Below are the financial statements that you are asked to prepare. The income statement for each year

Question:

Below are the financial statements that you are asked to prepare.

The income statement for each year will look like this:

1. How would you describe Nepean Boards’ cash flows for 2012? Write a brief discussion.

2. In light of your discussions in the previous question, what do you think about Scott’s expansion plans?

Nepean Boards is a small company that manufactures and sells snowboards in Ottawa. Scott Redknapp, the founder of the company, is in charge of the design and sale of the snowboards, but he is not from a business background. As a result, the company’s financial records are not well maintained. The initial investment in Nepean Boards was provided by Scott and his friends and family. Because the initial investment was relatively small, and the company has made snowboards only for its own store, the investors haven’t required detailed financial statements from Scott. But thanks to word of mouth among professional boarders, sales have picked up recently, and Scott is considering a major expansion. His plans include opening another snowboard store in Calgary, as well as supplying his “sticks” (boarder lingo for boards) to other sellers.

Scott’s expansion plans require a significant investment, which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from the banks. Naturally, the new investors and creditors require more organized and detailed financial statements than Scott previously prepared. At the urging of his investors, Scott has hired financial analyst Jennifer Bradshaw to evaluate the performance of the company over the past year.

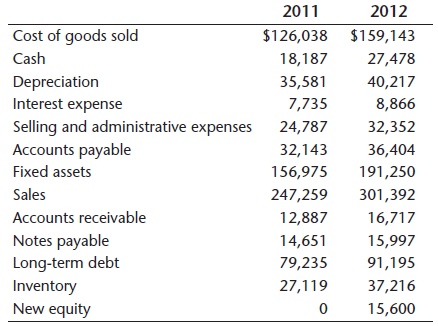

After rooting through old bank statements, sales receipts, tax returns, and other records, Jennifer has assembled the following information:

Nepean Boards currently pays out 50 percent of net income as dividends to Scott and the other original investors, and has a 20 percent tax rate. You are Jennifer’s assistant, and she has asked you to prepare the following:

1. A statement of comprehensive income for 2011 and 2012.

2. A statement of financial position for 2011 and 2012.

3. Operating cash flow for the year.

4. Cash flow from assets for 2012.

5. Cash flow to creditors for 2012.

6. Cash flow to shareholders for 2012.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Cash Flow From Assets

Cash flow from assets is the aggregate total of all cash flows related to the assets of a business. This information is used to determine the net amount of cash being spun off by or used in the operations of a business. The concept is comprised of... Cash Flow To Creditors

Cash flow to debt holder’s equation to compute the cash flow of a company. Cash flow is the measure of total amount of liquid cash that is moving in and out of the business. Cash flow to creditors formula is derived as I - E + B where I =...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield