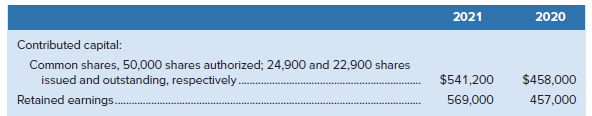

The equity section from the December 31, 2020 balance sheet of Candace Candy Corporation appeared as follows:

Question:

The equity section from the December 31, 2020 balance sheet of Candace Candy Corporation appeared as follows:

The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Candace Candy):Feb. 10 A $1.50 per share cash dividend was declared, and the date of record was five days later.

April 20 2,400 common shares were repurchased and retired at $20.00 per share.

May 10 A $1.50 per share cash dividend was declared, and the date of record was five days later.

Aug. 10 A $1.50 per share cash dividend was declared, and the date of record was five days later.

31 A 20% share dividend was declared when the market value was $32.00 per share.

Sept. 14 The share dividend was issued.

Nov. 10 A $1.50 per share cash dividend was declared, and the date of record was five days later.

Required

1. How many shares were outstanding on each of the cash dividend dates?

2. How much profit did the company earn during 2021?

3. Prepare the statement of changes in equity for the year ended December 31, 2021.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann