Prior to Year 8, Cooper Corporation engaged in a wide variety of industries, including weapons manufacturing under

Question:

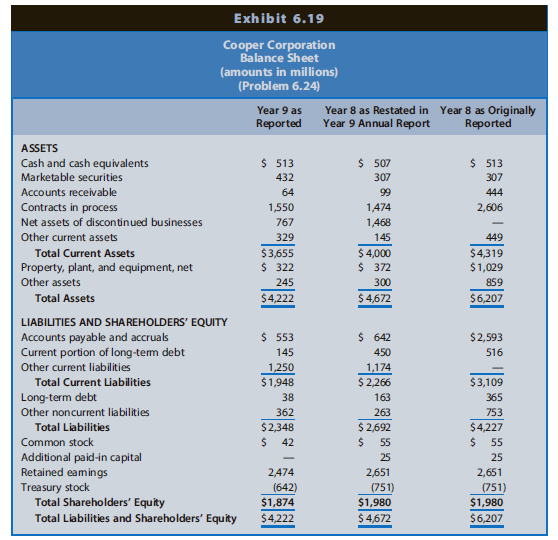

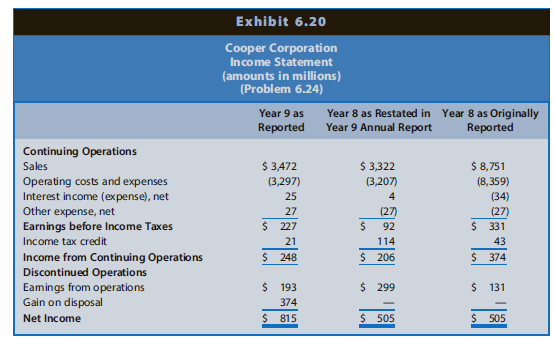

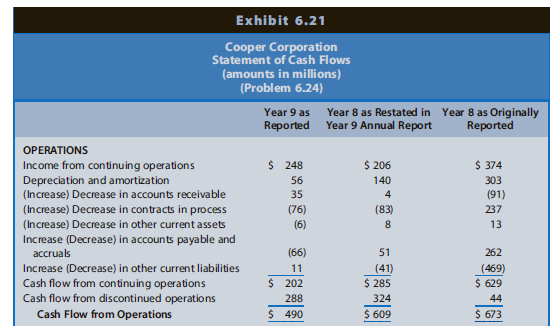

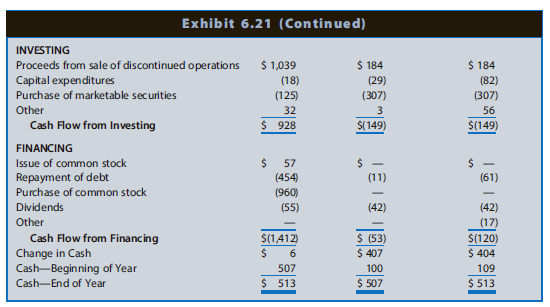

Prior to Year 8, Cooper Corporation engaged in a wide variety of industries, including weapons manufacturing under government contracts, information technologies, commercial aircraft manufacturing, missile systems, coal mining, material service, ship management, and ship financing. During Year 8, Cooper sold its information technologies business. During Year 9, Cooper sold its commercial aircraft manufacturing business. During Year 9, it also announced its intention to sell its missile systems, coal mining, material service, ship management, and ship financing businesses. These strategic moves left Cooper with only its weapons manufacturing business. Financial statements for Cooper for Year 9 as reported, Year 8 as restated in the Year 9 annual report for discontinued operations, and Year 8 as originally reported appear in Exhibit 6.19 (balance sheet), Exhibit 6.20 (income statement), and Exhibit 6.21 (statement of cash flows).

REQUIREDa. Refer to Exhibit 6.19. Why does the restated amount for total assets for Year 8 of $4,672 million differ from the originally reported amount of $6,207 million?b. Refer to Exhibit 6.20. Why are the originally reported and restated net income amounts for Year 8 the same (that is, $505 million) when each of the individual revenues and expenses decreased on restatement?c. Refer to Exhibit 6.21. Why is the restated amount of cash flow from operations for Year 8 of $609 million less than the originally reported amount of $673 million?d. If the analyst wanted to analyze changes in the structure of assets and equities between Year 8 and Year 9, which columns and amounts in Exhibit 6.19 would he or she use?Explain.e. If the analyst wanted to analyze changes in the operating profitability between Year 8 and Year 9, which columns and amounts in Exhibit 6.20 would he or she use? Explain.f. If the analyst wanted to use cash flow ratios to assess short-term liquidity and long-term solvency risk, which columns and amounts in Exhibit 6.21 would he or she use? Explain.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw