Assume that you are purchasing shares in a company in the variety store and gas bar supply

Question:

Assume that you are purchasing shares in a company in the variety store and gas bar supply business. Suppose you have narrowed the choice to BFI Trading Ltd. and Lin Corp. and have assembled the following data:

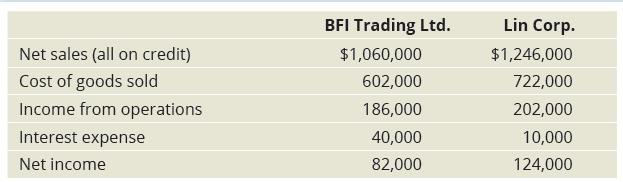

Selected income statement data for the year ended December 31, 2020:

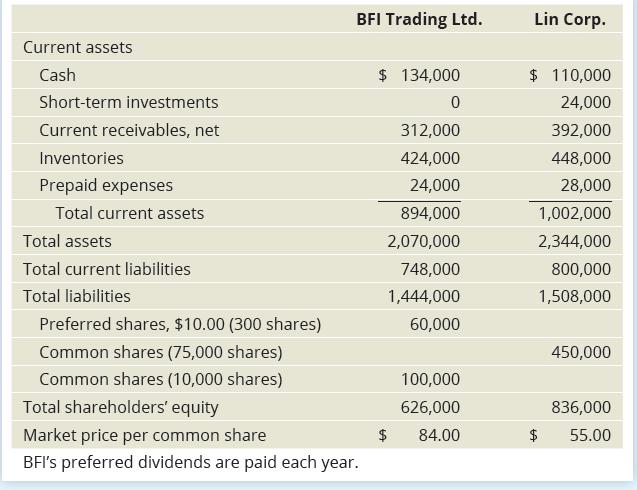

Selected balance sheet and market price data for the year ended December 31, 2020:

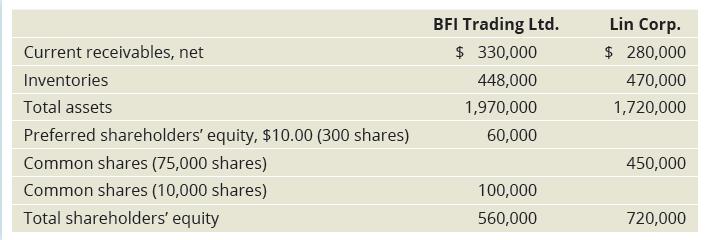

Selected balance sheet data at January 1, 2020:

Your investment strategy is to purchase the shares of companies that have low price– earnings ratios but appear to be in good shape financially. Assume you have analyzed all other factors and your decision depends on the results of the ratio analysis to be performed.

Required

Compute the following ratios (rounded to two decimal places) for both companies for the current year and decide which company’s shares better fit your investment strategy:

a. Current ratio

b. Acid-test ratio

c. Inventory turnover

d. Days’ sales in inventory

e. Accounts receivable turnover

f. Days’ sales in receivables

g. Debt ratio

h. Debt/equity ratio

i. Times-interest-earned ratio

j. Return on sales

k. Return on assets

l. Return on common shareholders’ equity

m. Earnings per common share

n. Price–earnings ratio

o. Book value per common share

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood