What is the total of consolidated revenues? a. $500,000 b. $460,000 c. $420,000 d. $400,000 On January

Question:

What is the total of consolidated revenues?

a. $500,000

b. $460,000

c. $420,000

d. $400,000

On January 1, Jarel acquired 80 percent of the outstanding voting stock of Suarez for $260,000 cash consideration. The remaining 20 percent of Suarez had an acquisition-date fair value of $65,000. On January 1, Suarez possessed equipment (five-year remaining life) that was undervalued on its books by $25,000. Suarez also had developed several secret formulas that Jarel assessed at $50,000. These formulas, although not recorded on Suarez’s financial records, were estimated to have a 20-year future life.

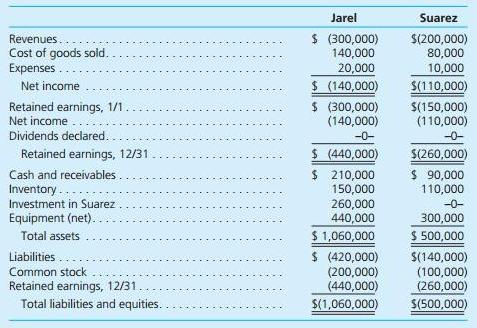

As of December 31, the financial statements appeared as follows:

Included in the above statements, Jarel sold inventory costing $80,000 to Suarez for $100,000. Of these goods, Suarez still owns 60 percent on December 31.

Step by Step Answer: