Assume Amazon.com reported the following amounts in its financial statements (in millions): Required: 1. Determine the inventory

Question:

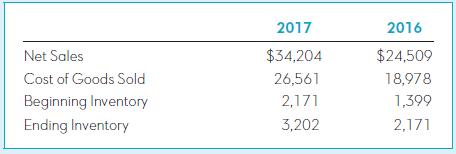

Assume Amazon.com reported the following amounts in its financial statements (in millions):

Required:

1. Determine the inventory turnover ratio and average days to sell inventory for 2017 and 2016. Round to one decimal place.

2. Comment on any changes in these measures and compare the inventory turnover at Amazon.com to inventory turnover at Barnes & Noble, Inc., where inventory turned over 3.2 times during 2017 (114.1 days to sell). Based on your own experience, what’s the key difference between Amazon.com and Barnes & Noble that leads one company’s results to be the picture of efficiency and the other to seem like a library?

Inventory Turnover RatioInventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh