Keith Williams and Brian Adams were students when they formed a partnership several years ago for a

Question:

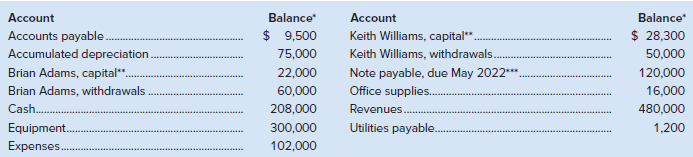

Keith Williams and Brian Adams were students when they formed a partnership several years ago for a parttime business called Music Works. Adjusted trial balance information for the year ended December 31, 2020, appears below.

Required

1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership agreement states that profit/(losses) are to be shared by allowing a $90,000 per year salary allowance to Williams, a $150,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio.

2. Prepare the journal entry to close the Income Summary account to the partners? capital accounts.

3. Prepare a statement of changes in equity and a classified balance sheet.

Analysis Component: Why might the partners? capital accounts be so small relative to the amount of the withdrawals made?

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann