Question:

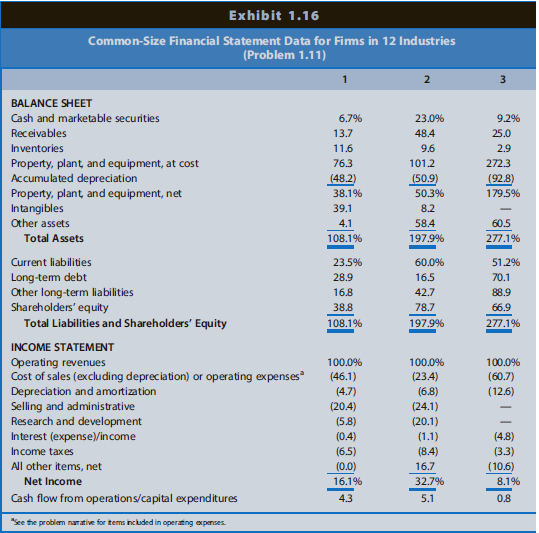

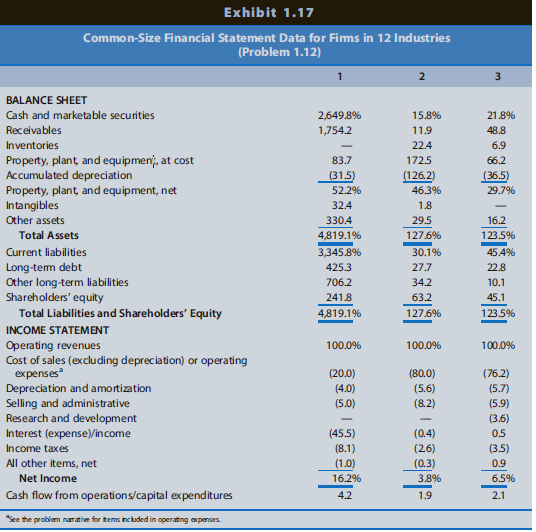

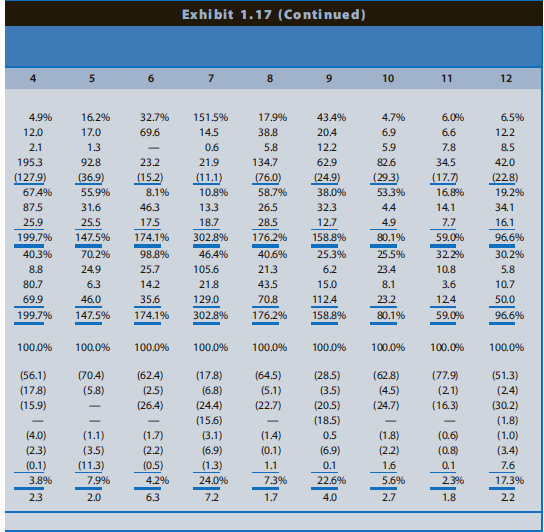

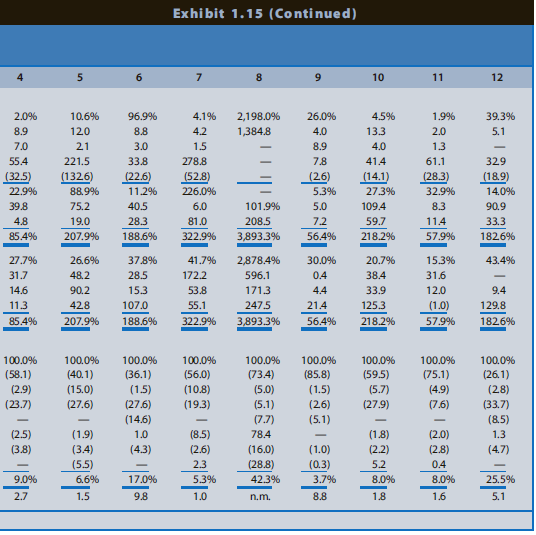

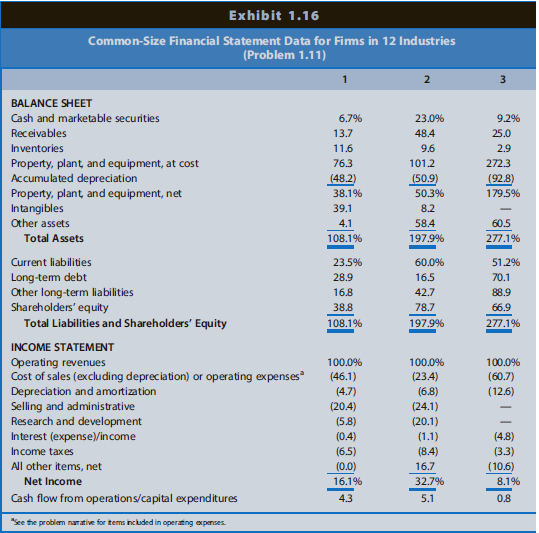

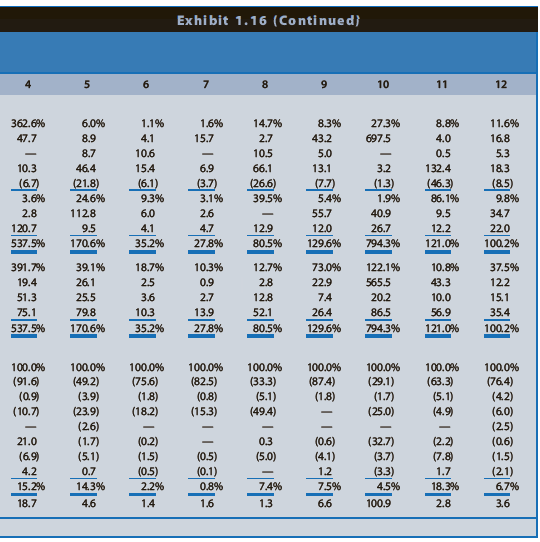

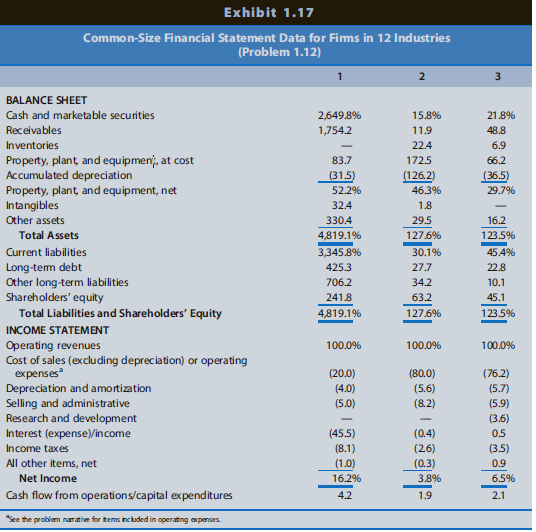

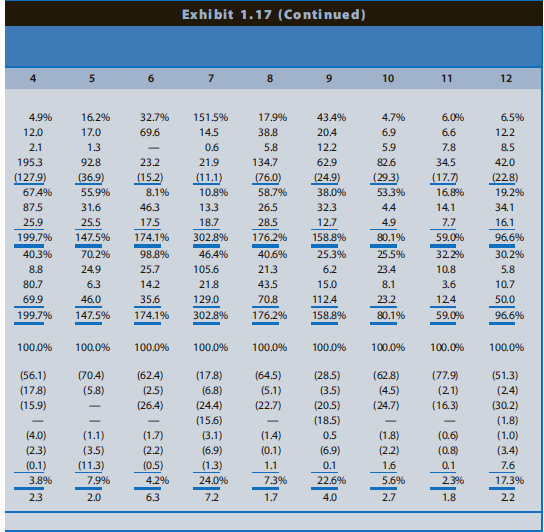

Effective financial statement analysis requires an understanding of a firm€™s economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.17 (pages 56€“ 57) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year). A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. The names of the 12 companies, the headquarter countries, and brief descriptions follow.

A. Accor (France): World€™s largest hotel group, operating hotels under the names of Sofitel, Novotel, Motel 6, and others. Accor has grown in recent years by acquiring established hotel chains.

B. Carrefour (France): Operates grocery supermarkets and hypermarkets in Europe, Latin America, and Asia.

C. Deutsche Telekom (Germany): Europe€™s largest provider of wired and wireless telecommunication services. The telecommunications industry has experienced increased deregulation in recent years.

D. E.ON AG (Germany): One of the major public utility companies in Europe and the world€™s largest privately owned energy service provider.

E. BNP Paribas (France): A multinational bank and financial services company. Offers insurance and banking services. Operating revenues include insurance premiums received, investment income, and interest revenue on loans. Operating expenses include amounts actually paid or amounts it expects to pay in the future on insurance coverage outstanding during the year.

F. Interpublic Group (U.S.): Creates advertising copy for clients. Inter public purchases advertising time and space from various media and sells them to clients. Operating revenues represent the commissions or fees earned for creating advertising copy and selling media time and space. Operating expenses include employee compensation.

G. Marks & Spencer (U.K.): Operates department stores in England and other retail stores in Europe and the United States. Offers its own credit card for customers€™ purchases.

H. Nestle´ (Switzerland): World€™s largest food processor, offering prepared foods, coffees, milk-based products, and mineral waters.

I. Roche Holding (Switzerland): Creates, manufactures, and distributes a wide variety of prescription drugs.

J. Nippon Steel (Japan): Manufacturer and seller of steel sheets and plates and other construction materials.

K. Oracle (U.S.): Offers a comprehensive and fully integrated stack of cloud applications and platform systems. Oracle outsources a majority of its manufacturing.

L. Toyota Motor (Japan): Manufactures automobiles and offers financing services to its customers.

REQUIRED

Use the ratios to match the companies in Exhibit 1.17 with the firms listed above, and explain your reasoning using the strategy framework in the chapter.

Transcribed Image Text:

