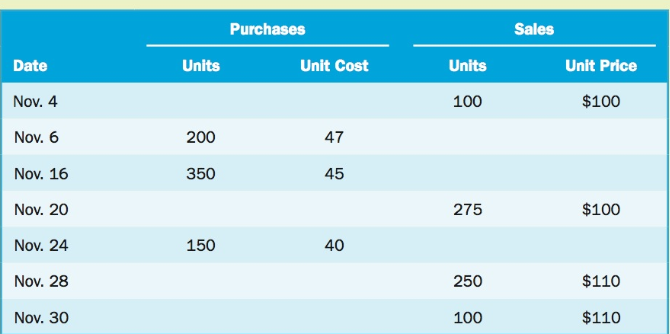

Tool Depot sells the latest selection of power tools and uses a perpetual inventory system. The following

Question:

Required

1. Calculate the cost of goods sold and ending inventory using the following methods.

a. FIFO

b. Moving weighted average. Round all unit costs to two decimal places and round all other numbers to the nearest dollar.

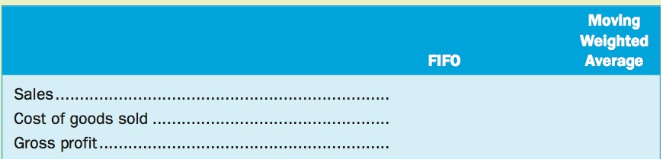

2. Using your calculations from Part 1, complete the following schedule:

3. Does using FIFO or moving weighted average produce

a. A higher gross profit?

b. A higher ending inventory balance?

4. Calculate the gross profit percentage for both methods for the month of November. Round to the nearest percentage.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: