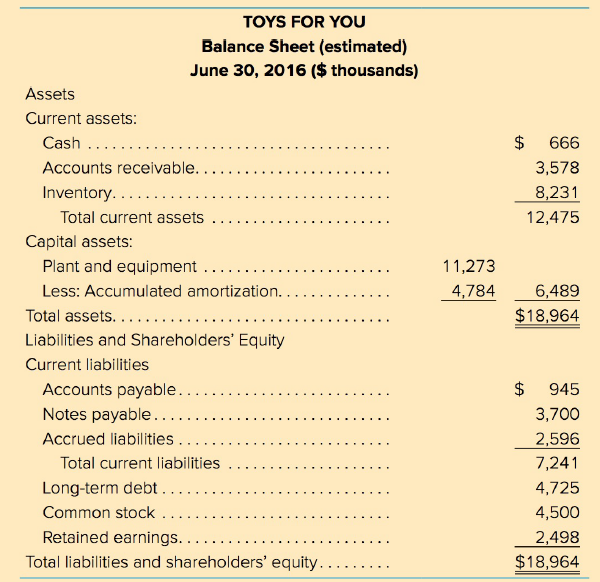

Toys for You, a manufacturing company, has been growing quickly but has found that its financial situation

Question:

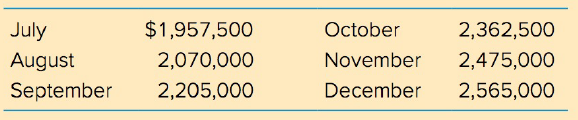

Sales for May were $1,732,500 and will be approximately $1,845,000 for the current month of June.

It is projected that the current collection period of 60 days will be reduced to 50 days for July and August, 42 days for September and October, and will meet the target of 35 days in November and December.

Purchases are forecast to be $585,000 a month beginning in July, until December. In May they were $675,000, and in June they are expected to be $607,500. The purchases are paid in 40 days. Labour expense will be paid as incurred and will be $195,000 a month. Other expenses of manufacturing will also be paid as incurred and are expected to be $375,000 a month. Cost of goods sold has regularly been 70 percent of sales.

Amortization is $38,000 per month. Selling and administrative expenses are expected to be 13 percent of sales. The tax rate is 42 percent.

There will be payments on notes of $675,000 in each of August and November. Interest of $270,000 and income taxes of $338,000 are both due in October. Dividends of $22,500 are payable in July and October.

Using the information above, prepare pro forma statements for Toys for You for the three months ending September and December 2016. Also construct a cash budget for the six-month period and identify any need for short-term financing. There are no changes in accounts not mentioned above. Comment on the policy changes and examine the consequences if the collection period remains at 60 days. Assume capital assets are sufficient for increased sales.

Cash BudgetA cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta