The transactions of Echo Systems for October through December 2017 have been recorded in the problem segments

Question:

Required

1. Record and post the appropriate closing entries.

2. Prepare a post-closing trial balance.

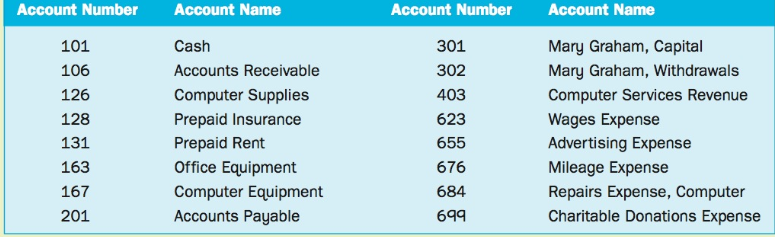

On October 1, 2017, Mary Graham organized a computer service company called Echo Systems. Echo is organized as a sole proprietorship and will provide consulting services, computer system installations, and custom program development. Graham has adopted the calendar year for reporting, and expects to prepare the company€™s first set of financial statements as of December 31, 2017. The initial chart of ac- counts for the accounting system includes these items:

Oct.

1. Graham invested $90,000 cash, a $36,000 computer system, and $18,000 of office equipment in the business.

2. Paid rent in advance of $9,000.

3. Purchased computer supplies on credit for $2,640 from Abbott Office Products.

5. Paid $4,320 cash for one year€™s premium on a property and liability insurance policy.

6. Billed Capital Leasing $6,600 for installing a new computer.

8. Paid for the computer supplies purchased from Abbott Office Products.

10. Hired Carly Smith as a part-time assistant for $200 per day, as needed.

12. Billed Capital Leasing another $2,400 for computer services rendered.

15. Received $6,600 from Capital Leasing on its account.

17. Paid $1,410 to repair computer equipment damaged when moving into the new office.

20. Paid $3,720 for an advertisement in the local newspaper.

22. Received $2,400 from Capital Leasing on its account.

28. Billed Decker Company $6,450 for services.

31. Paid Carly Smith for seven days€™ work.

31. Withdrew $7,200 cash from the business for personal use.

Nov

1. Reimbursed Graham€™s business automobile expense for 1,000 kilo metres at $1.00 per kilo metre.

2. Received $9,300 cash from Elite Corporation for computer services rendered.

5. Purchased $1,920 of computer supplies for cash from Abbott Office Products.

8. Billed Fostek Co. $8,700 for computer services rendered.

13. Notified by Alamo Engineering Co. that Echo€™s bid of $7,500 for an upcoming project was accepted.

18. Received $3,750 from Decker Company against the bill dated October 28.

22. Donated $1,500 to the United Way in the company€™s name.

24. Completed work for Alamo Engineering Co. and sent a bill for $7,500.

25. Sent another bill to Decker Company for the past due amount of $2,700.

28. Reimbursed Graham€™s business automobile expense for 1,200 kilo metres at $1.00 per kilo metre.

30. Paid Carly Smith for 14 days€™ work.

30. Withdrew $3,600 cash from the business for personal use.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann