Leslie Bjorn, Jason Douglas, and Tom Pierce have an architect firm and share profit(losses) in a 3:1:1

Question:

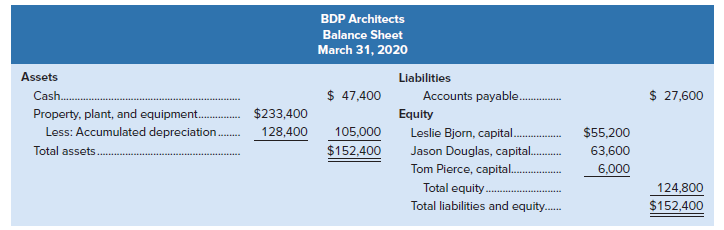

Leslie Bjorn, Jason Douglas, and Tom Pierce have an architect firm and share profit(losses) in a 3:1:1 ratio. They decide to liquidate their partnership on March 31, 2020. The balance sheet appeared as follows on the date of liquidation:

Required Prepare the entries on March 31, 2020, to record the liquidation under each of the following independent assumptions:

a. Property, plant, and equipment is sold for $270,000.

b. Property, plant, and equipment is sold for $66,000.

Assume that any deficiencies are paid by the partners.

LiquidationLiquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: