Refer to Problem 8.25 for Stebbins Corporation for Year 1, its first year of operations. Exhibit 8.31

Question:

Refer to Problem 8.25 for Stebbins Corporation for Year 1, its first year of operations. Exhibit 8.31 shows the amounts for the Canadian subsidiary for Year 2. The average exchange rate during Year 2 was C$1:US$0.82, and the exchange rate on December 31, Year 2, was C$1:US$0.84. The Canadian subsidiary declared and paid dividends on December 31, Year 2.

REQUIRED

a. Prepare a balance sheet, an income statement, and a retained earnings statement for the Canadian subsidiary for Year 2 in U.S. dollars, assuming that the Canadian dollar is the functional currency. Include a separate schedule showing the computation of the translation adjustment for Year 2 and the change in the translation adjustment account.

b. Repeat Requirement a assuming that the U.S. dollar is the functional currency. Include a separate schedule showing the computation of the translation gain or loss.

c. Why is the sign of the translation adjustment for Year 2 under the all-current translation method and the translation gain or loss under the monetary/nonmonetary translation method the same? Why do their amounts differ?

d. Assuming that the firm could justify either translation method, which method would management of Stebbins Corporation likely prefer for Year 2? Why?

Exhibit 8.31

Canadian Subsidiary Financial Statements Year 2 | |

Balance Sheet | |

ASSETS | |

Cash | C$116,555 |

Rent receivable | 30,000 |

Building (net) | 450,000 |

C$596,555 | |

LIABILITIES AND EQUITY | |

Accounts payable | C$ 7,500 |

Salaries payable | 5,500 |

Common stock | 555,555 |

Retained earnings | 28,000 |

C$596,555 | |

Income Statement | |

Rent revenue | C$150,000 |

Operating expenses | (34,000) |

Depreciation expense | (25,000) |

Translation exchange gain | — |

Net Income | C$ 91,000 |

Retained Earnings Statement | |

Balance, January 1, Year 2 | C$ 12,000 |

Net income | 91,000 |

Dividends | (75,000) |

Balance, December 31, Year 2 | C$ 28,000 |

Problem 8.25

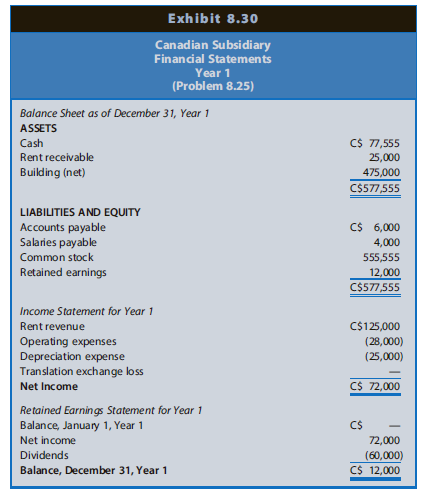

Stebbins Corporation established a wholly owned Canadian subsidiary on January 1, Year 1, by contributing US$500,000 for all of the subsidiary's common stock. The exchange rate on that date was C$1:US$0.90 (that is, one Canadian dollar equaled 90 U.S. cents). The Canadian subsidiary invested C$500,000 in a building with an expected life of 20 years and rented it to various tenants for the year. The average exchange rate during Year 1 was C$1:US$0.85, and the exchange rate on December 31, Year 1, was C$1:US$0.80. Exhibit 8.30 shows the amounts taken from the books of the Canadian subsidiary at the end of Year 1, measured in Canadian dollars.

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw