Holbrook Corporation has three divisions: pulp, paper, and fibers. Holbrooks new controller, Paul Weber, is reviewing the

Question:

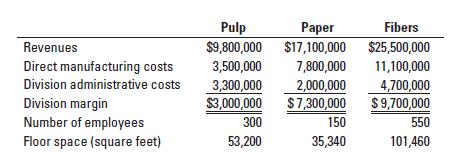

Holbrook Corporation has three divisions: pulp, paper, and fibers. Holbrook’s new controller, Paul Weber, is reviewing the allocation of fixed corporate-overhead costs to the three divisions. He is presented with the following information for each division for 2020:

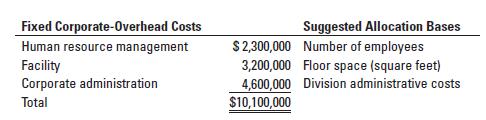

Until now, Holbrook Corporation has allocated fixed corporate-overhead costs to the divisions on the basis of division margins. Weber asks for a list of costs that comprise fixed corporate-overhead and suggests the following new allocation bases:

Required

1. Allocate 2020 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division’s operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)?

2. Allocate 2020 fixed costs using the allocation bases suggested by Weber. What is each division’s operating margin percentage under the new allocation scheme?

3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why?

4. Which allocation scheme should Holbrook Corporation use? Why? How might Weber overcome any objections that may arise from the divisions?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan