Assume you recently obtained a job with Perfume Passion, the largest specialty retailer of discounted fragrances in

Question:

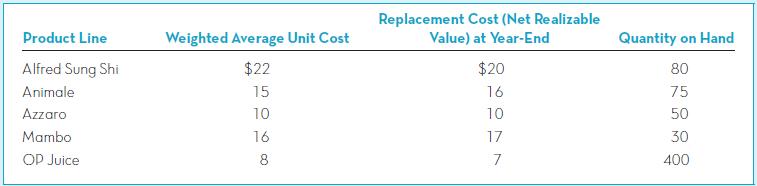

Assume you recently obtained a job with Perfume Passion, the largest specialty retailer of discounted fragrances in Canada. Your job is to estimate the amount of write-down required to value inventory at the lower of cost and net realizable value. The cost of inventory is calculated using the weighted average cost method and, at $368 million, it represents the company’s biggest and most important asset. Assume the corporate controller asked you to prepare a spreadsheet that can be used to determine the amount of the LC&NRV write-down for the current year. The controller provides the following hypothetical numbers for you to use in the spreadsheet.

You realize that you’ll need to multiply the quantity of each item by the lower of cost and net realizable value per unit. You emailed your friend Owen for Excel help.

From: Owentheaccountant@yahoo.com

To: Helpme@hotmail.com

Cc: Subject: Excel Help

So you don’t have any idea how to pick the lower of cost and net realizable value? You can do these several different ways, but the easiest is to use the MIN command. Set up your spreadsheet similar to the table you sent me, and then add two new columns. In the first new column, enter the command “= MIN(cost cell, net realizable value cell)” where cost cell is the cell containing the cost per unit and net realizable value cell is the cell containing the net realizable value per unit. Next, in the second new column, multiply the quantity by the lower of cost or net realizable value per unit, and then SUM the column.

Required:

1. Prepare a spreadsheet that calculates total lower of cost and net realizable value for inventory, applied on an item-by-item basis.

2. Prepare a journal entry to record the inventory lower of cost and net realizable value write-down.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh