Lola, age 67, began receiving a $1,000 monthly annuity in the current year upon the death of

Question:

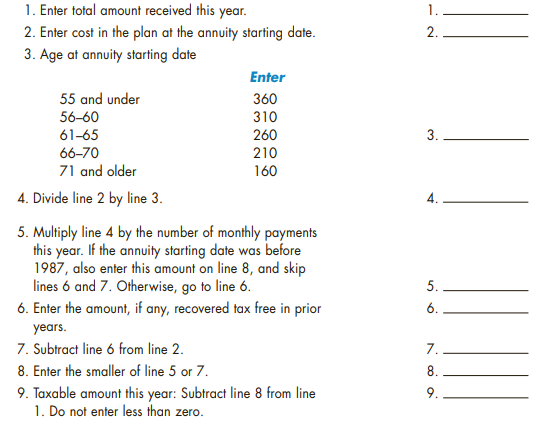

Lola, age 67, began receiving a $1,000 monthly annuity in the current year upon the death of her husband. She received seven payments in the current year. Her husband contributed $48,300 to the qualified employee plan. Use the Simplified Method Worksheet below to calculate Lola’s taxable amount from the annuity.

Transcribed Image Text:

1. Enter total amount received this year. 2. Enter cost in the plan at the annuity starting date. 3. Age at annuity starting date 1. 2. Enter 55 and under 360 310 260 56-60 61-65 3. . 66-70 210 71 and older 160 4. Divide line 2 by line 3. 4. - 5. Multiply line 4 by the number of monthly payments this year. If the annuity starting date was before 1987, also enter this amount on line 8, and skip lines 6 and 7. Otherwise, go to line 6. 6. Enter the amount, if any, recovered tax free in prior 5. 6. . years. 7. Subtract line 6 from line 2. 7. 8. Enter the smaller of line 5 or 7. 8. 9. Taxable amount this year: Subtract line 8 from line 1. Do not enter less than zero. 9.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

SIMPLIFIED METHOD WORKSHEET 1 Enter total amount received this year 2 ...View the full answer

Answered By

Hillary Waliaulah

As a tutor, I am that experienced with over 5 years. With this, I am capable of handling a variety of subjects.

5.00+

17+ Reviews

30+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Lola, age 62, began receiving a $2,000 monthly annuity in the current year upon the death of her husband. She received eight payments in the current year. Her husband contributed $40,000 to the...

-

Lola, age 62, began receiving a $1,000 monthly annuity in the current year upon the death of her husband. She received eight payments in the current year. Her husband contributed $58,500 to the...

-

Fifteen years ago, Mr. F paid $50,000 for a single-premium annuity contract. This year, he began receiving a $1,300 monthly payment that will continue for his life. On the basis of his age, he can...

-

Based on the following information, calculate the sustainable growth rate for Kaleb's Welding Supply: Profit margin = 7.5% Capital intensity ratio = .65 Debt-equity ratio = .60 Net income = $67,000...

-

Assume the same facts as CP12-4, except for additional data item (a) and the income statement. Instead of item (a) from CP12-4, assume that the company bought new golf clubs for $3,000 cash and sold...

-

Which of the following statements expresses the fact that the product of two numbers, a and b, is 6 greater than their sum? A) Ab + 6 > a + b B) Ab = a + b + 6 C) Ab + 6 = a + b D) Ab > a + b + 6

-

Describe the process of glycolysis. Is ATP produced during glycolysis?

-

Leslie Blandings, division manager of Audiotech Inc., was debating the merits of a new producta weather radio that would put out a warning if the county in which the listener lived were under a...

-

What are the religious beliefs of the south korea and does that impact consumer behaviour? What is/are the language(s)

-

Bert the Payroll Guy is about to retire after 40 years and it's time to replace his manual time card system with some sort of computerized database. You have been asked to come up with the database...

-

Sharon transfers to Russ a life insurance policy with a cash surrender value of $27,000 and a face value of $100,000 in exchange for real estate. Russ continues to pay the premiums on the policy...

-

Huihana receives a watch for achieving 20 years of employment with her employer. The watch cost the employer $225 and has a market value of $250 on the date awarded. Huihana is in the highest tax...

-

A watch manufacturer claims that its watches gain or lose no more that 8 seconds in a year. How accurate is this watch, expressed as a percentage?

-

For positive acure ngeles A and B , ir is know Mmmm that sin A=15/17 and tan B=5/12. Find the value of cos(A-B)in simplest form

-

How many types of stimulus materials should expect on the test? What are they? What are all of the content topics covered? What percentage of each content topic do you see? How much time are you...

-

Use the geometric method and solve by preparing a schedule from 0-5. Then find the slope. y = 240x^-1 + 15x^2 Find y when x = 2

-

How would Amazon use financial evaluation techniques to decide whether or not to engage in this project: inventory reduction through improved demand forecasting usingpredictive analytics and machine...

-

Steve LOVES coffee. Assume that caffeine levels in human blood serum decay according to the MATH1080 exponential decay model A ( t )= A 0 e - kt . If Steve instantly drinks a coffee, and all of the...

-

Office equipment that cost $67,000 had accumulated depreciation of $22,500 when it sold for $38,600. Using this information, indicate the items to be reported on the state- ment of cash flows...

-

A company produces earbuds. The revenue from the sale of x units of these earbuds is R = 8x. The cost to produce x units of earbuds is C = 3x + 1500. In what interval will the company at least break...

-

Jerry made the following contributions during 2016: His synagogue (by check) ...................................................... $1,050 The Democratic Party (by check)...

-

In June of 2016, Maureen's house is vandalized during a long-term power failure after a hurricane hit the city. The president of the United States declares Maureen's city a disaster area as a result...

-

On January 3, 2016, Carey discovers his diamond bracelet has been stolen. The bracelet had a fair market value and adjusted basis of $7,000. Assuming Carey had no insurance coverage on the bracelet...

-

Max Warrie, a famous former Australian cricketer had agreed to play at the Sydney Cricket Ground in an exhibition match against a rest of the world team in the coming Australian summer. He was to be...

-

Does a creditor have an obligation to advise a company to obtain legal advice before signing a contract? In this case, a director of a company is saying they did not know what they were signing when...

-

Randal embezzled $6000 of his employer's money and then disappeared. The employer's accountant called at Randal's residence and found out that his wife had a $3500 term deposit. When the accountant...

Study smarter with the SolutionInn App