Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress

Question:

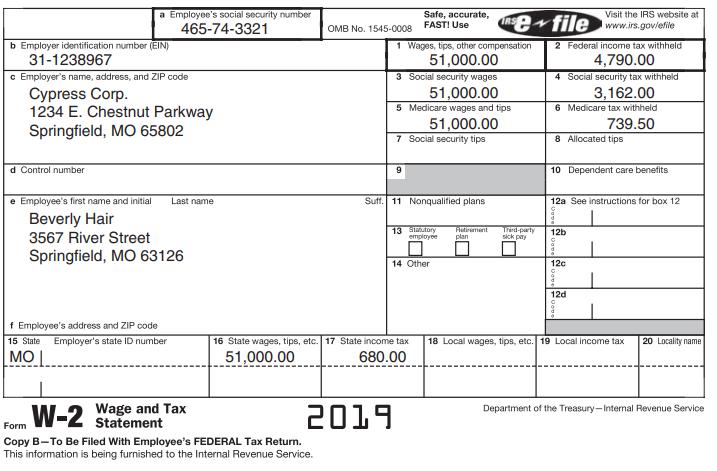

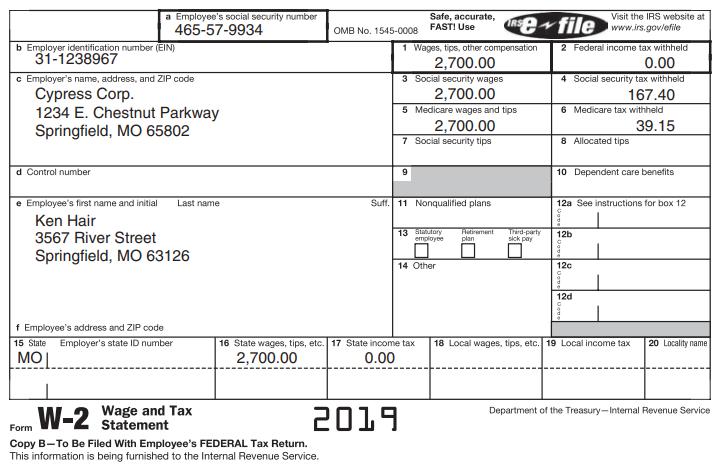

Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Ken’s birthdate is January 12, 1993 and Beverly’s birthdate is November 4, 1995. Bev and Ken’s earnings and income tax withholdings are reported on the following Form W-2s:

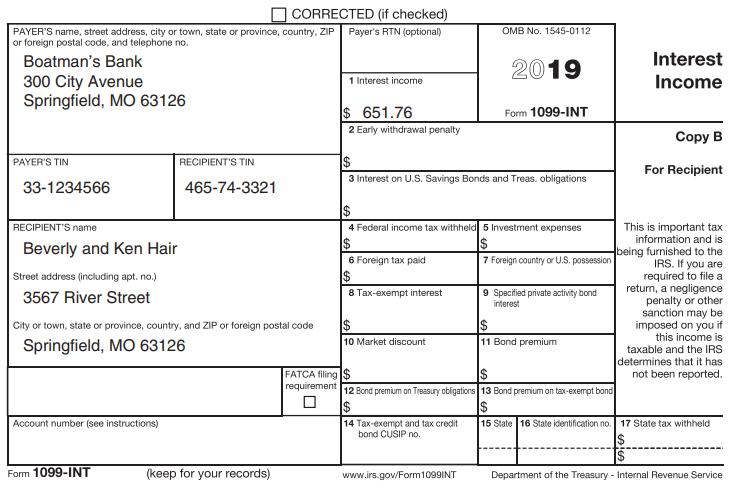

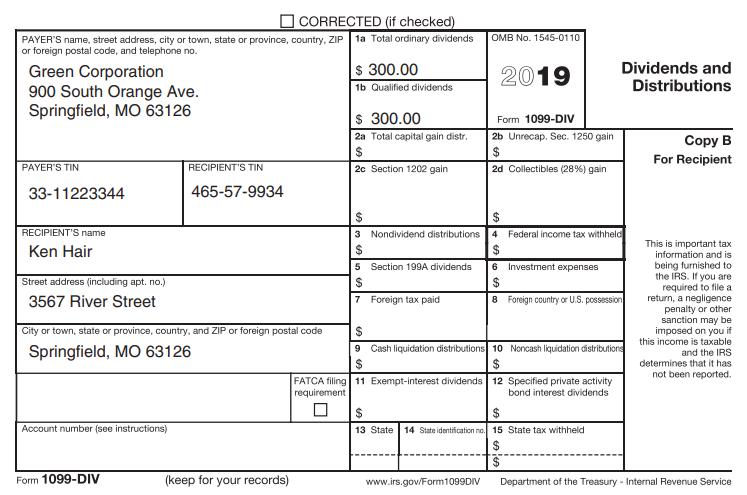

The Hairs have interest income of $1,000 on City of St. Louis bonds. Beverly and Ken also received the following Form 1099-INT and 1099-DIV:

Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books.

Last year, Beverly was laid off from her former job and was unemployed during January 2019. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation.

Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2014. During 2019, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken’s ex-wife.

During 2019, Ken’s aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman’s Bank savings account.

Required:

Complete the Hairs’ federal tax return for 2019 on Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet.

Step by Step Answer:

Income Tax Fundamentals 2020

ISBN: 9780357108239

38th Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill