Trident Corp. management is evaluating two independent projects. The costs and expected cash flows are given in

Question:

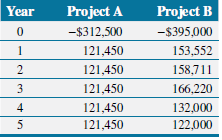

Trident Corp. management is evaluating two independent projects. The costs and expected cash flows are given in the following table. The cost of capital is 10 percent.

a. Calculate the projects’ NPV.

b. Calculate the projects’ IRR.

c. Which project should be chosen based on NPV? Based on IRR? Is there a conflict?

d. If you are the decision maker for the firm, which project or projects will be accepted? Explain your reasoning.

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Corporate Finance

ISBN: 978-1119371403

4th edition

Authors: Robert Parrino, David S. Kidwell, Thomas Bates

Question Posted: