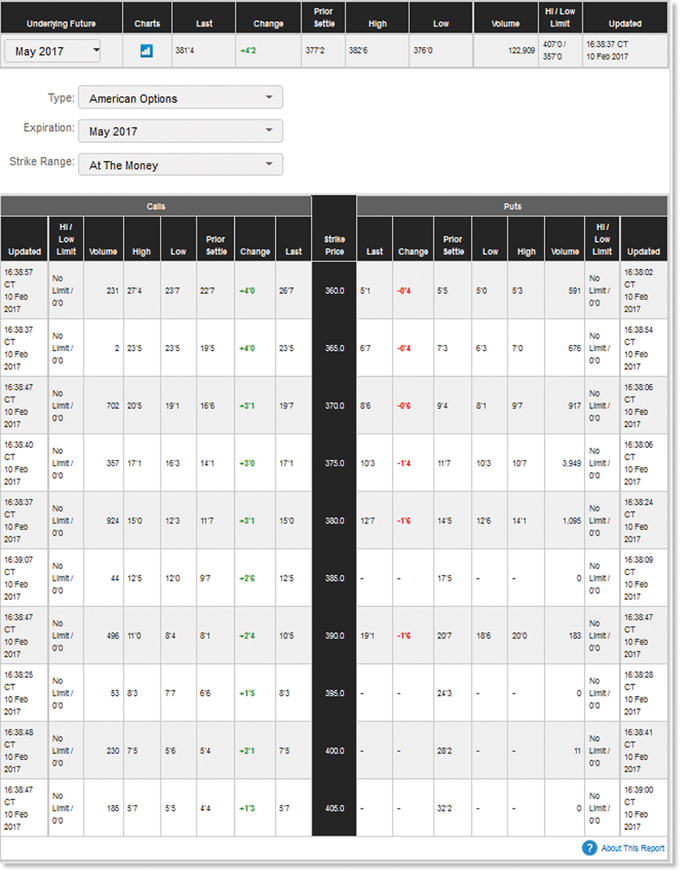

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the May 2017

Question:

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the May 2017 put option on corn futures with a strike price of $3.80. Assume your purchase was at the last price. What is the total cost? Suppose the price of corn futures is $3.61 per bushel at expiration of the option contract. What is your net profit or loss from this position? What if corn futures prices are $3.97 per bushel at expiration?

Table 23.2

In finance, the strike price of an option is the fixed price at which the owner of the option can buy, or sell, the underlying security or commodity.

Prior HI/ Low Settie Undernying Future Charts Last Change Limit Updated High Low Volume 4070/ 16:38 37 CT 122909 May 2017 381'4 +42 3772 3826 3760 10 Feb 2017 3570 Type: American Options Expiration: May 2017 Strike Range: At The Money Calls Puts HI/ HI/ strike Low Prior Prior Low Updated Updated Limit Volume Settie Change Last Price Last Change Settie High Volume Limit High Low LOw 16:38 02 16:38 57 No Limit/ 00 No ст ст 237 227 360.0 231 274 40 267 51 55 50 53 591 Limit/ 10 Feb 2017 10 Feb 2017 16:38 37 16:38 54 No ст ст 2 235 Limit/ 235 19'5 +40 23'5 365.0 67 73 63 70 676 Limit/ 10 Feb 10 Feb 2017 2017 16:38 47 16:38 06 No No ст ст Limit/ 00 702 205 166 197 370.0 86 94 81 97 917 Limit/ 191 10 Feb 10 Feb 00 2017 2017 16:38 06 ст 3.949 Limit/ 16:38 40 No No ст Limt/ 357 171 163 14'1 171 375.0 103 -1'4 117 103 107 10 Feb 10 Feb 00 2017 2017 16:3824 16:38 37 No No ст ст Limit/ 00 123 145 924 150 117 150 380.0 127 -re 126 141 1,095 Limit/ 10 Feb 10 Feb 00 2017 2017 16:39.07 16:38 09 No ст ст O Limit/ Limt/ 44 125 120 97 +26 125 385.0 175 10 Feb 10 Feb 00 2017 2017 16:38 47 16:38:47 No No ст ст 496 110 Limit/ 84 81 +24 105 390.0 191 207 186 200 183 Limit/ 10 Feb 10 Feb 00 00 2017 2017 16:38 28 ст O Limit/ 16:38 25 No No ст Limit/ 53 83 77 66 1'5 83 395.0 243 10 Feb 10 Feb 2017 2017 16:3841 16:38 48 No No ст ст Limt/ 230 75 56 54 +21 75 400.0 282 11 Limit/ 10 Feb 10 Feb 00 00 2017 2017 16:38 47 16:39:00 No No ст ст O Limit/ Limt/ 185 57 55 4'4 +13 57 405.0 322 10 Feb 10 Feb 00 2017 2017 ? About This Report я18

Step by Step Answer:

The price quote is 12 78 cents or 12875 per bushel and each contract is for 5...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-1260153590

12th edition

Authors: Stephen M. Ross, Randolph W Westerfield, Robert R. Dockson, Bradford D Jordan

Related Video

A put option is a financial contract that gives the owner the right, but not the obligation, to sell an underlying asset, such as a stock or a commodity, at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. Put options are used by investors as a form of insurance against a decline in the value of the underlying asset. If an investor expects the value of an asset to fall in the future, they can purchase a put option on that asset. If the value of the asset does fall, the put option will increase in value, allowing the investor to sell the asset at the higher strike price. For example, if an investor owns 100 shares of a stock that is currently trading at $50 per share, they may purchase a put option with a strike price of $45 and an expiration date three months in the future. If the stock price falls to $40 before the expiration date, the investor can exercise the put option and sell their shares for $45 each, even though the market price is only $40. This would allow the investor to limit their losses. It\'s important to note that purchasing a put option involves paying a premium to the seller of the option, and the investor can lose the entire premium if the price of the underlying asset does not decline as expected. Put options are just one type of financial derivative and should only be used by experienced investors who understand the risks involved.

Students also viewed these Business questions

-

Suppose your company has a building worth $165 million. Because it is located in a high-risk area for natural disasters, the probability of a total loss in any particular year is 1.15 percent. What...

-

A one-year call option contract on Cheesy Poofs Co. stock sells for $845. In one year, the stock will be worth $64 or $81 per share. The exercise price on the call option is $70. What is the current...

-

Suppose a share of stock sells for $63. The risk-free rate is 5 percent, and the stock price in one year will be either $70 or $80. a. What is the value of a call option with an exercise price of...

-

Besides warehouse layout decisions, what are some other applications where ranking items according to bang/buck might make sense?

-

Must any Chemistry problem like the one that starts this subsection-a balance the reaction problem-have infinitely many solutions?

-

Find a general term a, for the geometric sequence. a = 10, a = 2

-

Fantastic Sams and Defendants PSTEVO, LLC and Jeremy Baker entered into a franchise agreement pursuant to which Fantastic Sams granted PSTEVO a franchise to operate a Fantastic Sams Salon. According...

-

Rattigan Companys income statement contained the condensed information below. Rattigans balance sheet contained the comparative data at December 31, shown below. Accounts payable pertain to operating...

-

On the 1 January 2023, Garak's Goods Ltd sold some plant to Kleen Ltd for $82,000. Garak's Goods Ltd had originally paid $120,000 for this asset, and by the time of sale had charged accumulated...

-

Suppose that instead of superimposing a tree of degree u, we were to superimpose a tree of degree u 1/k , where k > 1 is a constant. What would be the height of such a tree, and how long would each...

-

Suppose a financial manager buys call options on 50,000 barrels of oil with an exercise price of $57 per barrel. She simultaneously sells a put option on 50,000 barrels of oil with the same exercise...

-

Refer to Table 23.1 in the text to answer this question. Suppose today is February 10, 2017, and your firm produces breakfast cereal and needs 145,000 bushels of corn in May 2017 for an upcoming...

-

Why is the formula for a variable costing income statement the basis for breakeven or cost-volume-profit analysis?

-

Construct a class definition to represent an employee of a company. Each employee is defined by an integer ID number, a double-precision pay rate, and the maximum number of hours the employee should...

-

What are the dos and dont for variable declaration for Java, Python, PHP, C#, JavaScript.

-

1. Do the financial statements include any vertical analysis information? Describe. 2. What information would you use to prepare a vertical analysis? 3. Do the financial statements include any...

-

What is climate change? Should the company be concerned about climate change? What if any skills does the accountant have to advise the directors about the company's response to climate change? 1 2 3...

-

Expected Standard 4. Suppose that we have three stocks with the following parameter values. Correlations of Returns Return Deviation Stock 1 Stock 2 Stock 3 0.25 v.5 0.5 Stock 1 Stock 2 Stock 3 0.10...

-

The comparative balance sheets for Montalvo Company show these changes in noncash current asset accounts: Accounts Receivable decreased $80,000, Prepaid Expenses increased $28,000, and Inventory...

-

Kims Konstructions has assembled the following data for a proposed straw-reinforced brick maker (SRBM): SRBM Cost: $26,000 Life: 5 years Revenue (p.a.) $11,000 Operating Expenses (p.a.) $3,000...

-

If Margoles Publishing from Problem 11 paid an underwriting spread of 7% for its IPO and sold 10 million shares, what was the total cost (exclusive of underpricing) to it of going public?

-

Chen Brothers, Inc., sold 4 million shares in its IPO, at a price of $18.50 per share. Management negotiated a fee (the underwriting spread) of 7% on this transaction. What was the dollar cost of...

-

Your firm is selling 3 million shares in an IPO. You are targeting an offer price of $17.25 per share. Your underwriters have proposed a spread of 7%, but you would like to lower it to 5%. However,...

-

Shaw Company has the following account balances: Receivables $ 1 0 0 , 0 0 0 Inventory 1 5 0 , 0 0 0 Land 1 0 0 , 0 0 0 Building net 2 5 0 , 0 0 0 Liabilities 1 0 0 , 0 0 0 Common stock 1 0 0 , 0 0 0...

-

Mizan Corporation, a manufacturing company, prepares its financial statements annually. During the last month of the fiscal year, Mizan experiences a significant surge in sales. The sales team closes...

-

A firm uses job - order costing. Current period facts: Actual overhead: $ 1 0 4 , 6 8 8 Applied overhead: $ 1 0 4 , 9 0 5 Budgeted overhead: $ 1 0 8 , 6 9 8 COGS balance ( before closing ) : $ 3 9 0...

Study smarter with the SolutionInn App