This problem compares the after tax income on a $35,000 investment for the following two investors resident

Question:

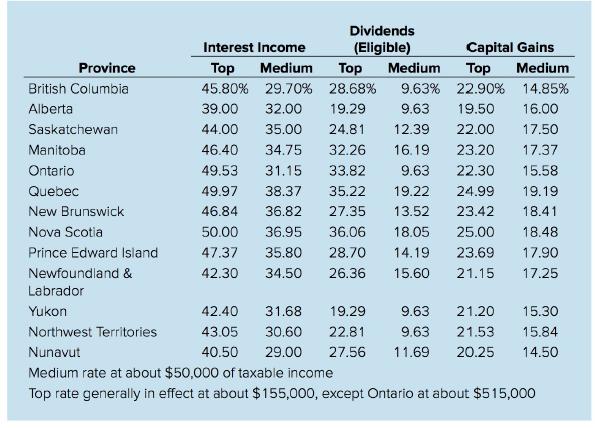

This problem compares the after tax income on a $35,000 investment for the following two investors resident in Ontario and two possible investments. Table 2-13 will be of assistance. Stanley Truck earns $45,000 per year. This is his only investment. Blanche Carr is in the top marginal tax bracket. This is her only investment. Investment A provides $2 ,800 in dividends and no capital gains. Investment B provides no dividends but $2,800 of capital gains.

a. Calculate the after tax return for Truck in Investment A and Investment B.

b. Calculate the after tax return for Carr in Investment A and Investment B.

c. Indicate the difference in after tax income between the two investors in Investment A.

d. Indicate the difference in after tax income between the two investors in Investment B.

e. In the answers to parts c and d, why is there a smaller difference between the answers for one investment than for the other?

Table 2-13

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta