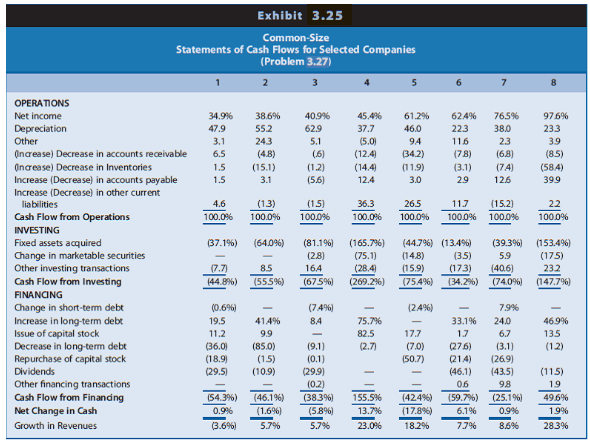

Exhibit 3.25 presents common-size statements of cash flows for eight firms in various industries. All amounts in

Question:

- Biogen creates and manufactures biotechnology drugs. Many drugs are still in the development phase in this high-growth, relatively young industry. Research and manufacturing facilities are capital-intensive, although the research process requires skilled scientists.

- Chevron Texaco explores, extracts, refines, and markets petroleum products. Extraction and refining activities are capital-intensive. Petroleum products are in the mature phase of their product life cycle.

- H. J. Heinz manufactures and markets branded consumer food products. Heinz has acquired several other branded food products companies in recent years.

- Home Depot sells home improvement products. Home Depot competes in a new retail category known as €˜€˜category killer€™€™ stores. Such stores offer a wide selection of products in a particular product category (for example, books, pet products, or office products). In recent years, these stores have taken away significant market share from more diversified department and discount stores.

- Inland Steel manufactures steel products. Although steel plants are capital-intensive, they also use unionized workers to process iron into steel products. Demand for steel products follows cyclical trends in the economy. Steel manufacturing in the United States is in the mature phase of its life cycle.

- Pacific Gas & Electric provides electric and gas utility services. The electric utility industry in the United States has excess capacity. Increased competition from less regulated, more open markets has forced down prices and led some utilities to reduce their capacity.

- ServiceMaster provides home cleaning and restoration services. ServiceMaster has recently acquired firms offering cleaning services for healthcare facilities and has broadened its home services to include termite protection, garden care, and other services. ServiceMaster operates as a partnership. Partnerships do not pay income taxes on their earnings each year. Instead, partners (owners) include their share of the earnings of ServiceMaster in their taxable income.

- Sun Microsystems creates, manufactures, and markets computers, primarily to the scientific and engineering markets and to network applications. Sun follows an assembly strategy in manufacturing computers, outsourcing the components from other firms worldwide.

REQUIRED

Use the clues in the common-size statements of cash flows to match the companies in Exhibit 3.25 with the companies listed here. Discuss the reasoning for your selection in each case.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Question Posted: