On a Saturday afternoon in May 2015, Robert Boyle and his wife Janet were sitting on the

Question:

There's just no comparison between life here and on the mainland."

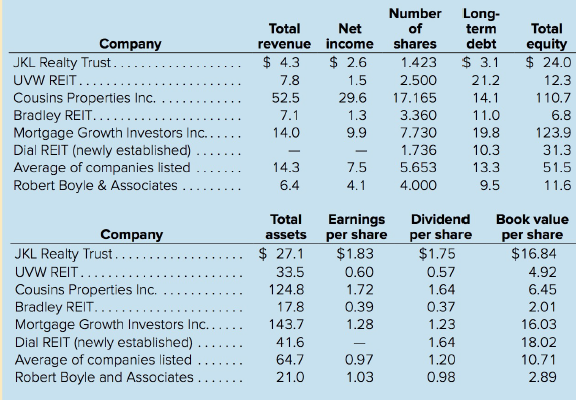

Table 1

Robert Boyle & Associates

Income Statement

For the Year Ending 2014

(in millions)

Loan income............................................$0.240

Rental income...........................................5.992

Other income ...... .. ........ . .. ....................0.168

Total income .... .. ........ . .. .. .. . .. .............6.400

Amortization ............. ................................0.920

Genera l and administrative expense........0.435

Operating income ....................... . ...........5.045

Interest expense ............. . .. .. .. . ....... ...0.945

Net income..............................................$4.100

Dividend paid..........................................$4.100

Table 2

Robert Boyle & Associates

Balance Sheet

As of December 31, 2014

(in millions)

Assets

Cash and equivalents ................................ .$ 2.100

Land development and construction loans......2.000

Property owned, net of amortization ........... .16.000

Other assets ............................ . ....................0.900

Total assets ................... .. .. .. .. ................$21.000

Liabilities and Equity

Bank borrowings .............. .. .. .. .. . ..... .....$ 2.000

Mortgages on property ..... .. .. . . .. . ............7.000

Other liabilities ............. . .............................0.550

Total liabilities .... . . ........ .. .. .. .. ...... ..........9.550

Common stock ........ . ................................11.550

Retained earnings........................................0.000

Total equity ................ .. .. . . .. . ................11.550

Total liabilities and equity.........................$21.000

"You get no argument from me," Janet replied. "I've been telling you that ever since we bought this house."

"You could develop real estate just as easily from here as in the city, you know. Which reminds me, what's the latest on the Saltspring Centre project? You've been quiet about it for about a week now." Janet referred to a proposal Robert had made a few months ago to build the first shopping centre on Saltspring Island.

Robert sighed. "Well, it's on the back burner right now for lack of financing. I'm convinced that it would make us a lot of money; but, the trouble is, it will take a lot of money to get it built-about $10 million, in fact, and that's more than we've ever had to raise before."

"Oh, come on," Janet said. (She had always been an active participant in the business.) "You've built two shopping centres so far, and didn't have any trouble getting the money for them. Why don't you just borrow some more?"

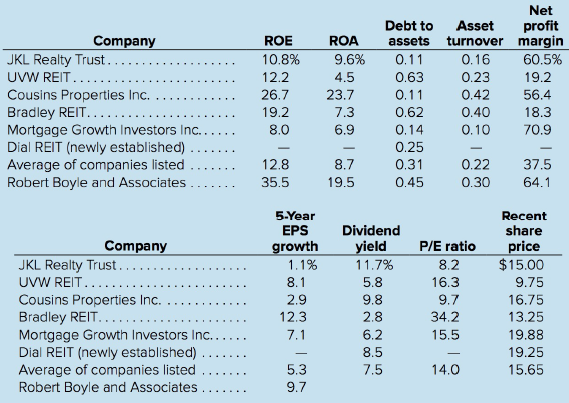

"Too much borrowed already, I'm afraid," Robert replied. "Our debt-to-assets ratio is quite a bit over the average for REITs now, and our investment dealer says that another loan, or even a bond issue, would be quite expensive in terms of interest cost." (See Table 3 for comparisons between Boyle & Associates and a sample of other REITs.) "Well, what about the shareholders?" Janet insisted. "Can't they contribute some more equity money?" (Boyle & Associates' 40 existing shareholders held 4 million shares with a book value of$2.89 each.)

Robert responded with a smile. "You know the answer to that already," he said. "You and I are the biggest shareholders. But even if alJ 40 shareholders put in an equal amount it would cost each of us $250,000. You and I don't have that kind of cash, and I'm sure the rest of the shareholders don't either." "Well, then," Janet continued unperturbed, "you need some more shareholders. Why don't you sell shares to the public? I'm sure it would be a great success once people knew what the company's plans were."

"Yes, that's what our investment dealer said, too," Robert replied. "But I have some reservations. For instance, look at the dilution effect. You know, to qualify as a REIT and, therefore, to pay no income tax at the corporate level, we pay out 100 percent of earnings every year as dividends. Anything that affects earnings per share, then, affects the shareholders' dividends. If we issue a whole lot of new shares, earnings per share will be diluted severely, and the existing shareholders will be most unhappy!"

"But, Robert," Janet said, "aren't you ignoring the money you will make on the proceeds of the shares issue? It seems to me that the income from the investment ought to more than offset the initial dilution, producing even more earnings-and dividends-than before. Surely the shareholders will see that."

"Maybe so," Robert said, "but that's not the only problem. Suppose, for example, that the whole shopping centre deal falls through?" (It was not certain at this time that the residents and government authorities on Saltspring would approve the project.) "If it does, the price of our company's shares, now publicly traded, will surely fall, to the dismay and embarrassment of us all. You know, managing a publicly traded company is not at all like managing a private one. The pressure for short-term performance is terrific. If I don't produce, I'll be voted out of office at the next shareholders' meeting."

"And that's another thing," Robert continued, warming up, "shareholders' meetings. Look what you have to go through as a publicly traded company: shareholders' meetings, annual reports, B.C. Securities Commission filings , disclosure notices, regulators poking around; why, the administrative tasks alone will require a couple of full- time people! Besides that, look at the cost of the issue itself. The investment dealer will take a cut of about 6.5 percent of the issue, and we'll have to pay about $60,000 out of-pocket for legal and accounting fees and printing expenses. I bet we'd have to issue almost $11 million in shares just to get $10 million in cash. Pretty expensive!"

"Yes, that's so," Janet agreed. "But even so, the benefits might outweigh the costs. One thing you haven't mentioned is the increase in liquidity for the company's shares you would get if they were publicly traded. You know most of our existing shareholders have been with us for the whole eight years, and they have quite a bit of money tied up in this one basket. How can they diversify their portfolios or sell their holdings outright? I bet they'd love to see the shares publicly traded in the market with an established price." "All right, you may have a point," Robert conceded. "Tell you what, I'll write a letter to our existing shareholders outlining the pros and cons, and ask them to respond with recommendations. If the prevailing sentiment is to go public, we'll do it, and if it's not, we won't. In the end, though, the whole discussion may depend on how badly we want to build the Saltspring Centre. If we want it, we'llprobablyhave to go public to build it." "I knew you would have it all figured out," Janet said, approvingly. "Now, how about a martini?"

a. Refer to Table 3 for comparisons between Boyle & Associates and other REITs. The industry average P/E ratio. The investment dealer will set Boyle's P/E ratio based on how the company compares to the industry average in six areas: return on equity, return on assets, debt to assets, asset turnover, net profit margin, and five-year earnings per share growth. The investment dealer will start with the industry average P/E, and will add one-half point for each of the areas in which Boyle is superior to the industry, and will subtract one-half point for each area in which Boyle is inferior to the industry. After tabulating the results, the investment dealer will subtract one point for good measure to ensure the issue presents an attractive opportunity. On this basis, what will the dealer determine to be the proper P/E ratio for Boyle & Associates?

b. Considering that the dealer's spread will be 6.5 percent of the total issue size, and Boyle will have to pay $60,000 out-of-pocket expenses, what is the total issue size necessary to yield $10 million in cash to the company?

c. Assume 699,029 shares will be sold at a public price of $15.45 to provide approximately $10.8 million. What dollar return on the net proceeds of the offering must Boyle & Associates earn to bring earnings per share up to what it was before the offering ($1.03)? After you compute the dollar return on the net proceeds, convert this to a ratio (percentage of net proceeds). Compare this answer to Boyle's return on assets in 2014 (Table 3). Based on the company's performance in 2014, do you think the required return can be earned?

d. If half of Boyle's associates decide to sell their existing shares in addition to the initial offering, how many total shares will have to be issued by the company to yield $10 million in cash to the company?

e. Summarize the pros and cons of Boyle & Associates going public. Based on Robert Boyle's letter, would you recommend going public or not? What would be the major reason affecting your opinion?

Table 3

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dealer

A dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta