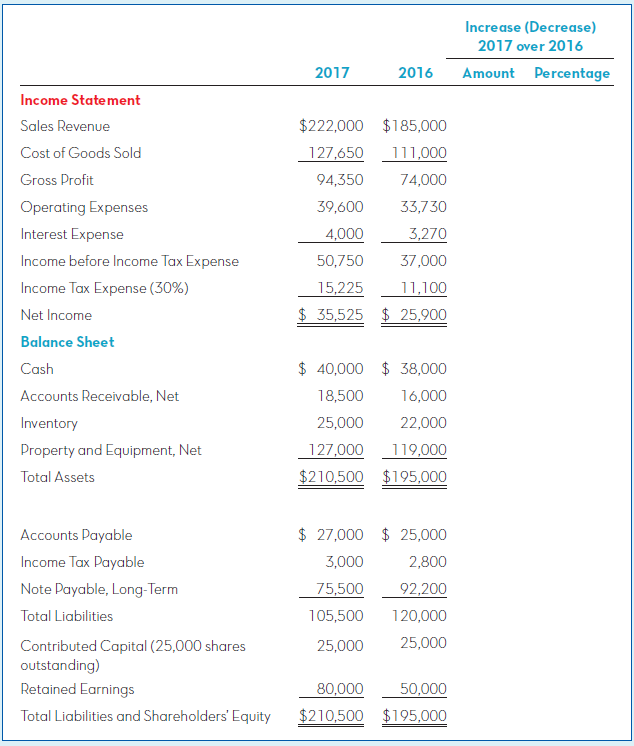

Use the data given in PB13-1 for Tiger Audio. Required: 1. Compute the gross profit percentage in

Question:

Use the data given in PB13-1 for Tiger Audio.

Required:

1. Compute the gross profit percentage in 2017 and 2016. Is the trend going in the right direction?

2. Compute the net profit margin for 2017 and 2016. Is the trend going in the right direction?

3. Compute the earnings per share for 2017 and 2016. Does the trend look good or bad? Explain.

4. Shareholders? equity totalled $65,000 at the end of 2015. Compute the return on equity ratios for 2017 and 2016. Is the trend going in the right direction?

5. Net property and equipment totalled $115,000 at the end of 2015. Compute the fixed asset turnover ratios for 2017 and 2016. Is the trend going in the right direction?

6. Compute the debt-to-assets ratios for 2017 and 2016. Is debt providing financing for a larger or smaller proportion of the company?s asset growth? Explain.

7. Compute the times interest earned ratios for 2017 and 2016. Do they look good or bad? Explain.

8. After Tiger released its 2017 financial statements, the company?s shares were trading at $17. After the release of its 2016 financial statements, the company?s share price was $12 per share. Compute the P/E ratios for both years. Does it appear that investors have become more or less optimistic about Tiger?s future success?

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh