The partnership of Telliher, Bachra, and Lang has experienced operating losses for three consecutive years. The partners,

Question:

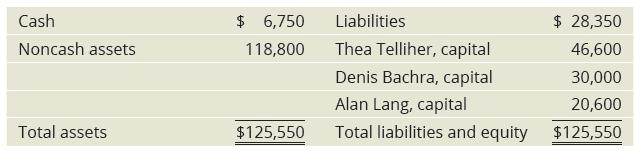

The partnership of Telliher, Bachra, and Lang has experienced operating losses for three consecutive years. The partners, who have shared profits and losses in the ratio of Thea Telliher, 60 percent, Denis Bachra, 20 percent, and Alan Lang, 20 percent, are considering liquidating of the business. They ask you to analyze the effects of liquidation under various possibilities about the sale of the noncash assets. Neither Telliher nor Lang have personal assets if they go into a deficit financial position. They present the following partnership balance sheet amounts at December 31, 2020:

Required

1. Prepare a summary of liquidation transactions (as illustrated in Exhibit 12–6) for each of the following situations:

a. The noncash assets are sold for $36,300.

b. The noncash assets are sold for $27,600.

2. What legal recourse do the remaining partners have to be reimbursed for deficit balances?

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood