Intel Corporation is a well-known supplier of computer chips, boards, systems, and software building blocks. Assume the

Question:

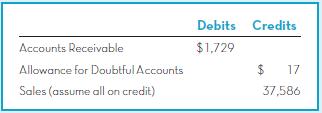

Intel Corporation is a well-known supplier of computer chips, boards, systems, and software building blocks. Assume the company recently reported the following amounts (in millions) in its unadjusted trial balance at its year-end of December 27, 2017:

Required:

1. Assume Intel uses ¼ of 1 percent of sales to estimate its Bad Debt Expense for the year. Prepare the adjusting journal entry required for the year, assuming no Bad Debt Expense has been recorded yet.

2. Now assume that Intel uses the aging of accounts receivable method and estimates that $40 million of its Accounts Receivable will be uncollectable. Prepare the adjusting journal entry required at December 27, 2017, for recording Bad Debt Expense.

3. Repeat requirement 2, except this time assume the unadjusted balance in Intel’s Allowance for Doubtful Accounts at December 27, 2017, was a debit balance of $20 million.

4. If one of Intel’s main customers declared bankruptcy in 2018, what journal entry would be used to write off its $15 million balance?

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh