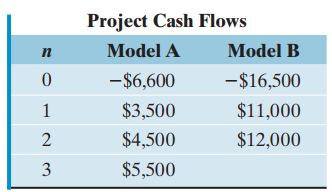

Consider the following cash flows for two types of models: Both models will have no salvage value

Question:

Both models will have no salvage value upon their disposal (at the end of their respective service lives). The firm€™s MARR is known to be 15%.

(a) Notice that both models have different service lives. However, Model A will be available in the future with the same cash flows. Model B is available now only. If you select Model B now, you will have to replace it with Model A at the end of year 2. If your firm uses the present worth as a decision criterion, which model should be selected, assuming that your firm will need one of the two models for an indefinite period?

(b) Suppose that your firm will need either model for only two years. Determine the salvage value of Model A at the end of year 2 that makes both models indifferent (equally likely).

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... MARR

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Step by Step Answer: