Refer to Figure 24.11 in the text to answer this question. Suppose you purchase an August 2012

Question:

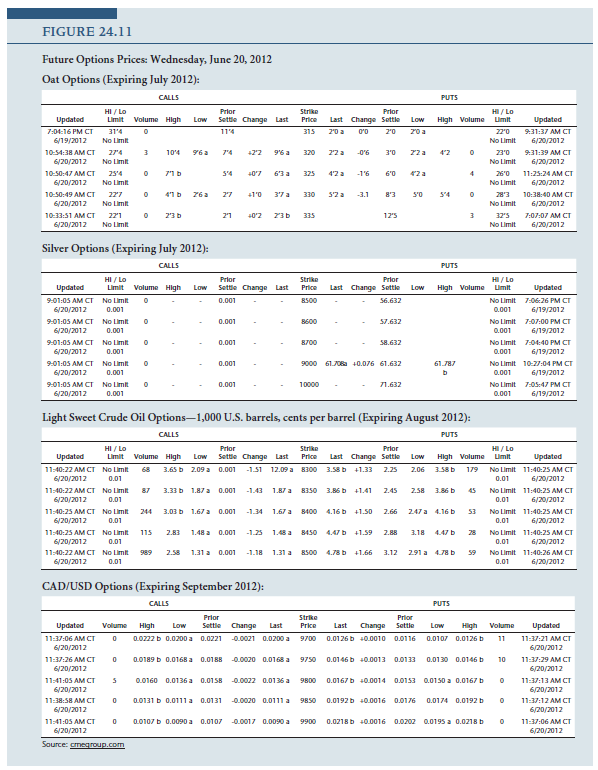

Refer to Figure 24.11 in the text to answer this question. Suppose you purchase an August 2012 call option on crude oil futures with a strike price of 8500 cents per barrel. How much does your option cost per barrel of oil? What is the total cost? Suppose the price of oil futures is 9000 cents per barrel at expiration of the options contract. What is your net profit or loss from this position? What if oil futures prices are 8000 cents per barrel at expiration?

Figure 24.11

In finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity.

Transcribed Image Text:

FIGURE 24.11 Future Options Prices: Wednesday, June 20, 2012 Oat Options (Expiring July 2012): CALLS PUTS H/ Lo Limit HI / Lo Limit Volume High Prior Strike Prior Settle Change Last High Volume Updated Low Price Last Change Settle Low Updated 9:31:37 AM CT 7:04:16 PM CT 31'4 11'4 315 O'0 2'0 22'0 6/19/2012 No Limit No Limit 6/20/2012 104 274 931:39 AM CT 10-54:38 AM CT 96 a לי22 9'6 a 320 -0'6 3'0 22a 6/20/2012 No Limit No Limit 6/20/2012 11:25:24 AM CT 10-50:47 AM CT 25'4 5'4 +07 6'3 a 325 4'2 a -1'6 6'0 6/20/2012 No Limit No Limit 6/20/2012 10-50:49 AM CT 4'1 b +1'0 330 -3.1 S'O 5'4 283 10:38:40 AM CT 6/20/2012 No Limit No Limit 6/20/2012 10:33:51 AM CT 7:07:07 AM CT 221 40'2 73b 335 12'5 32'5 6/20/2012 No Limit No Limit 6/20/2012 Silver Options (Expiring July 2012): CALLS PUTS H/ Lo HI / Lo Limit Prior Strike Prior Volume High Updated Low Settle Change Last Price Last Change Sottle Low High Volume Limit Updated 9:01:05 AM CT No Limit 0.001 8500 56.632 No Limit 7:06:26 PM CT 6/20/2012 0.001 0.001 6/19/2012 57.632 9:01:05 AM CT No Limit 0.001 8600 No Limit 7:07:00 PM CT 0.001 0.001 6/20/2012 6/19/2012 8700 9:01:05 AM CT No Limit 0.001 58.632 No Limit 7:04:40 PM CT 6/20/2012 0.001 0.001 6/19/2012 9:01:05 AM CT No Limit 0.001 9000 6170a +0.076 61.632 61.787 No Limit 10-27:04 PM CT 6/20/2012 0.001 0.001 6/19/2012 9:01:05 AM CT No Limit 0.001 10000 71.632 No Limit 7-05:47 PM CT 6/20/2012 0.001 0.001 6/19/2012 Light Sweet Crude Oil Options-1,000 U.S. barrels, cents per barrel (Expiring August 2012): CALLS PUTS Prior Settle Change Last Prior HI / Lo Limit H/ Lo Strike Volume High Price Updated Low Last Change Sottle Low High Volume Limit Updated 11:40:22 AM CT 6/20/2012 No Limit 68 3.65 b 2.09 a 0.001 -1.51 12.09 a 8300 3.58 b +1.33 2.25 2.06 3.58 b 179 No Limit 11:40:25 AM CT 0.01 0.01 6/20/2012 11:40:22 AM CT 3.86 b No Limit 87 3.33 b 1.87 a 0.001 -1.43 1.87 a 8350 3.86 b +1.41 2.45 2.58 45 No Limit 11:40:25 AM CT 6/20/2012 0.01 0.01 6/20/2012 3.03 b 1.6 a No Limit 11:40:25 AM CT 11:40:25 AM CT No Limit 244 0.001 -1.34 1.67 a 8400 4.16 b +1.50 2.66 247 a 4.16 b 53 0.01 6/20/2012 0.01 6/20/2012 כור 283 +1.59 4.47b 11:40:25 AM CT No Limit 1.48 a 0.001 -1.25 1.48 a 8450 4.47 b 2.88 3.18 28 No Limit 11:40:25 AM CT 6/20/2012 0.01 0.01 6/20/2012 11:40:22 AM CT 989 -1.18 4.78b No Limit 2.58 1.31 a 0.001 1.31 a 8500 4.78 b +1.66 3.12 291 a 59 No Limit 11:40:26 AM CT 6/20/2012 0.01 0.01 6/20/2012 CAD/USD Options (Expiring September 2012): CALLS PUTS Prior Strike Prior Updated Updated 11:37:06 AM CT Volume High Low Settle Change Last Price Last Change Settle Low High Volume 0.0222 b 0.0200 a 0.0221 -0.0021 0.0200 a 9700 0.0126 b 40.0010 0.0116 0.0107 0.0126 b 11 11:37:21 AM CT 6/20/2012 6/20/2012 11:37:29 AM CT 11:37:26 AM CT 0.0189 b 0.0168 a 0.0188 -0.0020 0.0168 a 9750 0.0146 b 40.0013 0.0133 0.0130 0.0146 b 10 6/20/2012 6/20/2012 11:41:05 AM CT 11:37:13 AM CT 0.0160 0.0136 a 0.0158 0.0022 0.0136 a 9800 0.0167 b +0.0014 0.0153 0.0150 a 0.0167 b 6/20/2012 6/20/2012 0.0131 b 0.01l1a 0.0131 11:37:12 AM CT 11:38:58 AM CT -0.0020 0.0111 a 9850 0.0192 b +0.0016 0.0176 0.0174 0.0192 b 6/20/2012 6/20/2012 0.0107 b 0.0090 a 0.0107 11:41:05 AM CT -0.0017 0.0090 a 9900 0.0218 b +0.0016 0.0202 0.0195 a 0.0218 b 11:37:06 AM CT 6/20/2012 6/20/2012 Source: cmngroup.com

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

Cost 08338 per barrel 08338 per barrel1000 barrels per cont...View the full answer

Answered By

Amit Kumar

I am a student at IIT Kanpur , which is one of the prestigious colleges in INDIA.

Cleared JEE Advance in 2017.I am a flexible teacher because I understand that all students learn in different ways and at different paces. When teaching, I make sure that every student has a grasp of the subject before moving on.

I will help student to get the basic understanding clear. I believe friendly behavior with student can help both the student and the teacher.

I love science and my students do the same.

4.90+

44+ Reviews

166+ Question Solved

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-0071051606

8th Canadian Edition

Authors: Stephen A. Ross, Randolph W. Westerfield

Question Posted:

Students also viewed these Business questions

-

Refer to Table 23.1 in the text to answer this question. Suppose you sell five May 2014 silver futures contracts this day at the last price of the day. What will your profit or loss be if silver...

-

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the June 2014 call option on com futures with a strike price of $5.05. Assume you purchased the future at the last price....

-

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the June 2014 put option on com futures with a strike price of $5.10. Assume your purchase was at the last price. What is...

-

I need one or more queries on the basis of database of netflix. I can upload the picture of database Create Index Modify Table Schema Delete Table Print CREATE TABLE Dates ( [PK] INTEGER PRIMARY KEY...

-

(a) and v 3 1

-

In Exercises 1 through 16, find the absolute maximum and absolute minimum (if any) of the given function on the specified interval. f(x) = x 3 + 3x 2 + 1; 3 x 2

-

Lynn Goldsmith is a photographer known for her photographs of famous musicians. In 1981, Goldsmith had a photography session with the singer Prince. Three years later, Vanity Fair obtained a license...

-

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the companys financial statements,...

-

In Figure 32.14, the battery has an emf of 12.0 V, the inductance is L, and the capacitance C is 9.0 pF. The switch has been set to position a for a long time so that the capacitor is charged. The...

-

Design the 4-to-1 MUX two ways Write a Verilog module called mux4to1 to implement 4-to-1 multiplexer using functional descriptions and if-else blocks. Write another Verilog module called...

-

The sub-prime crisis demonstrated the enormous social costs arising from the misuse of financial engineering. What do you think caused this misuse? How can it be prevented in the future?

-

Suppose a financial manager buys call options on 50,000 barrels of oil with an exercise price of $83 per barrel. She simultaneously sells a put option on 50,000 barrels of oil with the same exercise...

-

What is a voucher? What is a voucher package?

-

A company has a beta of 0.1, the T-bill rate is 6.68%, and the expected return on the market is 14.26%. What is its required rate of return? Do not round your intermediate calculations. Express as a...

-

a. Most currencies, such as fiat currencies (e.g. the U.S. Dollar), have a theoretically unlimited supply, while Bitcoin has a maximum fixed supply of only 18.7 million Bitcoin in total. Given the...

-

a.) What caused the recent increases in P&G products? b.) P&G announced 6% increase in sales revenue in the most recent quarter. Explain what we know is true of price elasticity given this increase...

-

1. Until roughly 2006, default rates on mortgages were fairly low due to ever increasing home prices. According to the videos, how did rising home prices make a cycle which then caused home prices to...

-

Given the coordinate matrix of x relative to a (nonstandard) basis B for R, find the coordinate matrix of x relative to the standard basis. B = {(1, 0, 0), (1, 1, 0), (0, 1, 1)}, []B =[4 0 2]T -01 E...

-

What is a family of funds? How is it related to shareholder exchanges?

-

Use the graphs of f and g to graph h(x) = (f + g) (x). To print an enlarged copy of the graph, go to MathGraphs.com. 1. 2. y 24 8. 2. -2 -2 4 6

-

The UKs financial markets regulator states that its objectives are to promote efficient, orderly and fair markets, help retail consumers achieve a fair deal, and improve the countrys business...

-

Assume that instead of fully financing the expansion with debt, the managers of ABB Ltd say they wish to maintain the ratio of non-current liabilities to equity after the expansion. What would ABBs...

-

Assume that, in 2016, ABB purchased a new automation technology for SFr500 million. They paid this on credit and wont be due to actually pay for the automation technology until 2018. The managers of...

-

Think back to a job situation in which your manager took action to reprimand, redirect, or reinforce your performance. 1. What did you do, and how was that behavior perceived by your manager? Was the...

-

Can you discuss the security features and mechanisms implemented in advanced operating systems to protect against various threats, including privilege escalation, malware, and denial-of-service...

-

Takeaways from the following each articles:- 1. "The Case for AI Insurance," by R. S. Siva Kumar and Frank Nagle, Harvard Business Review , April 29 2020. 2. "AI is Changing Work - and Leaders Need...

Study smarter with the SolutionInn App