VanHoutte Foods bought machinery on September 10, 2018, for $168,000. It was determined that the machinery would

Question:

VanHoutte Foods bought machinery on September 10, 2018, for $168,000. It was determined that the machinery would be used for six years or until it produced 260,000 units and then would be sold for about $27,600. Complete the schedule below by calculating annual depreciation to the nearest whole month for 2018, 2019, and 2020. VanHoutte?s year-end is December 31.

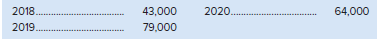

Assume actual units produced of:

Analysis Component: If depreciation is not recorded, what is the effect on the income statement and balance sheet?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: