Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2018: None of

Question:

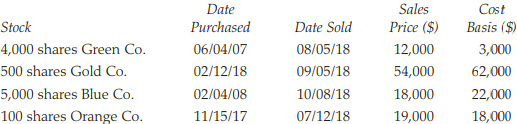

Charu Khanna received a Form 1099-B showing the following stock transactions and basis during 2018:

None of the stock is qualified small business stock. The stock basis was reported to the IRS. Calculate Charu’s net capital gain or loss using Schedule D and Form 8949 on Pages 4-49 through 4-52.

Transcribed Image Text:

Cost Basis ($) 3,000 62,000 22,000 Sales Price ($) Date Date Sold 08/05/18 09/05/18 10/08/18 Stock 4,000 shares Green Co. 500 shares Gold Co. 5,000 shares Blue Co. 100 shares Orange Co. Purchased 06/04/07 02/12/18 02/04/08 12,000 54,000 18,000 07/12/18 19,000 18,000 11/15/17

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 88% (9 reviews)

SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Names shown on return Capital Gains and Losses Go to Attach to Form 1040 or Form 1040NR wwwirsgovScheduled for instructions ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Calculate Larrys net capital gain or loss (assuming he has no other CGT events). On 1 June 2015 Larrys uncle Ben died and he left Larry a small house in Geelong (Geelong House). Ben had purchased the...

-

Karim Depak received a Form 1099-B showing the following stock transactions and basis during 2014: None of the stock is qualified small business stock. Calculate Karim's net capital gain or loss...

-

Record in T accounts the following stock transactions of Gorce Company, which represent all of the companys treasury stock transactions for the year: May 5 Purchased 3,200 shares of its own $2 par...

-

CASE STUDY. Case Study Chapters 1 and 2. Please post both case studies in Assignment Drop Box as one MS Word apa formate document. Note: See template provided for case study papers. Chapter 1 - Listo...

-

Kangaroo Jim Company reported beginning inventory of 100 units at a per unit cost of $25. It had the following purchase and sales transactions during 2012: Jan. 14 Sold 25 units at unit sales price...

-

Suggest three common descriptors for order.

-

How does the use of flexible variance analysis allow managers to isolate problem areas?

-

The unadjusted trial balance of PS Music as of July 31, 2014, along with the adjustment data for the two months ended July 31, 2014, are shown below. Based upon the adjustment data, the adjusted...

-

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is...

-

Write a report to present to the management of CardioGood Fitness to explain the functions of the CardioGood Fitness is a developer of high-quality cardiovascular exercise equipment. Its products...

-

During 2018, Tom sold Sears stock for $10,000. The stock was purchased 4 years ago for $13,000. Tom also sold Ford Motor Company bonds for $35,000. The bonds were purchased 2 months ago for $30,000....

-

Adam Grisly, a single taxpayer, retired from a long career in coal mining in 2017 when he was only 58 years of age. In 2018, his only source of income is wages of $17,500 from a part-time job. Adam...

-

An opera singer in a convertible sings a note at 600 Hz while cruising down the highway at 90 km/h. What is the frequency heard by a. A person standing beside the road in front of the car? b. A...

-

What is the relationship between racism, slavery and Edgar Allan Poe in his text "The Black Cat"?

-

What impact do you think popular culture is having in your own community and around the world? What can or should be done about this? list an example.

-

Summarise the main features of population and poverty rates given in Table1 below and comment on differences between and within countries over time. Table 1 Population and poverty rate by different...

-

How might we implement polymorphism in the driving program? Explain

-

Chad is divorced. His divorce was finalized on June 1, 2020. Chad's divorce decree states he is to receive family support payments in the amount of $1,000 each month. In 2022, he received family...

-

Norwest Products Inc., a wholesaler of office products, was organized on January 20 of the current year, with an authorization of 175,000 $1.50 preferred shares and unlimited common shares. The...

-

Diamond Walker sells homemade knit scarves for $25 each at local craft shows. Her contribution margin ratio is 60%. Currently, the craft show entrance fees cost Diamond $1,500 per year. The craft...

-

Betty owns three separate IRA accounts with different banks. She wishes to consolidate her three IRAs into one IRA in 2016. How many distribution rollovers may Betty make in 2016? a. One b. Two c....

-

Dick owns a house that he rents to college students. Dick receives $800 per month rent and incurs the following expenses during the year: Dick purchased the house in 1976 for $48,000. The house is...

-

Rebecca and Walter Bunge have been married for 5 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Rebecca is a homemaker and Walt is a high school teacher. Rebeccas Social...

-

Provide an overview of the best practices in risk identification during the risk identification step.

-

Explain what role does "Lead Time and Process Speed" play in the implementation of Lean Six Sigma?

-

In recent years, some Walmart workers have staged public protests about inadequate wages and unfair treatment. A number of these employees claim that management has retaliated against them for...

Study smarter with the SolutionInn App