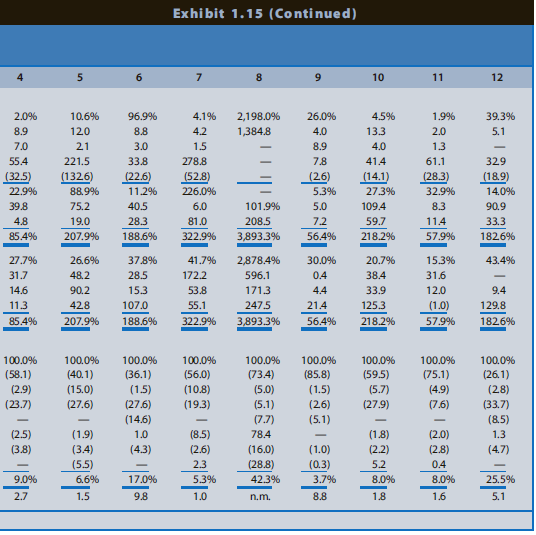

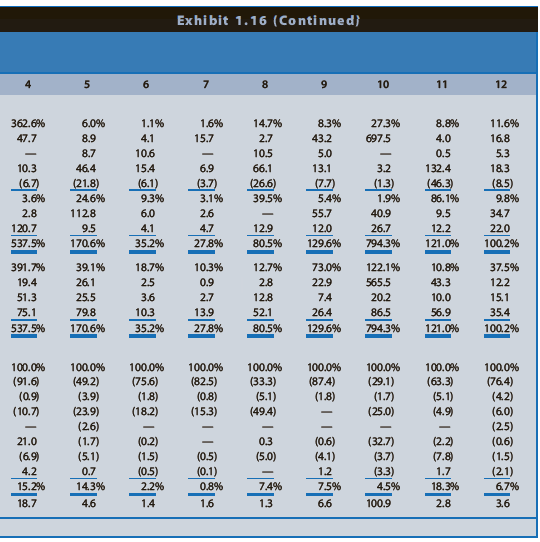

Exhibit 1.15 (Continued) 5 10 11 12 2.0% 10.6% 96.9% 4.1% 2,198.0% 26.0% 4.5% 1.9% 39.3% 8.9 120 8.8 4.2 1,384.8 4.0 13.3 2.0 5.1 7.0 21 3.0 1.5 8.9 4.0 1.3 33.8 278.8 55.4 221.5 7.8 41.4 61.1 329 (32.5) (2.6) (1326) (22.6) (52.8) (14.1) (28.3) (18.9) 22.9% 88.9% 11.2% 226.0% 5.3% 27.3% 32.9% 14.0% 101.9% 39.8 75.2 40.5 6.0 5.0 109.4 8.3 90.9 4.8 19.0 28.3 81.0 208.5 7.2 59.7 11.4 33.3 85.4% 207.9% 188.6% 322.9% 3,893.3% 56.4% 218.2% 57.9% 1826% 27.7% 26.6% 37.8% 41.7% 2,878.4% 30.0% 20.7% 15.3% 43.4% 172.2 31.6 31.7 48.2 28.5 596.1 0.4 38.4 9.4 14.6 90.2 15.3 53.8 171.3 4.4 33.9 12.0 21.4 125.3 11.3 42.8 107.0 55.1 247.5 (1.0) 129.8 57.9% 85.4% 207.9% 188.6% 322.9% 3,893.3% 56.4% 218.2% 1826% 100.0% (73.4) (5.0) (5.1) (7.7) 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% (58.1) (2.9) (23.7) (40.1) (36.1) (59.5) (26.1) (56.0) (10.8) (19.3) (85.8) (1.5) (75.1) (15.0) (1.5) (5.7) (4.9) (2.8) (27.6) (27.6) (26) (27.9) (7.6) (33.7) (14.6) (5.1) (8.5) (2.5) (1.9) 1.0 (8.5) 78.4 (1.8) (2.0) 1.3 (3.8) (3.4) (4.3) (2.6) (16.0) (28.8) (1.0) (2.2) (2.8) (4.7) (0.3) 5.2 (5.5) 2.3 0.4 9.0% 6.6% 17.0% 5.3% 42.3% 3.7% 8.0% 8.0% 25.5% 9.8 2.7 1.5 1.0 8.8 1.8 1.6 5.1 n.m. Exhibit 1.16 Common-Size Financial Statement Data for Fims in 12 Industries (Problem 1.11) BALANCE SHEET Cash and marketable securities 6.7% 23.0% 9.2% Receivables 13.7 48.4 25.0 Inventories 11.6 9.6 2.9 Property, plant, and equipment, at cost Accumulated depreciation Property, plant, and equipment, net Intangibles Other assets 76.3 101.2 272.3 (48.2) (50.9) (92.8) 38.1% 50.3% 179.5% 39.1 8.2 4.1 58.4 60.5 Total Assets 108.1% 197.9% 277.1% Current liabilities 23.5% 60.0% 51.2% Long-tem debt Other long-term liabilities Shareholders' equity 28.9 16.5 70.1 16.8 42.7 88.9 38.8 78.7 66.9 Total Liabilities and Shareholders' Equity 108.1% 197.9% 277.1% INCOME STATEMENT Operating revenues Cost of sales (excluding depreciation) or operating expenses Depreciation and amortization Selling and administrative Research and development Interest (expense)/income 100.0% 100.0% 100.0% (46.1) (23.4) (60.7) (4.7) (6.8) (12.6) (20.4) (24.1) (20.1) (5.8) (0.4) (1.1) (4.8) Income taxes (6.5) (0.0) (8.4) All other items, net (3.3) (10.6) 16.7 Net Income 16.1% 32.7% 8.1% Cash flow from operations/capital expenditures 4.3 5.1 0.8 "See the problem narative for tems included in operating oxpenses.