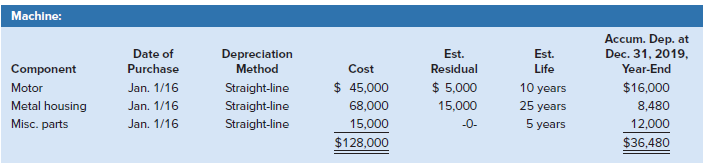

Flint Solar Energy showed the following information in its Property, Plant, and Equipment subledger regarding a machine.

Question:

Flint Solar Energy showed the following information in its Property, Plant, and Equipment subledger regarding a machine.

On September 1, 2020, the motor was replaced with a new one costing $60,000; it was purchased on account. The new motor had an estimated residual value of $10,000 and an estimated life of eight years. Calculate the total depreciation expense to be recorded on the machine for 2020.

Machine: Accum. Dep. at Dec. 31, 2019, Year-End Depreciation Date of Purchase Jan. 1/16 Jan. 1/16 Jan. 1/16 Est. Residual Est. Life Component Cost Method Straight-line Straight-line Straight-line 10 years Motor Metal housing Misc. parts $ 45,000 $ 5,000 15,000 $16,000 8,480 12,000 $36,480 25 years 5 years 68,000 15,000 $128,000 -0-

Step by Step Answer:

Motor old 45000 5000 40000 10yrs 812 2667 Motor ...View the full answer

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

Flint Energy showed the following information in its Property, Plant and Equipment Subledger regarding a machine. On September 1, 2014, the motor was replaced with a new one costing $60,000; it was...

-

Brainium Technologies showed the following information in its Property, Plant, and Equipment subledger regarding a warehouse. During 2020, it was determined that the original useful life on the...

-

Pete?s Propellers Company showed the following information in its Property, Plant, and Equipment subledger regarding Machine #5027. On January 7, 2020, the machine blade cracked and it was replaced...

-

Given the following marginal utility schedule for good X and good Y for an individual A, given that the price of X and the price of Y are both $10, and that the individual spends all his income of...

-

In which quadrant do the following points lie? (a) (1, 4) (b) (3, 2) (c) (4,3) (d) (4,1)

-

According to Thompson, what are the inherent evils created by any competitive market system? What alternative to capitalism did he suggest?

-

Do analytical efforts, big data examinations, and textual analyses impact compliance and fraud deterrence? Provide an explanation for your opinion.

-

Flash Manufacturing manufactures 16 GB flash drives (jump drives). Price and cost data for a relevant range extending to 200,000 units per month are as follows: Sales price Per-unit (current monthly...

-

Elaborate on why you feel that the chosen concept Tariffs is most important in relation to the wine and spirit industry. How does this affect you as a sales associate working in the wine and spirit...

-

The following is an extract from Accountancy Age, 25 January 2001. A powerful and shadowy group of senior partners from the seven largest firms has emerged to move closer to edging control of...

-

On August 26, 2015, Race World International purchased a piece of equipment for a total of $426,000. The PPE subledger shows the following information regarding the equipment: Early in 2020, it was...

-

Ocean Fishers Ltd. had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2012, for $77,000. The PPE subledger shows the following information regarding the boat: On June 27,...

-

a. What are the more likely alternatives for you to borrow $70 million? b. Assuming that you decide to issue debt securities, describe the types of financial institutions that may purchase these...

-

The acceleration of a point P, moving along a straight line, is directed to the point Z and its magnitude is inverse proportional to the distance x. For t=0 the point P has the distance Xo = 2 m, the...

-

Two forces,Force-60 N and Force-P with angle of 130 deg as shown. If the their resultant R is perpendicular to force P. what is the value of force P: 60 N R 130

-

Three point charges are glued down in the configuration shown below, where the distances a = 20 cm and b = 12 cm. What is the net electric field at point P? 10 nC a + + 5.0 nC b -10 nC P

-

Find lim x 5 (x 3)(x + 4) x+5

-

On March 1, 2024, Baddour, Incorporated, issued 10% bonds, dated January 1, with a face amount of $160 million. The bonds were priced at $142.50 million (plus accrued interest) to yield 12%. The...

-

You are provided with the following income accounts of Oakridge Ltd. for the year ended December 31, 2014. Oakridge reported profit from operations of $125,000 for the year ended December 31, 2014....

-

"Standard-cost procedures are particularly applicable to process-costing situations." Do you agree? Why?

-

(a) Define the terms assets, liabilities, and owners equity. (b) What items affect owners equity?

-

Which of the following items are liabilities of Stanley Jewelry Stores? (a) Cash. (b) Accounts payable. (c) Drawings. (d) Accounts receivable. (e) Supplies. (f) Equipment. (g) Salaries payable. (i)...

-

Which of the following items are liabilities of Stanley Jewelry Stores? (a) Cash. (b) Accounts payable. (c) Drawings. (d) Accounts receivable. (e) Supplies. (f) Equipment. (g) Salaries payable. (i)...

-

Using the data above, fill out the missing information below: The average of the variable score is 45 The average of the variable submission is 1.2 The sample variance of the submission is 1.7 . The...

-

Financial information is presented here for two companies. (a) Fill in the missing amounts. Sales revenue Sales returns and allowances (a) Crane Company Bramble Company $94,000 (d) $ 5,400 87,000...

-

Hartford Research issues bonds dated January 1 that pay interest semiannually on June 30 and December 31. The bonds have a $40,000 par value and an annual contract rate of 10%, and they mature in 10...

Study smarter with the SolutionInn App