Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph earns a total of $98,000

Question:

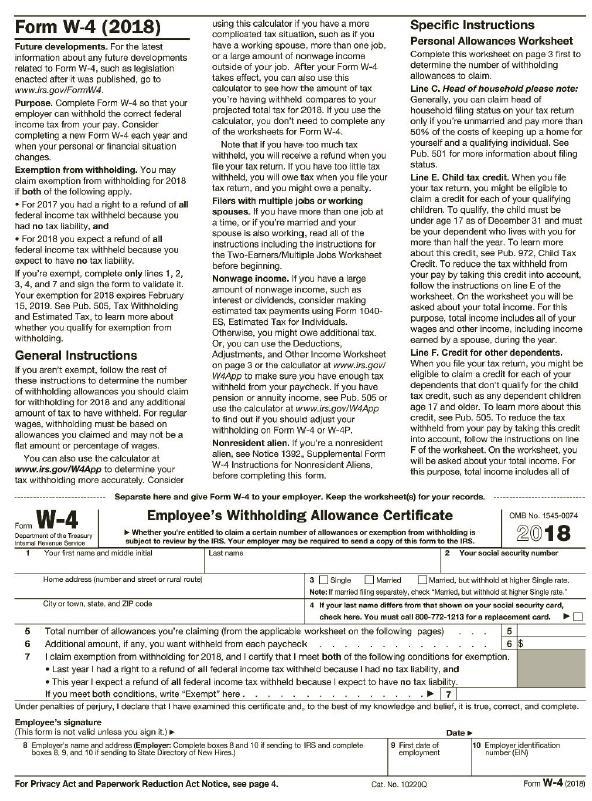

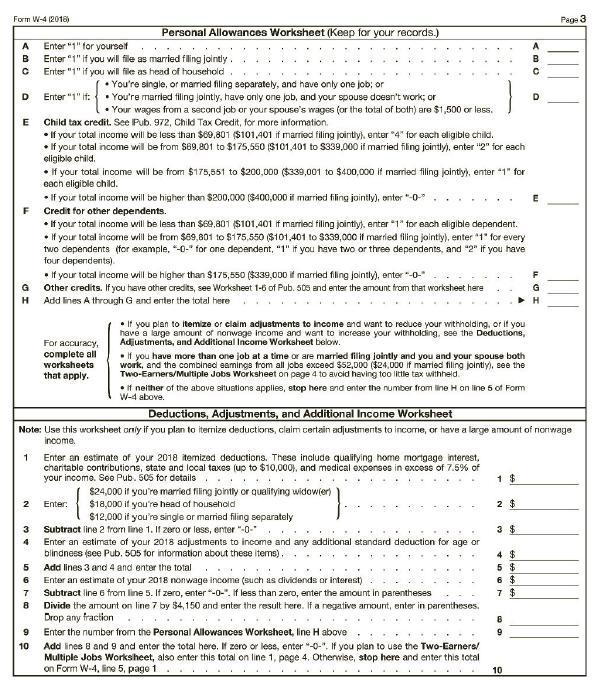

Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph earns a total of $98,000 and estimates their itemized deductions to be $28,500 for the year. Kathy is not employed. Use Form W-4 on Pages 9-39 and 9-40 to determine the number of withholding allowances that Ralph should claim.

Transcribed Image Text:

Form W-4 (2018) using this calculator if you have a more complicated tax situation, such as if you have a working spouse, more than one job, or a large amount of nonwage income outside of your job. After your Form W-4 takes effect, you can also use this calculator to see how the amount of tax Specific Instructions Personal Allowances Worksheet Future developments. For the latest information about any future developmonts related to Form W-4, such as legislation enacted after it was published, go to www.rs.gov/FormmW4. Purpose. Completa Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption trom withholding. You may claim exemption from withholding for 2018 if both of the following apply. • For 2017 you had a right to a refund of all federal income tax withheld because you had no tax liability, and • For 2018 you expect a refund of all federal income tax withheld because you expect to have no tax liability. If you're exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Your exemption for 2018 expires February 15. 2019. See Pub. 505, Tax Withholding and Estimated Tax, to learn more about whather you qualify for axemption from withholding. Complete this woriksheet on page 3 first to determine the number of withholding allowances to claim. you're having withheld compares to your projected total tax for 2018. If you use the calculator, you don't need to complete any of the worksheets for Form W-4. Line C. Head of houschold please note: Generally, you oan olaim head of household filing status on your tax retum only if you're unmarried and pay more than 50% of the costs of keeping up a home for yourself and a qualifying individual. See Pub. 501 for more information about filing Note that if you have too much tax withheld, you will receiwe a refund when you file your tax return. If you have too little tax withheld, you will owe tax when you file your tax ratum, and you might owa a penalty. Filers with multiple jobs or working spouses. If you have more than one job at a time, or if you're married and your spouse is also working, read all of the instructions including the instructions for the Two-Earners/Multiple Jobs Worksheet before beginning. Nonwage income. If you have a large amount of nonwage incorme, such as interest or cividends, consider making estimated tax payments using Form 1040- ES, Eatimated Tax for Individuals. Otherwise, you might owe additional tax. Or, you can use the Deductions, Adjustments, and Other Income Worksheet on page 3 or the calculator at www.irs.gov/ WAAPP to make sure you have enough tax withheld from yOur paycheck. If you have pension or annuity income, see Pub. 505 or Use the calculator at www.irs.gov/W4App to find out if you should adjust your withholding on Form W-4 or W-4P. Nonresident alien. if you're a nonresident alien, see Notice 1392, Supplemental Form W-4 Instructiona for Nonresident Aliens, before completing this form. status. Line E. Child tax credit. When you file your tax return, yau might be eligible to claim a credit for each of your qualifying children. To qualify, the child must be under age 17 as of December 31 and must be your depandent who lives more than half the year. To learn more about this credit, see Pub. 972, Child Tax Credit. To reduce the tax withheld from your pay by taking this credit into account. follow the instructions on line E of the ith you for worksheet, On the worksheet you will be asked about your total income. For this purpose, total income includes all of your wages and other income, including income Barned by a spouse, during the year. Line F. Credit for other dependents. When you file your tax return, you might be eligible to claim a credit for each of your dependents that don't quai fy for the child tax credit, such as any dependerit children age 17 and older. To leam mors about this credit, see Pub. 505. To reduce the tax withheld from your pay by taking this credit into account, follow the Instructions on Iine Fof the worksheet. On the worksheet, you will be asked about your total income. For this purpose, total income includes all of General Instructions If you aren't exempt, follow the rest of these instructions to determine the number of withholding allowances you should claim for withholding for 2018 and any additional amount of tax to have withheld. For regular wagas, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. You can also use the calculator at www.irs.gov/W4App to determine your tax withholding more accurately. Consider Separste here and give Form W-4 to your employer. Keep the worksheet(s) for your records. W-4 Employee's Withholding Allowance Certificate CMB No. 1545-0074 Fom Departmant of dha Troasury Intura Fnene Serrice Whether you're entitled to claim a certain number of allowances or exemption from withholding is subject to revieur by the IRS. Your employer may be requred to send a copy of this form to the IRS. 2018 Your frst name and middle intiel Last rame 2 Your social security number 3 OSrgle OMarried Note: If maried fing separately, check "Manled, but wilmold at Nigher Single rate 4 H your last name differs from that shown on your social security card, check here. You must call 800-772-1213 for a replacement card. Home address (number and street or rural routel OMaried, but withhold at higher Single rate. City or town, state, and ZIP code Total number of allowances you're claiming (rom the applicable worksheet on the following pages) Additional amount, if any. you want withheld from each paycheck I claim exemption from withholding for 2018, and I cartify that I meet both of the folowing conditions for exemption. • Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and • This year I expect a refund of all federal income tax withheld because ! expect to have no tax liability. If you meet both conditions, write "Exempt" here. Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete. 6. Employee's signature (This form is not valid unless you sign it.) 8 Emplayer's name ard address Employer: Complete boces Band 10 it sending to IPS and complete Date 9 First chte of emplayment 10 Employer idertfication number (EIN) baxes B 9, and 10 if sencing to State Directory af New Hires.) For Privacy Act and Paperwork Reduction Act Notice, see page 4. Cat. No. 102200 Form W-4 (2018)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (10 reviews)

Form W4 2018 Future developments For the latest information about any future developments related to Form W4 such as legislation enacted after it was published go to wwwirsgovFormW4 Purpose Complete F...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Mr. and Mrs. Wilson are married with one dependent child. They report the following information for 2017: Schedule C net profit.....................................................$66,650 Interest...

-

Mr. and Mrs. Wilson are married with one dependent child. They report the following information for 2018. Schedule C net profit .............................................................. $66,650...

-

Mr. and Mrs. Wilson are married with one dependent child. They report the following information for 2016: Schedule C net profit...

-

DEFINE TABLE AUTHORS WITH COLUMNS AUTHORID INT AND AUTHORNAME VARCHAR(30),ADD COLUMN LEVEL PRIMARY KEY CONSTRAINT FOR AUTHORID, ADD COLUMN LEVEL NOT NULL CONSTRAINT FOR AUTHORNAME 2. DEFINE TABLE...

-

Xerox Corporation is the company that made the photocopier popular, although it now describes itself as a technology and services enterprise that helps businesses deploy document management...

-

The pluck of a circle is defined as the area of the circle divided by . What is the pluck of a circle with radius 5 ?

-

Briefly, what is the difference between patient service revenue based on chargemaster prices and reported net patient service revenue? Between net patient service revenue and other operating revenue?

-

Portland Products is considering the purchase of one of three mutually exclusive projects for increasing production efficiency. The firm plans to use a 14% cost of capital to evaluate these...

-

Suppose you are holding a 3% coupon bond maturing in five years with a yield to maturity of 12%. If the current market interest rate on comparable five-year instruments is 7%, what is expected yearly...

-

Which of the following MIPS(32-bit) instructions branches maximum distance? a) BEQ b) BGTZ c) JAL d) BLT

-

Abbe, age 56, is married and has two dependent children, one age 14, and the other a 21 year-old full-time student. Abbe has one job, and her husband, age 58, is not employed. If she expects to earn...

-

Sophie is a single taxpayer. For the first payroll period in July 2018, she is paid wages of $3,900 monthly. Sophie claims one allowance on her Form W-4. a. Use the percentage method to calculate the...

-

Sketch the graph of the equation and use the Vertical Line Test to determine whether is a function of x. x - y = 0

-

What are the requirements set out by the covenants on the bank loans? Explain.

-

The two semicircular ends of a semicircular shape each have a radius of 18.5 cm, while the two flat sides of the shape are each 70 cm. What is the area of the full shape, in square cm? Round the...

-

Consider a research funding game in which two government agencies, the U.S. Department of Energy (DoE) and the Defense Advanced Research Projects Agency (DARPA), each decide which of two research...

-

Q6. (2 points) Section 4.1 Question 21: The tail of a language is defined as the set of all suffixes of its strings, that is, tail (L) = {y xy = L for some x = *}. Show that if L is regular, so is...

-

Explain the intricacies of network stack implementation within operating systems, covering topics such as packet processing, socket management, and protocol handling, while ensuring scalability and...

-

For each of the following items, determine the applicable income taxes using a tax rate of 30%. State whether the income taxes are additional taxes owing (O) or tax savings (S). Calculate the...

-

Graph one period of each function. y = 4 cos x

-

In 2018, Mary sells for $14,000 a machine used in her business. The machine was purchased on May 1, 2016, at a cost of $13,000. Mary has claimed depreciation on the machine of $8,000. What is the...

-

Derek purchases a small business from Art on July 1, 2018. He paid the following amounts for the business: Fixed assets..................................$220,000...

-

During 2018, Paul sells residential rental property for $290,000, which he acquired in 1997 for $145,000. Paul has claimed straightline depreciation on the building of $54,500. What is the amount and...

-

Review the disclosures in the 10-K filed April 10, 2008. Which audit firm accepted IRIDEX as a new client following PwC's resignation? In what important ways does that audit firm differ from PwC?...

-

Are the two groups of users who are offered (i) a $150 phone credit, or (ii) a $10 pre-paid\ Visa card probabilistically equivalent? Why or Why not? (1 point)\ Question 2. Are the two groups of users...

-

Grimm, a student, is in the 4 0 % ordinary income tax bracket. He sold a business - use building for a $ 3 0 0 K gain, where half the gain is unrecaptured 1 2 3 1 , and the other half is a regular...

Study smarter with the SolutionInn App