You are the portfolio manager of a highyield bond portfolio at Solomon Group. You are concerned about

Question:

You are the portfolio manager of a highyield bond portfolio at Solomon Group.

You are concerned about the financial stability of Florida Gypsum Corporation (FGC), whose bonds represent one of the holdings in your portfolio at the middle of Year 6. The bonds you hold, 13.25% senior subordinated debentures due in Year 16, were issued at par in Year 5, and are currently priced in your portfolio at 53. Your high-yield bond sales staff is not optimistic they can even develop a bid at that level. FGC is a large producer of gypsum products, accounting for approximately one-third of total gypsum sales. The company also manufactures ceiling tile, caulks, sealants, floor and wall adhesives, and other specialty building products.

In Year 5, FGC did a leveraged recapitalization of its balance sheet. This involved paying a large dividend to common shareholders financed with several new subordinated debt financings, including the 13.25% debentures that you hold. The company’s primary competitor, American Gypsum, is highly leveraged, following its acquisition by a large Canadian company. Due to a downturn in residential and commercial construction activity beginning in Year 4, demand for gypsum wallboard fell off through the middle of Year 6. However, capacity continues to expand at a rate of nearly 2% per year. As a result, capacity utilization has declined to 85% currently, from 87% in Year 4 and a peak of 95% in Years 1 and 2. The price of wallboard, which peaked in Year 2, has subsequently declined by more than 30%.

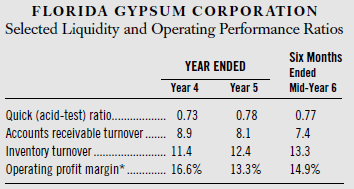

To help you in analyzing FGC’s prospects, you assemble various financial data that follow. The director of fixed income research at Solomon Group suggests that you look carefully at ratios of short-term liquidity and operating performance, specifically the quick ratio, accounts receivable turnover ratio, inventory turnover ratio, and operating profit margin. You prepare the table below and schedule a meeting with the director to discuss what the firm should do with FGC.

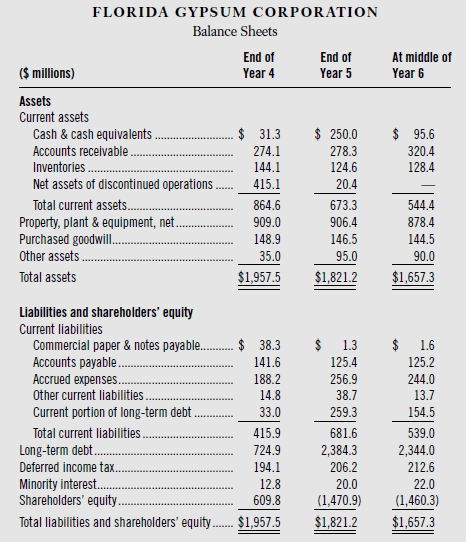

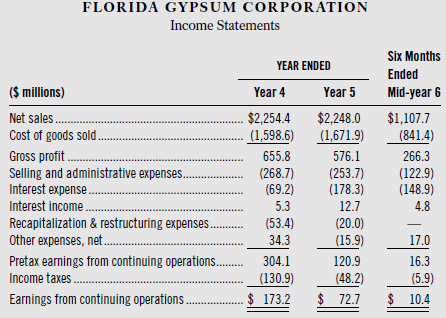

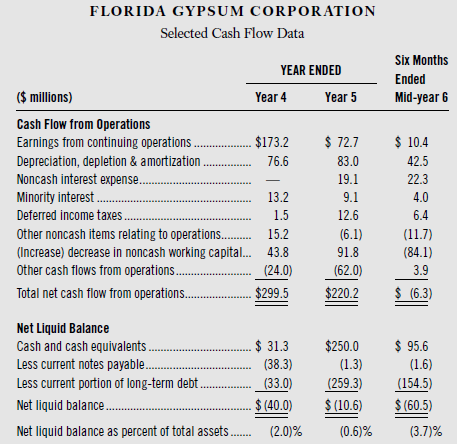

Financial statement data for Florida Gypsum Corporation include the following:

Required:

a. The director of fixed income research subsequently argues that the four ratios computed do not reveal important changes in the financial condition of FGC. Discuss limitations of these ratios in assessing the liquidity and operating performance of a company like FGC.

b. Identify at least two better measures of short-term liquidity and operating performance for FGC. Calculate their values and discuss their trend over the period Year 4 through middle of Year 6. Explain why these measures better reflect FGC’s liquidity and operating performance.

c. Based on the analysis performed in (b) and on the background information provided, recommend and justify whether you should attempt to sell the FGC bonds, retain them, or buy more FGC bonds.

Inventory Turnover RatioInventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Debentures

Debenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Financial Statement Analysis

ISBN: 978-0073379432

10th edition

Authors: K. R. Subramanyam, John J. Wild