The comparative statements of Larker Tool SA are presented below. All sales were on account. Instructions Compute

Question:

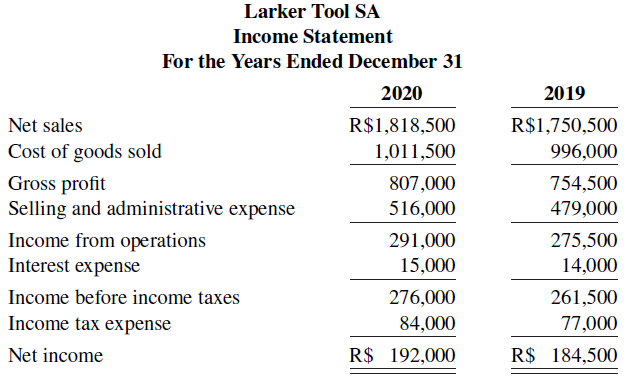

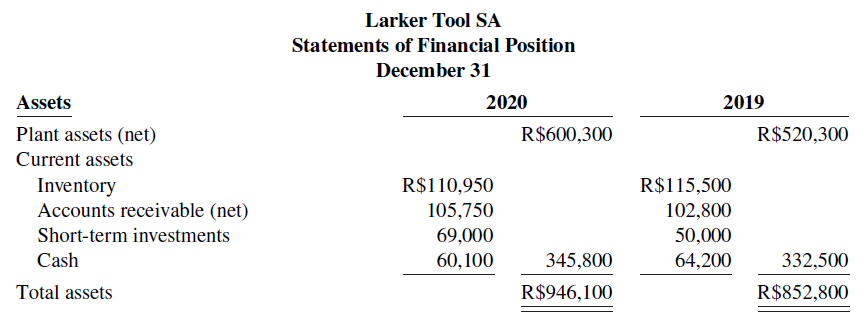

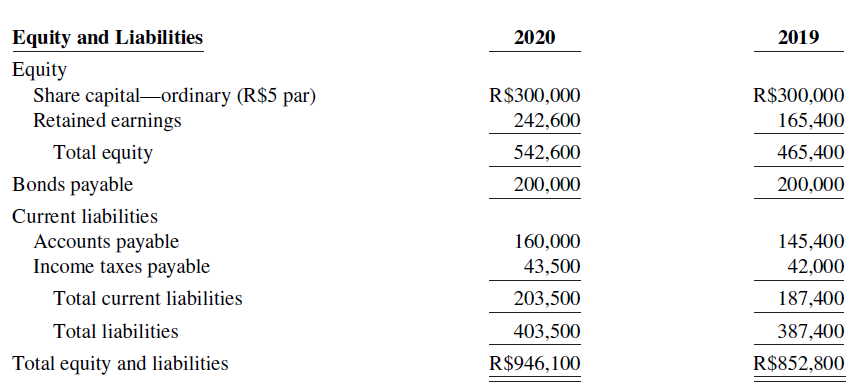

The comparative statements of Larker Tool SA are presented below.

All sales were on account.

Instructions

Compute the following ratios for 2020. (Weighted-average ordinary shares in 2020 were 60,000.)

a. Earnings per share.

b. Return on ordinary shareholders’ equity.

c. Return on assets.

d. Current ratio.

e. Acid-test ratio.

f. Accounts receivable turnover.

g. Inventory turnover.

h. Times interest earned.

i. Asset turnover.

j. Debt to assets ratio.

Transcribed Image Text:

Larker Tool SA Income Statement For the Years Ended December 31 2020 2019 R$1,750,500 Net sales R$1,818,500 996,000 Cost of goods sold 1,011,500 Gross profit Selling and administrative expense 807,000 754,500 516,000 479,000 Income from operations Interest expense 275,500 291,000 15,000 14,000 Income before income taxes 261,500 276,000 84,000 Income tax expense 77,000 R$ 192,000 R$ 184,500 Net income Larker Tool SA Statements of Financial Position December 31 Assets 2020 2019 Plant assets (net) Current assets R$600,300 R$520,300 R$110,950 R$115,500 Inventory Accounts receivable (net) Short-term investments Cash 105,750 69,000 60,100 102,800 50,000 345,800 64,200 332,500 Total assets R$946,100 R$852,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (15 reviews)

a b c d e f ...View the full answer

Answered By

Madhur Jain

I have 6 years of rich teaching experience in subjects like Mathematics, Accounting, and Entrance Exams preparation. With my experience, I am able to quickly adapt to the student's level of understanding and make the best use of his time.

I focus on teaching concepts along with the applications and what separates me is the connection I create with my students. I am well qualified for working on complex problems and reaching out to the solutions in minimal time. I was also awarded 'The Best Tutor Award' for 2 consecutive years in my previous job.

Hoping to get to work on some really interesting problems here.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt

Question Posted:

Students also viewed these Business questions

-

Condensed statement of financial position and income statement data for Clarence Limited appear below. Additional information: 1. The market price of Clarences ordinary shares was 4.00, 5.00, and...

-

As the chartered public accountant for Bonita Ltd., you have been asked to develop some key ratios from the comparative financial statements. This information is to be used to convince creditors that...

-

Willingham Ltd. has the following comparative statements of financial position data. Additional information for 2020: 1. Net income was 28,000. 2. Sales on account were 418,000. Sales returns and...

-

Explain, in your own words, what is meant by source inspection.

-

A grating has 5000.0 slits / cm. How many orders of violet light of wavelength 412 nm can be observed with this grating?

-

The number of bacteria in a culture is increasing according to the law of exponential growth. There are 125 bacteria in the culture after 2 hours and 350 bacteria after 4 hours. (a) Find the initial...

-

In the organizational chart for the consumer-packaged goods firm in Figure 22 5, where do product line, functional, and geographical groupings occur? Figure 22-5 Chief Marketing Officer or Vice...

-

Crystal City established a capital projects fund to account for the construction of a new bridge. During the year the fund was established, the city issued bonds, signed (and encumbered) $6 million...

-

Provide a clear definition of SES (Socioeconomic Status), encompassing its components such as income, education, and occupation. Discuss the societal implications of SES and its role in shaping...

-

The following data have been collected for a British health care IT project for two-week reporting periods 2 through 12. Compute the SV, CV, SPI, and CPI for each period. Plot the EV and the AC on...

-

Comparative statement data for Lionel Company and Barrymore Company, two competitors, appear below. All statement of financial position data are as of December 31, 2020, and December 31, 2019....

-

Financial information for Ernie Bishop Company is presented below. Additional information: 1. Inventory at the beginning of 2019 was 118,000. 2. Total assets at the beginning of 2019 were 632,000. 3....

-

Give recent examples of related and unrelated diversification.

-

A wire 4.00 cm long carries a current of 350 mA. A magnetic field is at an angle of 60 to the wire. What is the strength of the magnetic field (T) required to produce a force of 0.100 N?

-

A radiographer lifts a 1 . 0 kg grid from the floor to the top of a 1 . 6 m table with an acceleration of 2 . 5 / s ^ 2 . What is the power exerted if it takes 1 . 0 s ?

-

What mass of ice is required to reduce the temperature of a tub filled with 2 0 kg of water at 2 0 degrees celsius to a temperature of 0 degrees celsius? Assume the initial temperature of the ice is...

-

Evaluate the following limit. Enter the exact answer. If the limit does not exist, enter DNE. lim h0 6-h-6 h =

-

a 3 0 , 0 0 0 kg humpback whale is swimming with a linear speed of 1 5 m / s in a circular with a radius of 4 0 meters what is the net force required for her to maintain the same speed?

-

The value of g at any latitude ( may be obtained from the formula g = 32.09 (1 + 0.0053 sin2 () ft/s2 Which takes into account the effect of the rotation of the earth, as well as the fact that the...

-

The Thomas Corporation was organized on Jan. 1, 2020. On Dec. 31, 2021, the corporation lost most of its inventory in a warehouse fire before the year-end count of inventory was to take place. just...

-

Manufacturing cost data for Criqui Company are presented below. InstructionsIndicate the missing amount for each letter (a) through(i). Case A Case B Case C Direct materials used Direct labor...

-

Incomplete manufacturing cost data for Ikerd Company for 2010 are presented as follows for four different situations. Instructions(a) Indicate the missing amount for each letter.(b) Prepare a...

-

Aikman Corporation has the following cost records for June 2010. Instructions(a) Prepare a cost of goods manufactured schedule for June 2010.(b) Prepare an income statement through gross profit for...

-

Determine the key elements in appraising various types of quantitative research designs, which might be useful for your own nursing practice. 4. Illustrate key concepts relevant to quantitative...

-

Is the big-box store practicing illegal price competition? Explain your answer. If it is, what federal act is it violating? If the big-box store is not practicing illegal price competition, how can...

-

1.) Consider the baggage check-in of a small airlineCheck in data indicates that from 9 a.m to 10 a.m, 255 passenger check inMoro ever, based on counting the numbers of passengers waiting in line for...

Study smarter with the SolutionInn App