As she headed toward her boss's office, Emily Hamilton, chief operating officer for the Aerocomp Corporation-a computer

Question:

As she prepared to enter Kay's office, Emily pulled her summary sheets from her briefcase and quickly reviewed the details of the four projects, all of which she considered to be equally risky.

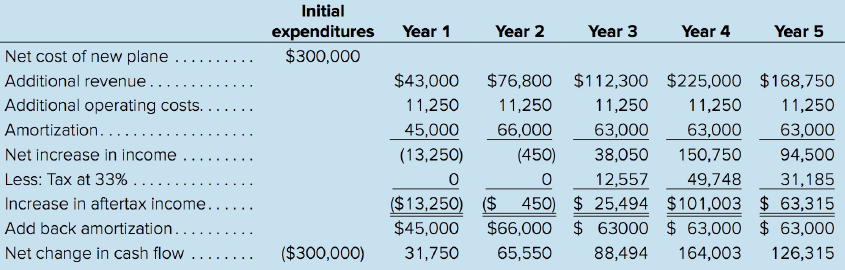

A. A proposal to add a jet to the company's fleet. The plane was only six years old and was considered a good buy at $300,000. In return, the plane would bring over $600,000 in additional revenue during the next five years with only about $56,000 in operating costs. (See Table 1 for details.)

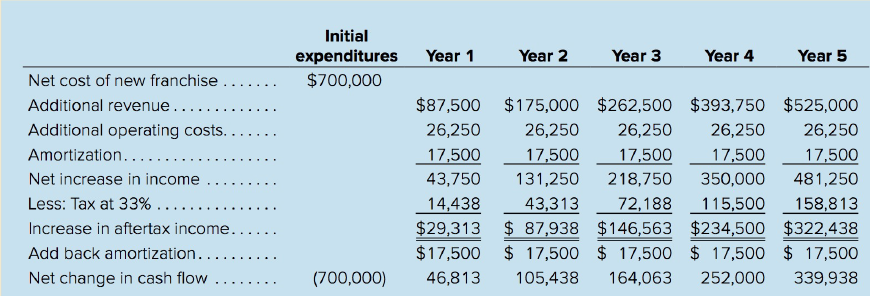

B. A proposal to diversify into copy machines. The franchise was to cost $700,000, which would be amortized over a 40-year period. The new business was expected to generate over $1.4 million in sales over the next five years, and over $800,000 in aftertax earnings. (See Table 2 for details.)

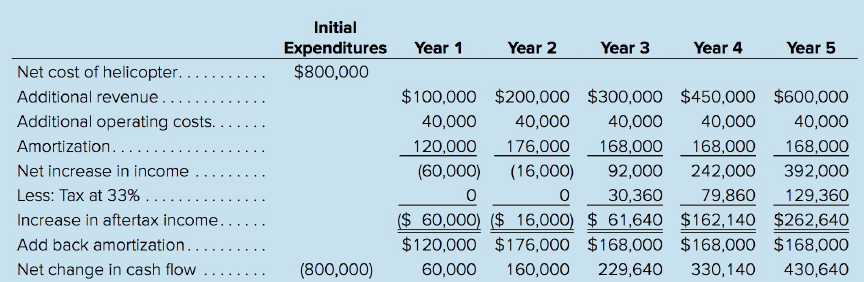

C. A proposal to buy a helicopter. The machine was expensive and, counting additional training and licensing requirements, would cost $40,000 a year to operate. However, the versatility that the helicopter was expected to provide would generate over $1.5 million in additional revenue, and it would give the company access to a wider market as well. (See Table 3 for details.)

Table 1

Financial analysis of project A: Add a twin-jet to the company's fleet

Table 2

Financial analysis of project 8: Diversify into copy machines

Table 3

Financial analysis of project C: Add a helicopter to the company's fl eet

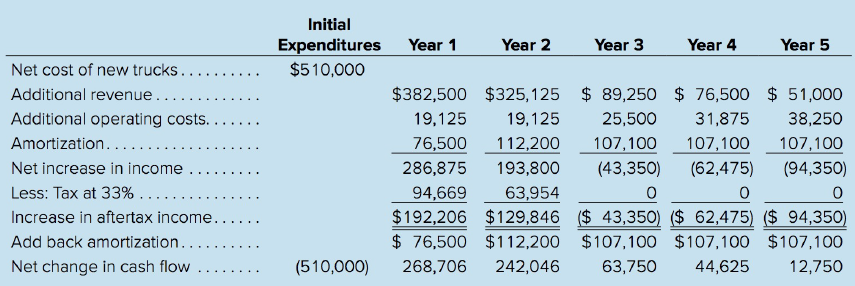

D. A proposal to begin operating a fleet of trucks. Ten could be bought for only $51,000 each, and the additional business would bring in almost $700 ,000 in new sales in the first two years alone. (See Table 4 for details.)

In her mind, Emily quickly went over the evaluation methods she had used in the past: payback period, internal rate of return, and net present value. Emily knew that Kay would add a fourth, size of reported earnings, but she hoped she could talk Kay out of using it this time. Emily herself favoured the NPV method, but she had always had a tough time getting Kay to understand it.

One additional constraint that Emily had to deal with was Kay's insistence that no outside financing be used this year. Kay was worried that the company was growing too fast and had piled up enough debt for the time being. She was also against a stock issue for fear of diluting earnings and her control over the firm.

Table 4

Financial analysis of project D: Add fleet of trucks

As a result of Kay's prohibition of outside financing, the size of the capital budget this year was limited to $800,000, which meant that only one of the four projects under consideration could be chosen. Emily wasn't too happy about that, either, but she had decided to accept it for now and concentrate on selecting the best of the four.

As she closed her briefcase and walked toward Kay's door, Emily reminded herself to have patience; Kay might not trust financial analysis, but she would listen to sensible arguments. Emily only hoped her financial analysis sounded sensible!

a. Refer to Tables 1 through 4. Add up the total increase in aftertax income for each project. Given what you know about Kay Marsh, to which project do you think she will be attracted?

b. Compute the payback period, IRR, and NPV of all four alternatives based on cash flow. Use 10 percent for the cost of capital in your calculations. For the payback period, merely indicate the year in which the cash flow equals or exceeds the initial investment. You do not have to compute midyear points.

c. (1) According to the payback method, which project should be selected?

(2) What is the chief disadvantage of this method?

(3) Why would anyone want to use this method?

d. (1) According to the IRR method, which project should be chosen?

(2) What is the major disadvantage of the IRR method that occurs when high IRR projects are selected?

(3) Can you think of another disadvantage of the IRR method?

(4) If Kay had not putalimiton the size of the capital budget, would the IRR method allow acceptance of all four alternatives? If not, which one( s) would be rejected and why?

e. (1) According to the NPV method, which project should be chosen? How does this differ from the answer under the IRR?

(2) If Kay had not put a limit on the size of the capital budget, under the NPV method which projects would be accepted? Do the NPV and IRR both reject the same project(s)? Why?

(3) Given all the facts of the case, are you more likely to select project A or C?

f. (1) According to the PI method, which project should be chosen?

(2) Does your answer conflict with the NPV method? Why? Which method suggests the best project?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta