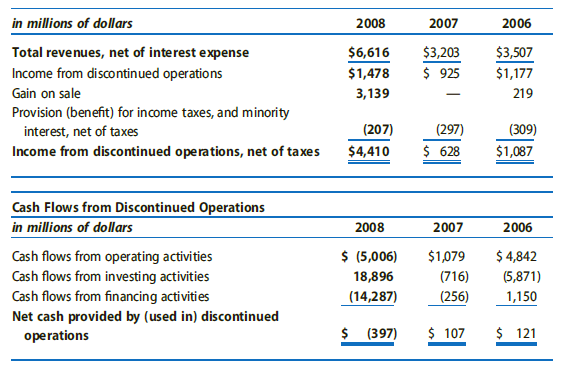

(1)Diluted shares used in the diluted EPS calculation represent basic shares for 2009 due to the net loss. Using actual diluted shares would result in anti-dilution.Excerpts from Financial Statement Notes:The following excerpts were disclosed in the notes to Citigroup's 2008 financial statements:3. Discontinued Operations Sale of Citigroup's German Retail Banking Operations On December 5, 2008, Citigroup sold its German retail banking operations to Credit Mutuel for Euro 5.2 billion, in cash plus the German retail bank's operating net earnings accrued in 2008 through the closing. The sale resulted in an after-tax gain of approximately $3.9 billion including the after-tax gain on the foreign currency hedge of $383 million recognised during the fourth quarter of 2008. The sale does not include the corporate and investment banking business or the Germanybased European data center. The German retail banking operations had total assets and total liabilities as of November 30, 2008, of $15.6 billion and $11.8 billion, respectively. Results for all of the German retail banking businesses sold, as well as the net gain recognized in 2008 from this sale, are reported as Discontinued Operations for all periods presented. Summarized financial information for Discontinued Operations, including cash flows, related to the sale of the German retail banking operations is as follows:

(1)Diluted shares used in the diluted EPS calculation represent basic shares for 2009 due to the net loss. Using actual diluted shares would result in anti-dilution.Excerpts from Financial Statement Notes:The following excerpts were disclosed in the notes to Citigroup's 2008 financial statements:3. Discontinued Operations Sale of Citigroup's German Retail Banking Operations On December 5, 2008, Citigroup sold its German retail banking operations to Credit Mutuel for Euro 5.2 billion, in cash plus the German retail bank's operating net earnings accrued in 2008 through the closing. The sale resulted in an after-tax gain of approximately $3.9 billion including the after-tax gain on the foreign currency hedge of $383 million recognised during the fourth quarter of 2008. The sale does not include the corporate and investment banking business or the Germanybased European data center. The German retail banking operations had total assets and total liabilities as of November 30, 2008, of $15.6 billion and $11.8 billion, respectively. Results for all of the German retail banking businesses sold, as well as the net gain recognized in 2008 from this sale, are reported as Discontinued Operations for all periods presented. Summarized financial information for Discontinued Operations, including cash flows, related to the sale of the German retail banking operations is as follows:

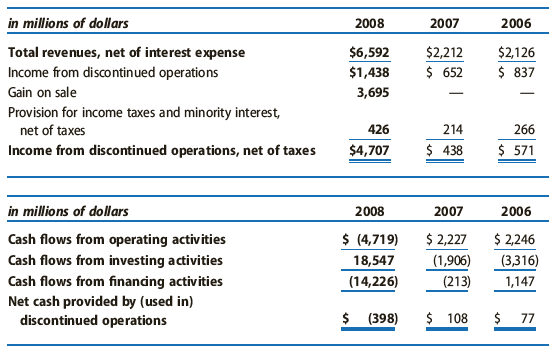

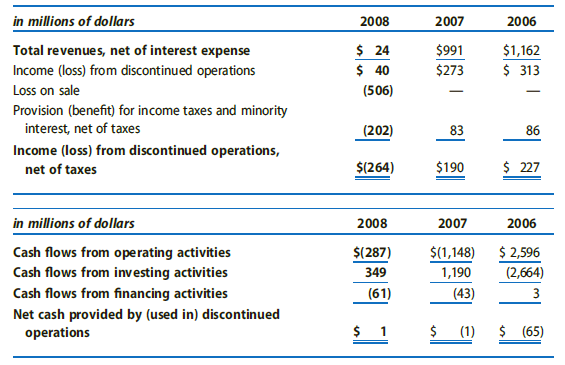

CitiCapital On July 31, 2008, Citigroup sold substantially all of CitiCapital, the equipment finance unit in North America. The total proceeds from the transaction were approximately $12.5 billion and resulted in an after-tax loss to Citigroup of $305 million. This loss is included in Income from discontinued operations on the Company's Consolidated Statement of Income for the second quarter of 2008. The assets and liabilities for CitiCapital totaled approximately $12.9 billion and $0.5 billion, respectively, at June 30, 2008.This transaction encompassed seven CitiCapital equipment finance business lines, including Healthcare Finance, Private Label Equipment Finance, Material Handling Finance, Franchise Finance, Construction Equipment Finance, Bankers Leasing, and CitiCapital Canada. CitiCapital's Tax Exempt Finance business was not part of the transaction and was retained by Citigroup.CitiCapital had approximately 1,400 employees and 160,000 customers throughout North America.Results for all of the CitiCapital businesses sold, as well as the net loss recognized in 2008 from this sale, are reported as Discontinued operations for all periods presented.Summarized financial information for Discontinued operations, including cash flows, related to the sale of CitiCapital is as follows:

CitiCapital On July 31, 2008, Citigroup sold substantially all of CitiCapital, the equipment finance unit in North America. The total proceeds from the transaction were approximately $12.5 billion and resulted in an after-tax loss to Citigroup of $305 million. This loss is included in Income from discontinued operations on the Company's Consolidated Statement of Income for the second quarter of 2008. The assets and liabilities for CitiCapital totaled approximately $12.9 billion and $0.5 billion, respectively, at June 30, 2008.This transaction encompassed seven CitiCapital equipment finance business lines, including Healthcare Finance, Private Label Equipment Finance, Material Handling Finance, Franchise Finance, Construction Equipment Finance, Bankers Leasing, and CitiCapital Canada. CitiCapital's Tax Exempt Finance business was not part of the transaction and was retained by Citigroup.CitiCapital had approximately 1,400 employees and 160,000 customers throughout North America.Results for all of the CitiCapital businesses sold, as well as the net loss recognized in 2008 from this sale, are reported as Discontinued operations for all periods presented.Summarized financial information for Discontinued operations, including cash flows, related to the sale of CitiCapital is as follows:

Sale of the Asset Management Business On December 1, 2005, the Company completed the sale of substantially all of its Asset Management business to Legg Mason, Inc. (Legg Mason).On January 31, 2006, the Company completed the sale of its Asset Management business within Bank Handlowy (an indirect banking subsidiary of Citigroup located in Poland) to Legg Mason. This transaction, which was originally part of the overall Asset Management business sold to Legg Mason on December 1, 2005, was postponed due to delays in obtaining local regulatory approval. A gain from this sale of $18 million after-tax and minority interest ($31 million pretax and minority interest) was recognized in the first quarter of 2006 in Discontinued operations. During March 2006, the Company sold 10.3 million shares of Legg Mason stock through an underwritten public offering. The net sale proceeds of $ 1.258 billion resulted in a pretax gain of $24 million in ICG. In September 2006, the Company received from Legg Mason the final closing adjustment payment related to this sale. This payment resulted in an additional after-tax gain of $51 million ($83 million pretax), recorded in Discontinued operations.Sale of the Life Insurance and Annuities Business On July 1, 2005, the Company completed the sale of Citigroup's Travelers Life & Annuity and substantially all of Citigroup's international insurance businesses to MetLife, Inc. (MetLife). During the first quarter of 2006, $15 million of the total $657 million federal tax contingency reserve release was reported in Discontinued operations as it related to the Life Insurance and Annuities business sold to MetLife. In July 2006, Citigroup recognized an $85 million after-tax gain from the sale of MetLife shares. This gain was reported in income from continuing operations in ICG.In July 2006, the Company received the final closing adjustment payment related to this sale, resulting in an after-tax gain of $75 million ($115 million pretax), which was recorded in Discontinued operations. In addition, during the third quarter of 2006, a release of $42 million of deferred tax liabilities was reported in Discontinued operations as it related to the Life Insurance & Annuities business sold to MetLife.In December 2008, the Company fulfilled its previously agreed upon obligations with regard to its remaining 10% economic interest in the long-term care business that it had sold to the predecessor of Genworth Financial in 2000. Under the terms of the 2005 sales agreement of Citi's Life Insurance and Annuities business to MetLife, Citi agreed to reimburse MetLife for certain liabilities related to the sale of the long-term-care business to Genworth's predecessor. The assumption of the final 10% block Genworth at December 31, 2008, resulted in a pretax loss of $50 million ($33 million after-tax), which has been reported in Discontinued operations.Combined Results for Discontinued Operations The following is summarized financial information for the German retail banking operations, CitiCapital, Life Insurance and Annuities business, Asset Management business, and TPC:

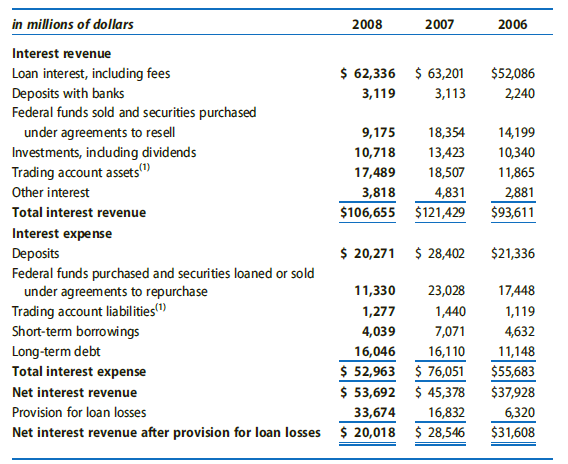

5. Interest Revenue and Expense For the years ended December 31, 2008, 2007, and 2006, respectively, interest revenue and expense consisted of the following:

(1) Interest expense on Trading account facilities of ICG is reported as a reduction of interest revenue from Trading account assets.

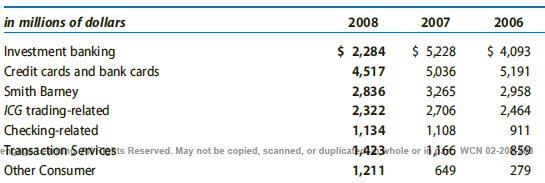

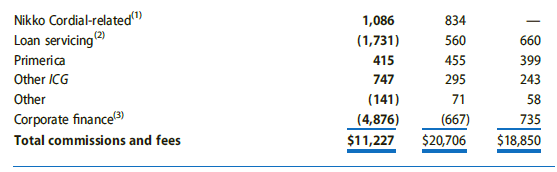

6. Commissions and FeesCommissions and fees revenue includes charges to customers for credit and bank cards, including transaction-processing fees and annual fees; advisory and equity and debt underwriting services; lending and deposit-related transactions, such as loan commitments, standby letters of credit and other deposit and loan servicing activities; investment management-related fees, including brokerage services and custody and trust services; and insurance fees and commissions. The following table presents commissions and fees revenue for the years ended December 31:

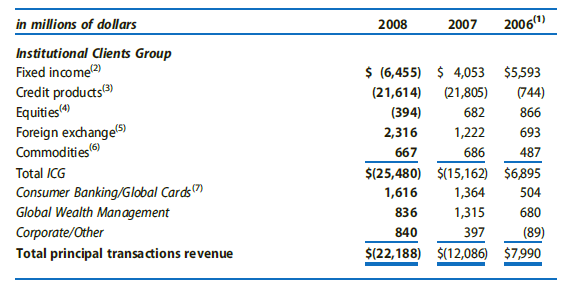

(1) Commissions and fees for Nikko Cordial have not been detailed due to unavailability of the information.(2) Includes fair value adjustments on mortgage servicing assets. The mark-to-market on the underlying economic hedges of the MSRs is included in Other revenue.(3) Includes write-downs of approximately $4.9 billion in 2008 and $1.5 billion in 2007, net of underwriting fees, on funded ?nd unfunded highly leveraged finance commitments, recorded at fair value and reported as loans held for sale in Other assets. Write-downs were recorded on all highly leveraged finance commitments where there was value impairment, regardless of funding date.7. Principal TransactionsPrincipal transactions revenue consists of realized and unrealized gains and losses from trading activities. Not included in the table below is the impact of net interest revenue related to trading activities, which is an integral part of trading activities?? profitability. The following table presents principal transactions revenue for the years ended December 31:

(1) Reclassified to conform to the current period??s presentation.(2) Includes revenues from government securities and corporate debt, municipal securities, preferred stock, mortgage securities, and other debt instruments. Also includes spot and forward trading of currencies and exchange-traded and over-the-counter (OTC) currency options, options on fixed income securities, interest rate swaps, currency swaps, swap options, caps and floors, financial futures, OTC options, and forward contracts on fixed income securities. Losses in 2008 reflect the volatility and dislocation in the credit and trading markets.

(3) Includes revenues from structured credit products such as North America and Europe collateralized debt obligations. In 2007 and 2008, losses recorded were related to subprime-related exposures in ICG??s lending and structuring business and exposures to super senior CDOs.

(4) Includes revenues from common, preferred and convertible preferred stock, convertible corporate debt, equity linked notes, and exchange-traded and OTC equity options and warrants.

(5) Includes revenues from foreign exchange spot, forward, option and swap contracts, as well as translation gains and losses.(6) Primarily includes the results of Phibro LLC, which trades crude oil, refined oil products, natural gas, and other commodities.(7) Includes revenues from various fixed income, equities and foreign exchange transactions.

10. RestructuringIn the fourth quarter of 2008, Citigroup recorded a pretax restructuring expense of $1.797 billion pre-tax related to the implementation of a Company-wide re-engineering plan. This initiative will generate headcount reductions of approximately 20,600. The charges related to the 2008 Re-engineering Projects Restructuring Initiative are reported in the Restructuring line on the Company??s Consolidated Statement of Income and are recorded in each segment. In 2007, the Company completed a review of its structural expense base in a Company-wide effort to create a more streamlined organization, reduce expense growth, and provide investment funds for future growth initiatives. As a result of this review, a pretax restructuring charge of $1.4 billion was recorded in Corporate/Other during the first quarter of 2007. Additional net charges of $151 million were recognized in subsequent quarters throughout 2007 and a net release of $31 million in 2008 due to a change in estimates. The charges related to the 2007 Structural Expense Review Restructuring Initiative are reported in the Restructuring line on the Company??s Consolidated Statement of Income. The primary goals of the 2007 Structural Expense Review and Restructuring, and the 2008

Re-engineering Projects and Restructuring Initiatives were:

- Eliminate layers of management/improve workforce management;

- Consolidate certain back-office, middle-office and corporate functions.

- Increase the use of shared services.

- Expand centralized procurement.

- Continue to rationalize operational spending on technology.

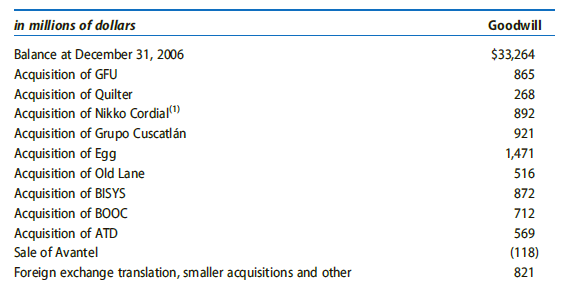

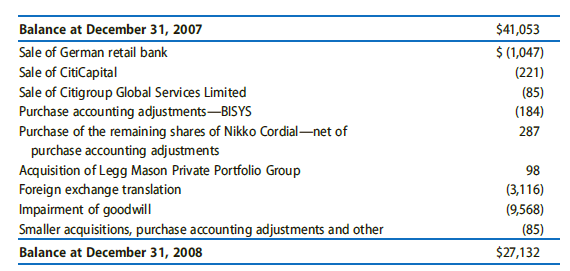

The implementation of these restructuring initiatives also caused certain related premises and equipment assets to become redundant. The remaining depreciable lives of these assets were shortened, and accelerated depreciation charges began in the second quarter of 2007 and fourth quarter of 2008 for the 2007 and 2008 initiatives, respectively, in addition to normal scheduled depreciation.19. Goodwill and Intangible AssetsGoodwillThe changes in goodwill during 2007 and 2008 were as follows:

In the following press release, Citi further describes the source of the goodwill impairment:Citi Announces Fourth Quarter Goodwill Impairment of $9.6 Billion42 Results in Additional Net Loss of $9.0 Billion for 2008 New York - Citi announced today that it recorded a pre-tax goodwill impairment charge of approximately $9.6 billion ($8.7 billion after-tax) in the fourth quarter of 2008. Citi had previously announced in its fourth quarter earnings press release (January 16, 2009) that it was continuing to review its goodwill to determine whether a goodwill impairment had occurred as of December 31, 2008, and this charge is the result of that review and testing. The goodwill impairment charge was recorded in North America Consumer Banking, Latin America Consumer Banking, and EMEA Consumer Banking, and resulted in a write-off of the entire amount of goodwill allocated to those reporting units. The charge does not result in a cash outflow or negatively affect the Tier 1 or Total Regulatory Capital ratios, Tangible Common Equity or Citi's liquidity position as of December 31, 2008. In addition, Citi recorded a $374 million pre-tax charge ($242 million after-tax) to reflect further impairment evident in the intangible asset related to Nikko Asset Management at December 31, 2008.

The primary cause for both the goodwill and the intangible asset impairments mentioned above was the rapid deterioration in the financial markets, as well as in the global economic outlook generally, particularly during the period beginning mid-November through year-end 2008. This deterioration further weakened the near term prospects for the financial services industry.

Giving effect to these charges, Net Income (Loss) from Continuing Operations for 2008 was $(32.1) billion and Net Income (Loss) was $(27.7) billion, resulting in Diluted Earnings per Share of $(6.42) and $(5.59) respectively. A complete description of Citi's goodwill impairment testing as of December 31, 2008 and the related charges will be included in Citi's Form 10-K to be filed with the Securities and Exchange Commission on or before March 2, 2009.

REQUIREDConsider the following items reported in Citi??s Consolidated Statement of Income:

- Principal transactions

- Realized (gain) losses from sales of investments

- Provision for loan losses

- Restructuring

- Other operating expenses (which presumably includes the goodwill impairment)

- Discontinued operations

- Discuss whether you would eliminate all or part of each item when assessing current profitability and forecasting the future earnings of Citi. If so, what adjustments would you make to the financial statements (assuming a tax rate of 35%)?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Intangible Assets

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Annuity

An annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw