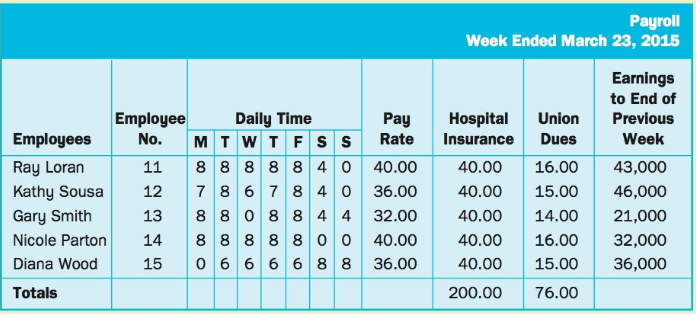

The payroll records of Brownlee Company provided the following information for the weekly pay period ended March

Question:

The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2015:

Required

1. Enter the relevant information in the proper columns of a payroll register and complete the register; calculate CPP and EI deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week.

2. Prepare general journal entries to record the payroll register information, including the employer’s expenses.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann