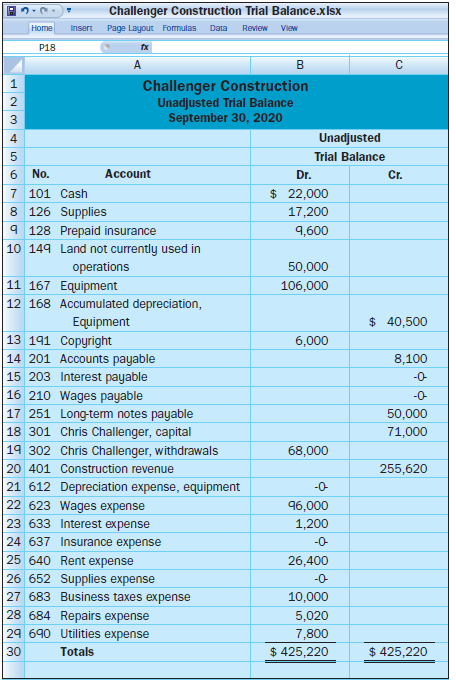

This unadjusted trial balance is for Challenger Construction at the end of its fiscal year, September 30,

Question:

This unadjusted trial balance is for Challenger Construction at the end of its fiscal year, September 30, 2020. The beginning balance of the owner?s capital account was $46,000 and the owner invested another $25,000 cash in the company during the year.

Required

1. Prepare a 10-column work sheet for fiscal 2020, starting with the unadjusted trial balance and including these additional facts:

a. The inventory of supplies at the end of the year had a cost of $3,200.

b. The cost of expired insurance for the year is $8,400.

c. Annual depreciation of the equipment is $17,600.

d. The September utilities expense was not included in the trial balance because the bill arrived after it was prepared. Its $750 amount needs to be recorded.

e. The company?s employees have earned $4,200 of accrued wages.

f. The interest expense of $120 for September has not yet been paid or recorded.

2. Use the work sheet to prepare the adjusting and closing entries.

3. Prepare an income statement, a statement of changes in equity, and a classified balance sheet. $16,000 of the long-term note payable is to be paid by September 30, 2021.

Analysis Component: Analyze the following potential errors and describe how each would affect the 10- column work sheet. Explain whether the error is likely to be discovered in completing the work sheet and, if not, the effect of the error on the financial statements.

a. The adjustment to record used supplies was credited to Supplies for $3,200 and debited the same amount to Supplies Expense.

b. When completing the adjusted trial balance in the work sheet, the $22,000 cash balance was incorrectly entered in the Credit column.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann