The CFO of Ink Imagination (II) wants to calculate next year?s EPS using different leverage ratios. II?s

Question:

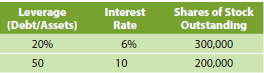

The CFO of Ink Imagination (II) wants to calculate next year?s EPS using different leverage ratios. II?s total assets are $5 million, and its marginal tax rate is 40 percent. The company has estimated next year?s EBIT for three possible economic states: $1.2 million with a 0.2 probability, $800,000 with a 0.5 probability, and $500,000 with a 0.3 probability. Calculate II?s expected EPS, standard deviation, and coefficient of variation for each of the following capital structures. Which capital structure do you recommend?

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: