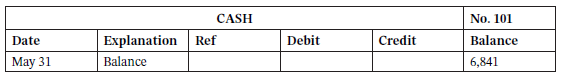

On May 31, 2021, Forester Theatre?s cash account per its general ledger showed the following balance: The

Question:

On May 31, 2021, Forester Theatre?s cash account per its general ledger showed the following balance:

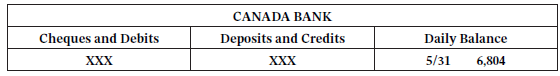

The bank statement from Canada Bank on that date showed the following balance:

A comparison of the details on the bank statement with the details in the Cash account revealed the following facts.

1. The statement included a debit memo of $45 for the monthly bank service charges.

2. Cash sales of $836 on May 12 were deposited in the bank. The bookkeeper recorded the deposit in the cash journal as $846.

3. Outstanding cheques on May 31 totalled $515 and deposits in transit were $1,436.

4. On May 18, the company issued cheque #1581 for $685 to M. Datz on account. The cheque, which cleared the bank in May, was incorrectly journalized and posted by Forester Theatre for $658.

5. A $2,500 note receivable was wired to the bank account of Forester Theatre on May 31. Interest was not collected for the note.

6. Included with the cancelled cheques was a cheque issued by Bohr Theatre for $600 that was incorrectly charged to Forester Theatre by the bank.

7. On May 31, the bank statement showed an NSF charge of $934 for a cheque issued by Tyler Bickell, a customer, to Forester Theatre on account.

Instructions

a. Prepare the bank reconciliation at May 31.

b. Prepare the necessary adjusting entries at May 31.

Sue Forester is contemplating implementing an EFT process for all supplier payments as she believes EFT is less expensive for a company because there is a reduced need for internal control as compared with writing cheques. Is Sue correct? Why or why not?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak