Cooper and Brandy are married and file a joint income tax return with two separate Schedule Cs.

Question:

Cooper and Brandy are married and file a joint income tax return with two separate Schedule Cs. Cooper is an independent security specialist who spent $395 on uniforms during the year. His laundry expenses for the uniforms were $175 for this year, plus $65 for altering them. Brandy works as a drill press operator and wears jeans and a work shirt on the job, which cost $175 this year. Her laundry costs were $50 for the work clothes. Brandy is also required by state regulators to wear safety glasses and safety shoes when working, which cost a total of $115. How much is their total deduction on their Schedule Cs for special clothing and uniforms? $.

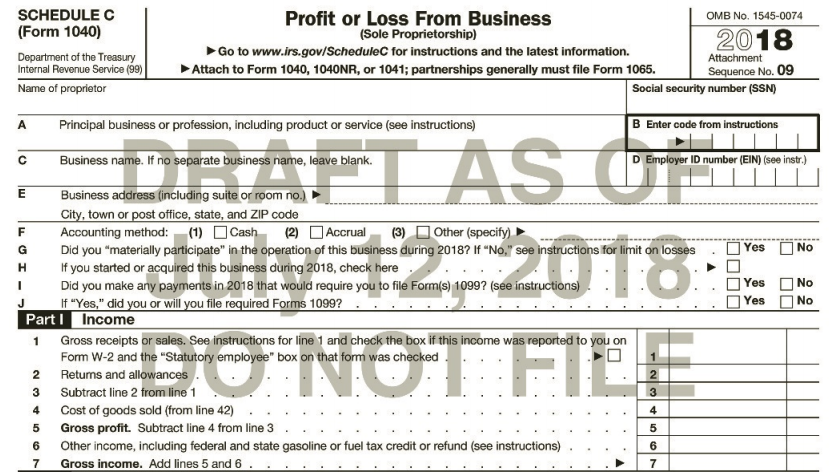

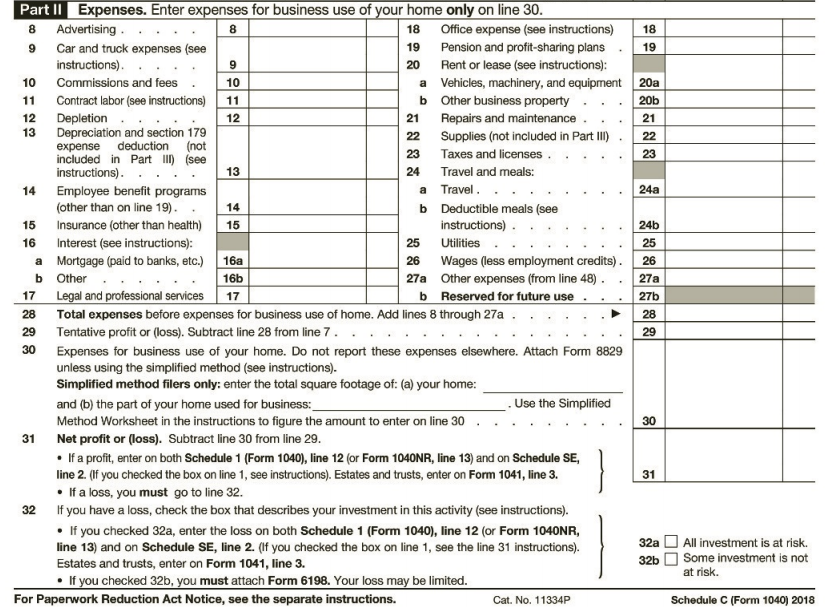

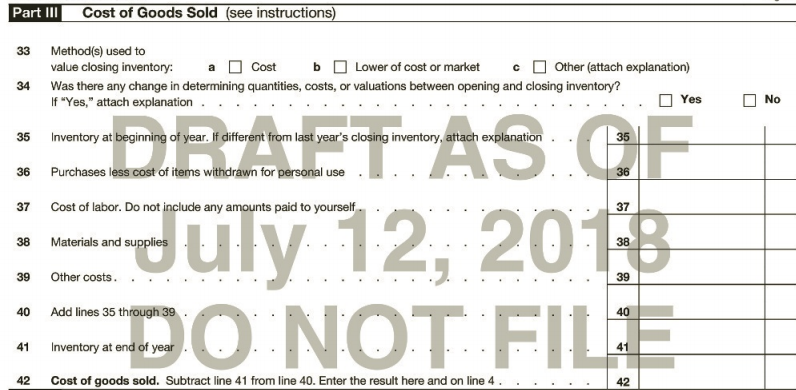

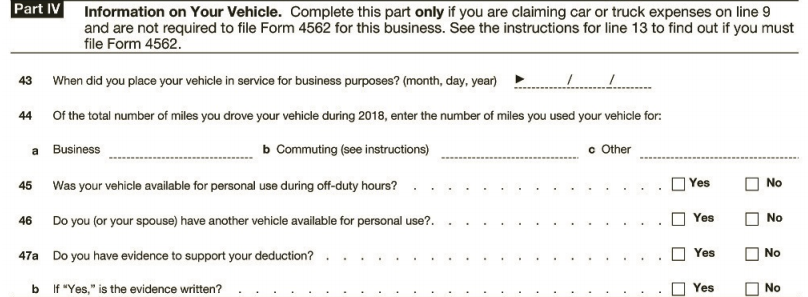

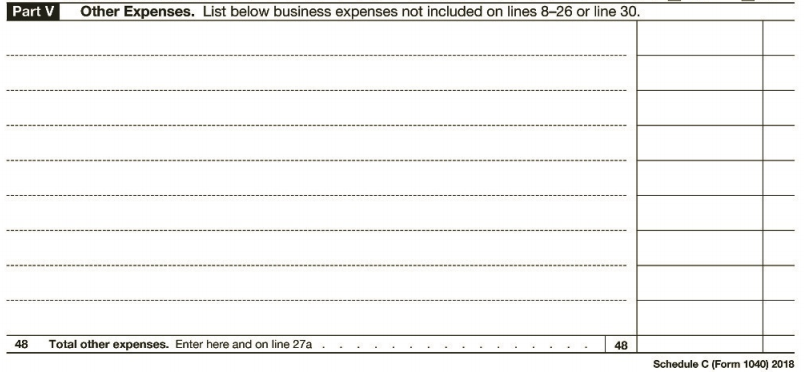

Profit or Loss From Business (Sole Proprietorship) Go to www.irs.gov/Schedulec for instructions and the latest information. Attach to Form 1040, 1040NR, or 1041; partnerships generally must file Form 1065. SCHEDULE C (Form 1040) OMB No. 1545-0074 2018 Attachment Sequence No. 09 Department of the Treasury Internal Revenue Service (99) Name of proprietor Social security number (SSN) B Enter code from instructions A Principal business or profession, including product or service (see instructions) DRAFT AS OF #2,2018· Business name. If no separate business name, leave blank. Employer ID number (EIN) (see instr.) Business address (including suite or room no.) City, town or post office, state, and ZIP code Accounting method: (1) OCash Did you "materially participate" in the operation of this business during 2018? If "No." see instructions for limit on losses If you started or acquired this business during 2018, check here Did you make any payments in 2018 that would require you to file Form(s) 1099? (see instructions) If "Yes," did you or will you file required Forms 1099? Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that fom was checked Retums and allowances 3 Subtract line 2 from line 1 Cost of goods sold (from line 42) (3) D Other (specify) (2) DAccrual O Yes No Yes No Yes O No EBONOT FILE 3. Gross profit. Subtract line 4 from line 3 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 6. Gross income. Add lines 5 and 6 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising . 9 Car and truck expenses (see Office expense (see instructions) Pension and profit-sharing plans 8. 18 18 19 19 instructions). 20 Rent or lease (see instructions): a Vehicles, machinery, and equipment 20a b Other business property Repairs and maintenance. Supplies (not included in Part III) Taxes and licenses. 10 Commissions and fees 10 11 Contract labor (see instructions) 11 · 20b 12 Depletion Depreciation and section 179 expense deduction (not included in Part I) (see instructions). .. Employee benefit programs (other than on line 19). 12 21 21 13 22 22 23 23 13 24 Travel and meals: 14 a Travel. 24a 14 b Deductible meals (see 15 Insurance (other than health) 15 instructions). 24b 16 Interest (see instructions): a Mortgage (paid to banks, etc.) ь other Legal and professional services 25 Utilities 25 Wages (less employment credits). 16a 26 26 16b 27a Other expenses (from line 48) . 27a 17 17 b Reserved for future use 27b Total expenses before expenses for business use of home. Add lines 8 through 27a Tentative profit or (loss). Subtract line 28 from line 7. . . 28 28 29 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: Use the Simplified and (b) the part of your home used for business: Method Worksheet in the instructions to figure the amount to enter on line 30 Net profit or (loss). Subtract line 30 from line 29. • If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, 30 31 line 2. (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 • If a loss, you must go to line 32. 32 If you have a loss, check the box that describes your investment in this activity (see instructions). • If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on Form 1041, line 3. • If you checked 32b, you must attach Form 6198. Your loss may be limited. 32a All investment is at risk. 32b Some investment is not at risk. For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 11334P Schedule C (Form 1040) 2018

Step by Step Answer:

Coopers uniforms 395 Laundry for Coopers uniforms 175 Alterations fo...View the full answer

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Students also viewed these Business questions

-

Jay contributes property with a fair market value of $16,000 and an adjusted basis of $5,000 to a partnership in exchange for an 8 percent partnership interest. a. Calculate the amount of gain...

-

Wilson has a 40 percent interest in the assets and income of the CC&W Partnership, and the basis in his partnership interest is $45,000 at the beginning of 2018. During 2018, the partnerships net...

-

Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to maintain his license. This year he paid $1,150 in course fees for his continuing legal...

-

what is the name of Dc output symbol on eagle in this circuit? XL2 EE20 core Flyback Transformer 4 SCHOTTKY [ 3 D4 SB160 IC2 EL817 OPTOCOUPLER thS 1 2 C2 470uF 25V R3 Tko ZD1 12V/1W DC Output 12V,...

-

Biz Zing Inc. (BZI) provides life and work counseling to companies. At the end of 2012, BZI's total assets were $1,120. BZI's unadjusted trial balance includes the following for the twelve months...

-

a. On the same axes sketch the curves given by y = (x + 1) 3 and y = 3x(x 1). b. Explain how your sketch shows that there is only one real solution to the equation x 3 + 6x + 1 = 0.

-

What are the legal requirements of boards?

-

Dry Quick (DQ) is a medium-sized, private manufacturing company located near Timmins, Ontario. DQ has a June 30 year-end. Your firm, Poivre & Sel (P&S), has recently been appointed as auditors forDQ....

-

Fred currently earns $9,400 per month. Fred has been offered the chance to transfer for three to five years to an overseas affiliate. His employer is willing to pay Fred $10,400 per month if he...

-

Ten thousand airline reservation stations are competing for the use of a single slotted ALOHA channel. The average station makes 18 requests/hour. A slot is 125 sec. What is the approximate total...

-

Which of the following self-employed taxpayers are most likely permitted to deduct the cost of their uniform? a. A lawyer who is required by her employer to wear a business suit. b. A furnace...

-

Abigail contributes land with an adjusted basis of $56,000 and a fair market value of $58,000 to Blair and Partners, a partnership. Abigail receives a 50% interest in Blair. What is Blairs recognized...

-

Use Version 2 of the Chain Rule to calculate the derivatives of the following functions. y = e tan t

-

What constitutes deviant behavior, and how does society typically react or respond to it?"

-

Clearly define the topic of maritime security in the Caribbean and provide background information on the importance of the region for global trade and security. Identify and describe the main...

-

Business deals don't always work out. Please share a story of a merger or acquisition that had a good or bad outcome in biotech? Whether it was a success or failure, please explain why it turned out...

-

Write a C++ program to delete an element of a list of integer's numbers of size N, then shift all the rest of the list toward the deleted element: example: original list 1, 40, 21, 11, 31, 5, 7; if...

-

Your community hospital is exploring the purchase of an EHRS. The chief nursing officer wants you, the informatics nurse, to educate the nurse leaders about potential benefits and detriments of an...

-

Louis, Alexis, and Donald LLP had equity balances on January 1, 2015, as follows: Sandra Louis ........................$106,700 Amelia Alexis ....................... 58,400 Alex Donald...

-

The test statistic in the NeymanPearson Lemma and the likelihood ratio test statistic K are intimately related. Consider testing H 0 : = 0 versus H a : = a , and let * denote the test statistic...

-

An asset (not an automobile) put in service in June 2016 has a depreciable basis of $40,000 and a recovery period of 5 years. Assuming bonus depreciation is used, half-year convention and no election...

-

James purchased office equipment for his business. The equipment has a depreciable basis of $14,000 and was put in service on June 1, 2016. James decides to elect straight-line depreciation under...

-

Which of the following statements with respect to the depreciation of property under MACRS is incorrect? a. Under the half-year convention, one-half year of depreciation is allowed in the year the...

-

1. Compare and contrast the uses and relative advantages of X-rays, ultrasound, gamma camera and MRI in examining internal structures. 2. Evaluate the hazards of X-rays, ultrasound, gamma camera and...

-

What is the missing line of code? my_list = ["one", "two", "three"] print(x)

-

A cylindrical capacitor has an inner conductor of radius 2.2 mm and an outer conductor of radius 3.5 mm. The two conductors are separated by vacuum, and the entire capacitor is 2.4 m long. Part A...

Study smarter with the SolutionInn App