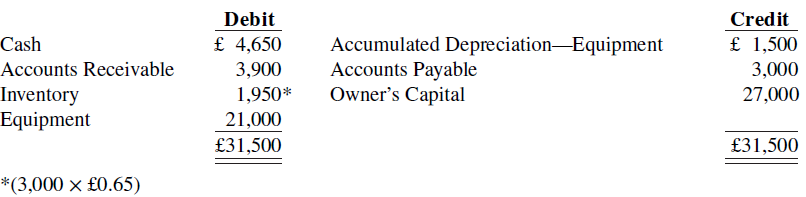

On December 1, 2020, Cambridge Printers had the account balances shown below. The following transactions occurred during

Question:

On December 1, 2020, Cambridge Printers had the account balances shown below.

The following transactions occurred during December.

Dec. 3 Purchased 4,000 units of inventory on account at a cost of £0.72 per unit.

5 Sold 4,400 units of inventory on account for £0.92 per unit. (It sold 3,000 of the £0.65 units and 1,400 of the £0.72.)

7 Granted the December 5 customer £184 credit for 200 units of inventory returned costing £144. These units were returned to inventory.

17 Purchased 2,200 units of inventory for cash at £0.78 each.

22 Sold 2,000 units of inventory on account for £0.95 per unit. (It sold 2,000 of the £0.72 units.)

Adjustment data:

1. Accrued salaries payable £400.

2. Depreciation £200 per month.

Instructions

a. Journalize the December transactions and adjusting entries, assuming Cambridge uses the perpetual inventory method.

b. Enter the December 1 balances in the ledger T-accounts and post the December transactions. In addition to the accounts mentioned above, use the following additional accounts: Cost of Goods Sold, Depreciation Expense, Salaries and Wages Expense, Salaries and Wages Payable, Sales Revenue, and Sales Returns and Allowances.

c. Prepare an adjusted trial balance as of December 31, 2020.

d. Prepare an income statement for December 2020 and a classified statement of financial position at December 31, 2020.

e. Compute ending inventory and cost of goods sold under FIFO, assuming Cambridge uses the periodic inventory system.

f. Compute ending inventory and cost of goods sold under average-cost, assuming Cambridge uses the periodic inventory system.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt