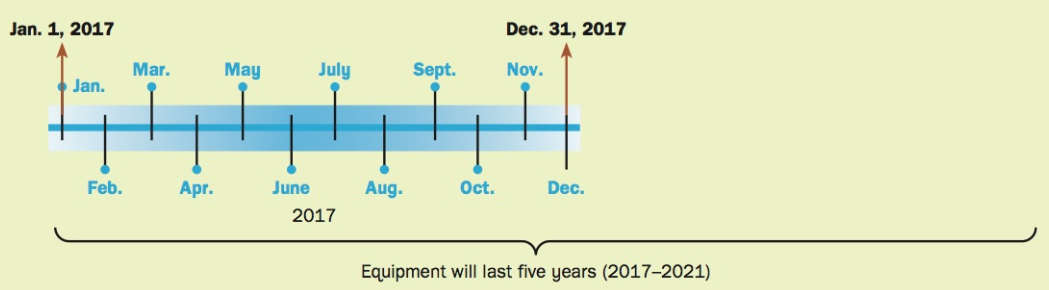

On January 1, 2017, Taco Taqueria, a Mexican restaurant, purchased equipment for $12,000 cash. Taco Taqueria estimates

Question:

a. Record the journal entry on January 1, 2017.

b. What is the formula to calculate straight-line depreciation?

c. Using the straight-line depreciation method, calculate the annual depreciation for 2017 (Jan. 1 to Dec. 31 2017).

d. In order to prepare the annual financial statements, record the adjusting journal entry for depreciation on December 31, 2017.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: