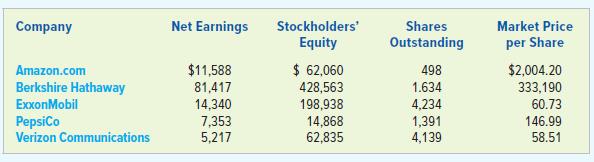

Listed here are data for five companies. These data are for the companies 2019 fiscal years. The

Question:

Listed here are data for five companies. These data are for the companies’ 2019 fiscal years. The market price per share is the closing price of the companies’ stock the day after they announced their 2019 earnings. Except for market price per share, all amounts are in millions. The shares outstanding number is the weighted-average number of shares the company used to compute basic earnings per share. Note that the numbers for Berkshire Hathaway are significantly different that the other companies. For example, the number for its shares outstanding includes a decimal, not a comma. Its shares outstanding are about are 1.6 million, not 1.6 billion.

Required

a. Compute the earnings per share (EPS) for each company.

b. Compute the P/E ratio for each company.

c. Using the P/E ratios, rank the companies’ stock in the order that the stock market appears to value the companies, from most valuable to least valuable. Identify reasons the ranking based on P/E ratios may not represent the market’s optimism for some companies.

d. Compute the book value per share for each company.

e. Compare each company’s book value per share to its market price per share. Based on the data, rank the companies from most valuable to least valuable.

Step by Step Answer:

Fundamental Financial Accounting Concepts

ISBN: 9781260786583

11th Edition

Authors: Thomas P. Edmonds