Consider the following pre-merger information about Firm X and Firm Y: Assume that Firm X acquires Firm

Question:

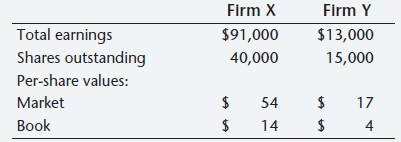

Consider the following pre-merger information about Firm X and Firm Y:

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $6 per share. Assuming that neither firm has any debt before or after the merger, construct the post-merger statement of financial position for Firm X assuming the use of the purchase accounting method.

Transcribed Image Text:

Firm X Firm Y Total earnings Shares outstanding Per-share values: Market Book $13,000 15,000 $91,000 40,000 17 54 4 14

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

a Since neither company has any debt using the pooling method the asset value o...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted:

Students also viewed these Business questions

-

Assume that the following statements of financial position are stated and a book value. Construct a post-merger statement of financial position assuming that Amherst Co. purchases Essex Inc. and the...

-

The shareholders of Tilbury Company have voted in favour of a buyout offer from Dover Corporation. Information about each firm is given here: Tilburys shareholders will receive one share of Dover...

-

You have been hired to value a new 25-year callable, convertible bond. The bond has a 4.8 percent coupon, payable annually. The conversion price is $9, and the stock currently sells for $3.21. The...

-

ABC Corporation purchased a residential property for the use of its Accounting Manager. The property is payable over 12 annual installments of P275,000 including interest but have a cash price of...

-

There has been much interest in whether industries in the United States are moving from the Northeast and North Central regions to the South and West, motivated by the warmer climate, by lower wages,...

-

Solve each inequality, and graph the solution set. 9x - 8 4x + 25 - 0

-

On March 13, 1963, Ernesto Miranda was arrested for kidnapping and rape and taken to a Phoenix police station. After being identified by the complaining witness, he was questioned by two police...

-

Cost System Choices, Budgeting, and Variance Analyses for Sacred Heart Hospital The purpose of this integrated exercise is to demonstrate how a change in the cost systems allocation base can result...

-

To determine the kinetics (rates) of ozone depletion reactions, chemists perform controlled laboratory studies. In this simulated lab, we will interpret data obtained from such laboratory experiments...

-

A fitness enthusiast is trying to strengthen his calf muscles. He uses the exercise machine below. His heels apply a force to the padded bar. This lifts the heavy weights. a. The centre of mass of...

-

Tecumseh Inc. is analyzing the possible merger with Devonshire Inc. Savings from the merger are estimated to be a one-time after-tax benefit of $120 million. Devonshire Inc. has 4 million shares...

-

In the previous problem, suppose the fair market value of Essexs fixed assets is $9,300 versus the $6,400 book value shown. Amherst pays $16,000 for Essex and raises the needed funds through an issue...

-

What is the difference between the twos complement representation of an integer and the twos complement of an integer?

-

Analyze current or latest economics problem or issue by focusing on COVID-19. a. Carefully describe the latest or current economic problem. Clearly state the issue, actors, time and country involved....

-

In your own words and using this week's materials for support, answer the following question/prompts: Provide an example of an employment agreement, preferably a personal example. Explain the concept...

-

5) (15) Logistic model: A State wishes to establish a herd of elk in a forest where none are present. The population follows the Logistic Model given by P(t) = 840 1+14e-0.15t a) (2)Find the initial...

-

The local market in country M will not buy the eco product concept for more than $10. However, upper-level management would like to know if it is still possible for BB to take advantage of the...

-

10. Mr. Webster is planning to retire in 30 years, and his goal is to have $1,500,000 in his retirement fund when he retires. He will start by depositing $35,000 into his fund today and $1,000 at the...

-

Over a four-year period, Matt Ewing purchased shares in the Barreau du Quebec Canadian Equity Fund. Using the information below, answer the following questions. Year Investment Amount Price per share...

-

Which of the following is NOT a magnetic dipole when viewed from far away? a) A permanent bar magnet. b) Several circular loops of wire closely stacked together with the same current running in each...

-

What does the term window dressing mean in the context of financial statements? Identify three window-dressing techniques that companies use. What implications does this have for cash flows in terms...

-

Finance executives need to know and understand the corporate governance environment in which they operate. 1. Visit the European Corporate Governance Institute website (www.ecgi.org) and download the...

-

Since the financial crisis, investors have become increasingly vocal about the size of executive pay and many companies have seen remuneration packages refused by shareholders at annual general...

-

Identify how the discount charged for discounting notes is reported on the income statement. Deducted from income from opertaions. in the other income and expenses section. as a nonoperating expense....

-

Identify and include your personal responsibilities and accountabilities Identify any barriers to fulfilling task requirements and include ways to manage these Produce a final schedule for...

-

Explain the following terms using the MitchReads data to illustrate your answer di) Independent Events dii) Mutually Exclusive diii) Complement div) Conditional Probability dv) Collectively Exhaustive

Study smarter with the SolutionInn App