Pirate Pete Moving Corporation has been in operation since January 1, 2017. It is now December 31,

Question:

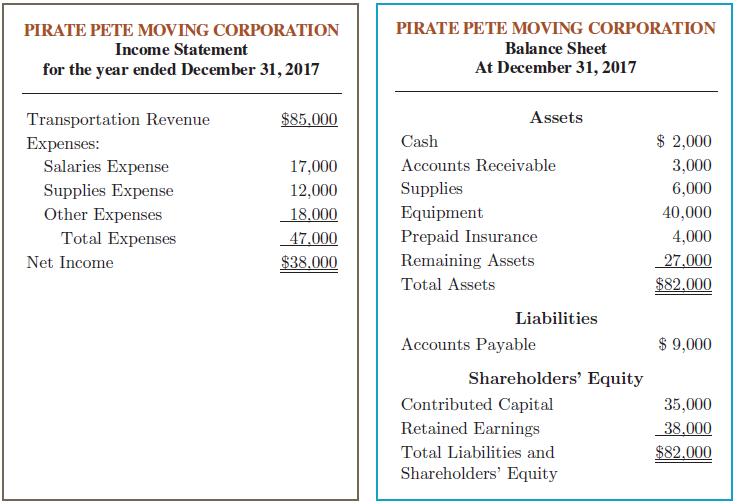

Pirate Pete Moving Corporation has been in operation since January 1, 2017. It is now December 31, 2017, the end of the annual accounting period. The company has not done well financially during its first year, although revenue has been fairly good. Three shareholders manage the company, but they have not given much attention to record-keeping. In view of a serious cash shortage, they have applied to your bank for a $20,000 loan. As a loan officer, you requested a complete set of financial statements. The following 2017 annual financial statements were prepared by the company’s office staff.

After briefly reviewing the statements and looking into the situation, you requested that the statements be redone (with some expert help) to incorporate depreciation, accruals, supply counts, income taxes, and so on. As a result of a review of the records and supporting documents, the following additional information was developed:

a. The Supplies amount of $6,000 shown on the balance sheet has not been adjusted for supplies used during 2017. A count of the supplies on hand on December 31, 2017, showed $1,800.

b. The insurance premium paid in 2017 was for years 2017 and 2018. The total insurance premium was debited in full to Prepaid Insurance when paid in 2017 and no adjustment has been made.

c. The equipment cost $40,000 when it was purchased January 1, 2017. It had an estimated annual depreciation of $8,000. No depreciation has been recorded for 2017.

d. Unpaid (and unrecorded) salaries at December 31, 2017, amounted to $2,200.

e. At December 31, 2017, transportation revenue collected in advance amounted to $7,000. This amount was credited in full to Transportation Revenue when the cash was collected earlier during 2017.

f. Income taxes for the year are calculated as 25 percent of income before tax.

Required:

1. Prepare the adjusting journal entries required on December 31, 2017, based on the preceding additional information. You may need to create new accounts not yet included in the income statement or balance sheet.

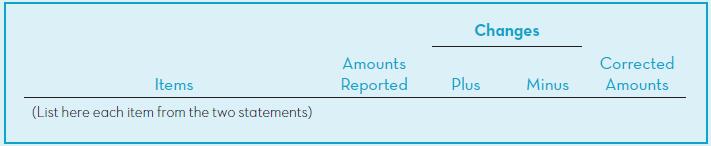

2. Redo the preceding statements after taking into account the adjusting journal entries. One way to organize your response is as follows:

3. Recording the adjusting journal entries had the following effects:

a. Increase or decrease (select one) net income by $

b. Increase or decrease (select one) total assets by $

4. Write a letter to the company explaining the results of the adjustments and your preliminary analysis.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh