Sapporo Enterprises is reviewing an investment proposal. The initial cost and estimates of the book value of

Question:

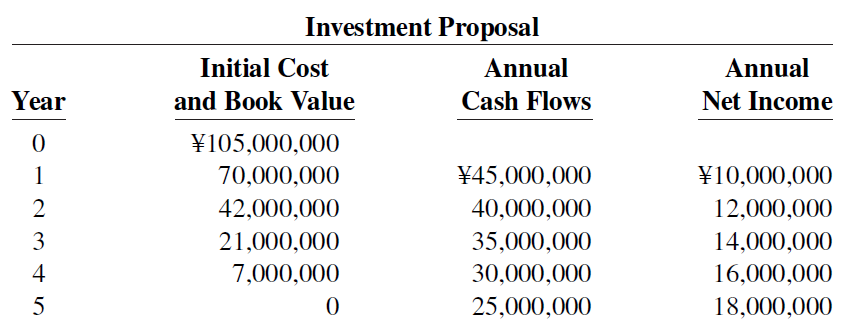

Sapporo Enterprises is reviewing an investment proposal. The initial cost and estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year are presented in the schedule below. All cash flows are assumed to take place at the end of the year. The residual value of the investment at the end of each year is equal to its book value. There would be no residual value at the end of the investment’s life.

Sapporo uses an 11% target rate of return for new investment proposals.

Instructions

a. What is the cash payback period for this proposal?

b. What is the annual rate of return for the investment?

c. What is the net present value of the investment?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt