Dick owns a house that he rents to college students. Dick receives $800 per month rent and

Question:

Dick owns a house that he rents to college students. Dick receives $800 per month rent and incurs the following expenses during the year:

Real estate taxes.................. $1,250

Mortgage interest.................. 1,500

Insurance.................. 425

Repairs.................. 562

Association dues.................. 1,500

Dick purchased the house in 1978 for $48,000. The house is fully depreciated. Calculate Dick’s net rental income for the year, assuming the house was rented for a full 12 months.

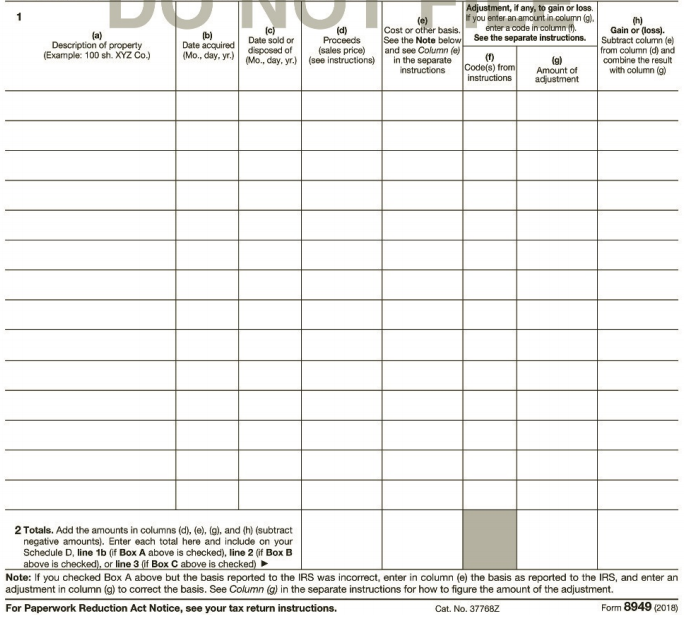

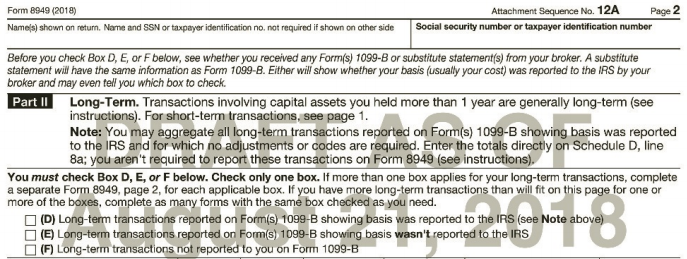

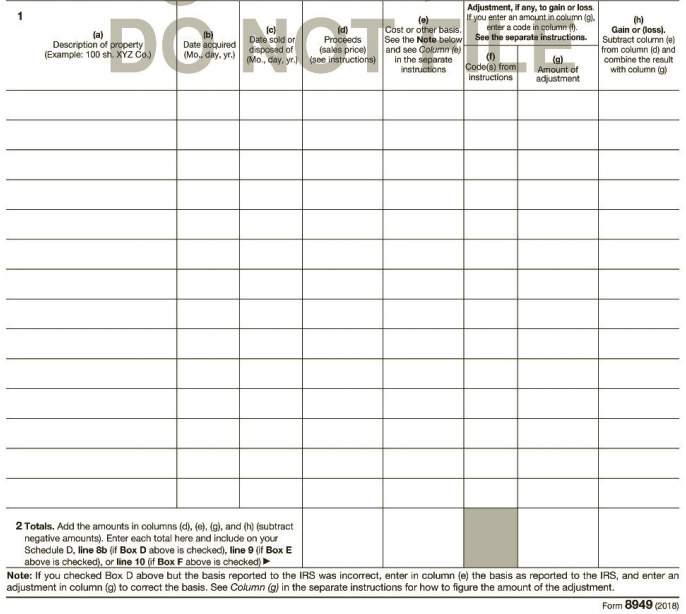

Transcribed Image Text:

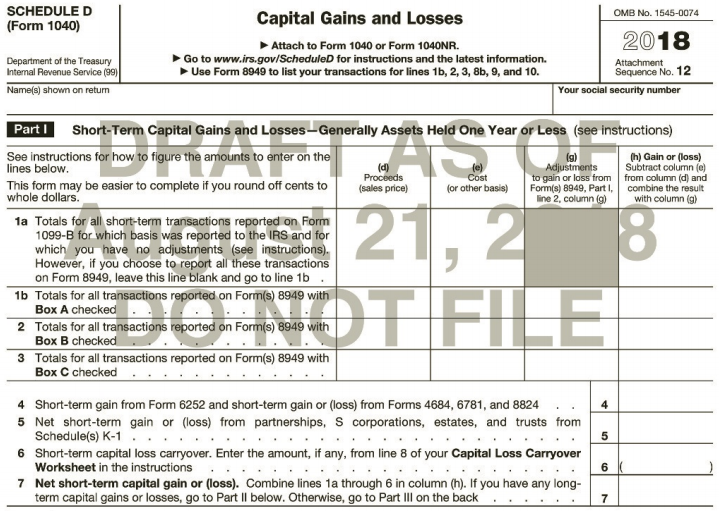

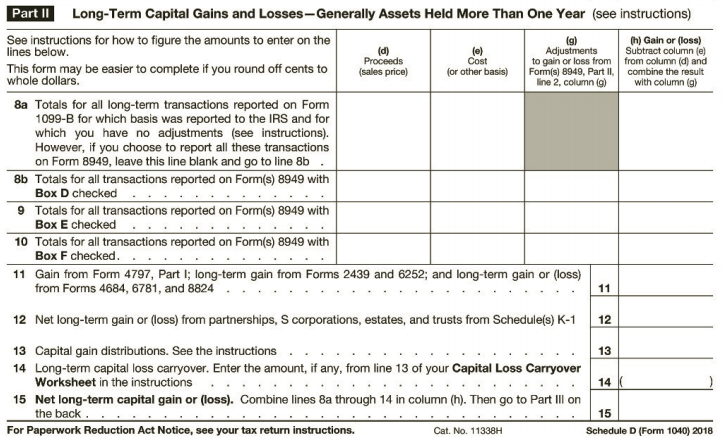

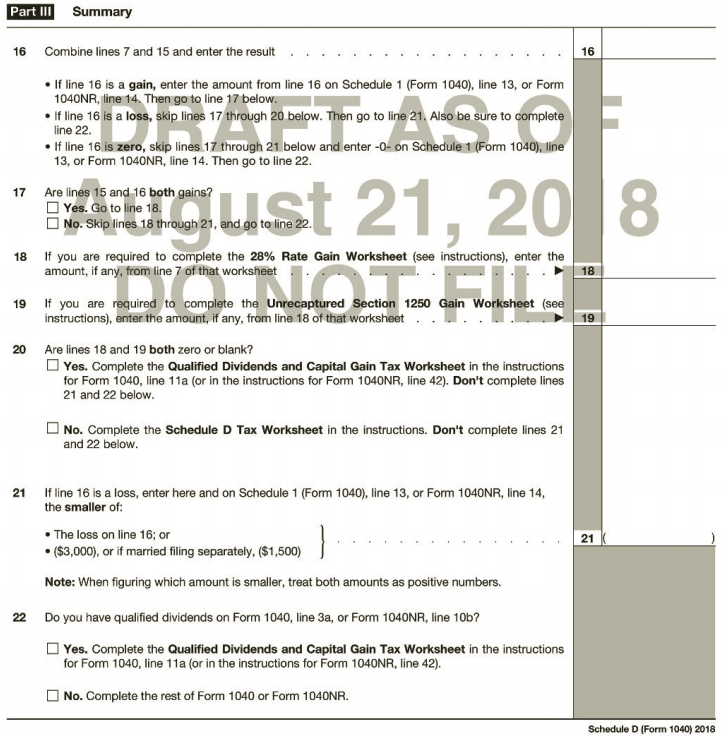

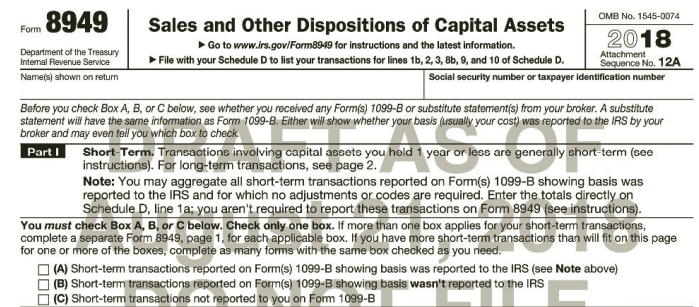

SCHEDULE D OMB No. 1545-0074 Capital Gains and Losses (Form 1040) 2018 Attach to Form 1040 or Form 1040NR. Go to www.irs.gov/ScheduleD for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Department of the Treasury Intemal Revenue Service (99) Attachment Sequence No. 12 Name(s) shown on retum Your social security number EDRAF 21,2 JO NOT FILE Part I Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. (g) Adjustments to gain or loss from Form(s) 8949, Part I, line 2, column (g) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result with column (g) (d) Proceeds (sales price) Cost (or other basis) This form may be easier to complete if you round off cents to whole dollars. 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 5 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1. 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back 4 Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. (h) Gain or (loss) Subtract column (e) to gain or loss from from column (d) and Form(s) 8949, Part II, combine the result with column (g) (g) Adjustments (d) Proceeds (sales price) (e) Cost (or other basis) This form may be easier to complete if you round off cents to whole dollars. line 2, column (g) 8a Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b . 8b Totals for all transactions reported on Form(s) 8949 with Box D checked 9 Totals for all transactions reported on Form(s) 8949 with Box E checked 10 Totals for all transactions reported on Form(s) 8949 with Box F checked. 11 Gain from Form 4797, Part I; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from Forms 4684, 6781, and 8824 11 12 Net long-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 12 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 15 Net long-term capital gain or (loss). Combine lines 8a through 14 in column (h). Then go to Part Ill on the back. 14 15 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2018

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

Rental income 800 x 12 months 9600 Expenses Real estate tax...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During the current year, Kim incurs the following expenses with respect to her beachfront condominium in Hawaii... Insurance ............... $500 Repairs and maintenance ......... $700 Interest on...

-

During the current year, Kim incurs the following expenses with respect to her beachfront condominium in Hawaii: Item Amount Insurance $ 500 Repairs and maintenance 700 Interest on mortgage .....

-

During the current year, Kim incurs the following expenses with respect to her beachfront condominium in Hawaii: Item Amount Insurance............................................................ $...

-

Describe the general process used to determine the ULRD using AICPA sampling tables?

-

Prepare journal entries to record the transactions in PA7-1 assuming that a periodic inventory system is used, with inventory costs being determined on a FIFO basis.

-

Five white and four black balls are arranged in a row. What is the probability that the end balls are of different colors?

-

What are some recent trends in inventory management by healthcare providers?

-

Siblings Jordan and Morgan Hartley are partners in a trendy toy store called ToyMania! Jordan, as senior partner, receives an annual salary allowance of $20,000 and 60 percent of all income/losses...

-

Who told Fannie Mae that when it came to compliance with accounting rules, "You weren't even on the page"?

-

1. The local government is running a flu vaccination program. Are the following costs fixed, variable, or step costs? (a) Costs of occupancy (b) Costs of management (c) Costs of part-time employee...

-

Which of the following forms is used to report wages, tips and other compensation paid to employees? a. Form W-4 b. Form W-2G c. Form W-2 d. Form 1099-R e. Form 1099-MISC

-

In 2018, Tim, a single taxpayer, has ordinary income of $29,000. In addition, he has $2,000 in short-term capital gains, long-term capital losses of $10,000, and long-term capital gains of $4,000....

-

What is LexisNexis Academic?

-

What might be more authentic expressions of Native relationships with land/landscape?

-

How woul sharing half of your belonging help to create "an inseparable bond of brotherhood?" explain

-

Which ratio most directly impacts whether or not the accounts receivable turnover rate gets out of hand (meaning the AR turnover rate is greater than 3 months' worth of revenue?

-

How does the CAFR help stakeholders, including citizens, policymakers, and investors, understand a government's financial health and performance?

-

Communication Style:Were your thoughts conveyed clearly and concisely? Confidence: Do you appear calm, collected, and composed? Professional Demeanor:What is your body language conveying? Are you...

-

During 2015, Emmerson Construction Ltd. earned $387,456 in revenue, incurred $219,364 in expenses, and declared cash dividends of $50,000. Journalize the closing entries for Emmerson Construction...

-

Fill in each blank so that the resulting statement is true. A solution to a system of linear equations in two variables is an ordered pair that__________ .

-

Jim has a net operating loss in 2016. If he does not make any special elections, what is the first year to which Jim carries the net operating loss? a. 2012 b. 2013 c. 2014 d. 2015 e. 2017

-

Go to the IRS website (www.irs.gov) and redo Problem 1 (Chapter 3, Group 2) using the most recent interactive Schedule C (Form 1040) on the IRS website that will allow the required information to be...

-

Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: What is the net income Margaret should show on her...

-

At the beginning of year 1, Unbalanced Bank makes a three-year, fixed-rate loan to Butterfly Corp. Butterfly promises to repay Unbalanced in three installments of $100 each year at the ends of years...

-

inces General Requirement Journal General Ledger Trial Balance Income Statement Balance Sheet Analysis Using the information from the requirements in the previous tabs, complete the 'Analysis' tab....

-

Mr. Pous has just inaugurated his new jewelry workshop. His specialty is rings and bracelets. Due to the novelty of his business, Mr. Pous will specialize in the production of a certain model of ring...

Study smarter with the SolutionInn App