Marston Corporation manufactures pharmaceutical products that are sold through a network of sales agents. The agents are

Question:

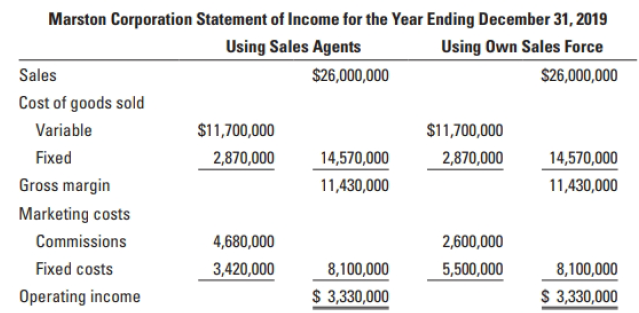

Marston Corporation manufactures pharmaceutical products that are sold through a network of sales agents. The agents are paid a commission of 18% of sales. The statement of income for the year ending December 31, 2019, under two scenarios, is as follows:

Marston is considering hiring its own sales staff to replace the network of agents. Marston will pay its salespeople a commission of 10% and incur additional fixed costs of $2,080,000.

Required

1. Calculate Marston Corpora tion's 2019 contribution margin percentage, breakeven revenues, and degree of operating leverage under each of the two scenarios. (You will first have to recast the 2019 statement of income assuming Marston had hired its own sales staff.)

2. Describe the advantages and disadvantages of each type of sales alternative.

3. In 2020, Marston uses its own salespeople, who demand a 15% commission. If all other cost behaviour patterns are unchanged, how much revenue must the salespeople generate in order to earn the same operating income as in 2019?

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 978-0134453736

8th Canadian Edition

Authors: Srikant M. Datar, Madhav V. Rajan, Louis Beaubien