Aggressive Corporation approaches Matt Taylor, a loan officer for Oklahoma State Bank, seeking to increase the companys

Question:

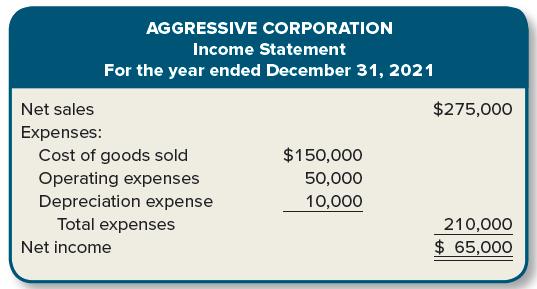

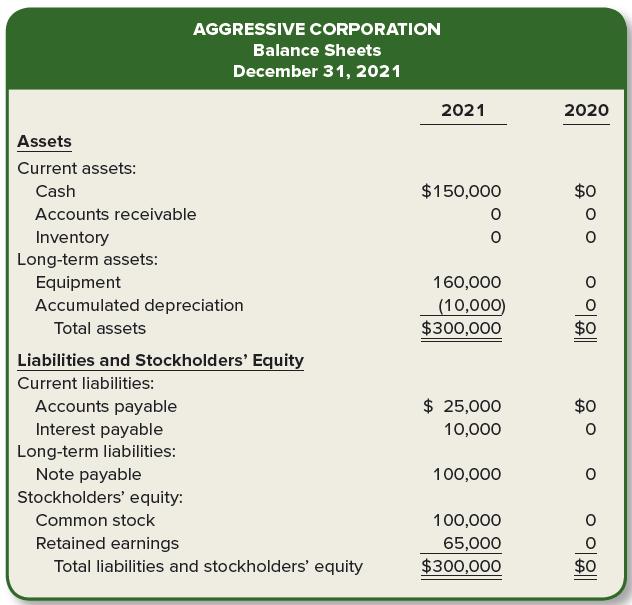

Aggressive Corporation approaches Matt Taylor, a loan officer for Oklahoma State Bank, seeking to increase the company’s borrowings with the bank from $100,000 to $200,000. Matt has an uneasy feeling as he examines the loan application from Aggressive Corporation, which just completed its first year of operations. The application included the following financial statements.

Matt notices that the company has no ending accounts receivable and no ending inventory, which seems suspicious. Matt is also wondering why a company with $150,000 in cash is seeking an additional $100,000 in borrowing.

Seeing Matt’s hesitation, Larry Bling, the CEO of Aggressive Corporation, closes the door to the conference room. He shares with Matt the following additional information:

• The ending accounts receivable balance is actually $60,000 but because those accounts are expected to be collected very soon, I assumed a balance of $0 and counted those receivables as cash collected.

• The ending inventory balance is actually $40,000, but I believe that inventory can easily be sold for $75,000 in the near future. So, I included sales revenue of $75,000 (and cost of goods of $40,000) in the income statement, and cash collected of $75,000 (and no inventory) in the balance sheet.

Plus, Larry tells Matt that he’ll be looking for a new CFO in another year to run Aggressive Corporation along with his other businesses, and Matt is just the kind of guy he is looking for. Larry mentions that as CFO, Matt would receive a significant salary. Matt is flattered and says he will look over the loan application and get back to Larry concerning the additional $100,000 loan by the end of the week.

Required:

1. Understand the reporting effect: Calculate operating cash flows using the financial statements provided by Larry.

2. Specify the options: Calculate operating cash flows without the two assumptions made by Larry.

3. Identify the impact: Could Larry’s assumptions affect Matt’s decision for the bank to lend an additional $100,000 to Larry?

4. Make a decision: Should Matt use Larry’s assumption in analyzing the loan for Aggressive Corporation?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann