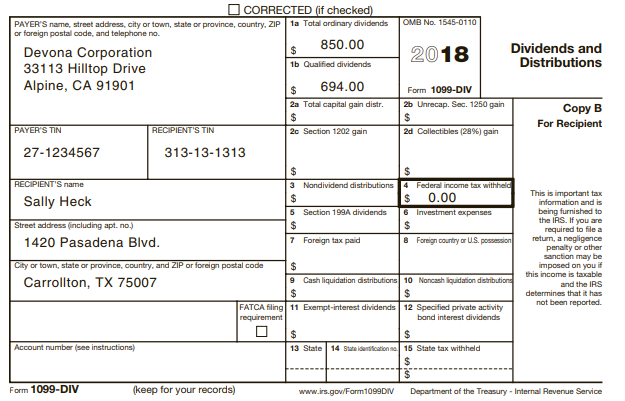

Sally and Charles Heck received the following Form 1099-DIV in 2018: The Hecks also received the following

Question:

Sally and Charles Heck received the following Form 1099-DIV in 2018:

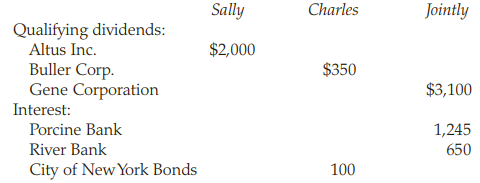

The Hecks also received the following dividends and interest in 2018 (Forms 1099-DIV not shown):

Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 (on Page 2-53) for them for the 2018 tax year. Do not attempt to complete the Qualified Dividends and Capital Gain Tax Worksheet.

Transcribed Image Text:

CORRECTED (if checked) OMB No. 1545-0110 1a Total ordinary dividends PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 850.00 Dividends and Distributions Devona Corporation 33113 Hilltop Drive Alpine, CA 91901 2$ 2018 1b Qualified dividends 694.00 Form 1099-DIV 2a Total capital gain distr. 2$ 26 Unrecap. Sec. 1250 gain 2$ Copy B For Recipient RECIPIENT'S TIN PAYER'S TIN 20 Section 1202 gain 2d Collectibles (28%) gain 27-1234567 313-13-1313 24 24 RECIPIENT'S name 3 Nondividend distributions 24 5 Section 199A dividends Federal income tax withheld 2$ 4 This is important tax information and is being furnished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable 0.00 6 Investment expenses 24 Sally Heck Street address (including apt. no.) 24 7 Foreign tax paid 8 Foreign country or U.S. possesion 1420 Pasadena Blvd. City or town, state or province, country, and ZIP or foreign postal code 2$ 9 Cash liquidation distributions 10 Noncash liquidation distributions 24 Carrollton, TX 75007 and the IRS determines that it has not been reported. %24 FATCA filing 11 Exempt-interest dividends 12 Specified private activity requirement bond interest dividends 2$ Account number (see instructions) 13 State 14 Sute identification no 15 State tax withheld 24 Form 1099-DIV (keep for your records) www.irs.gov/Form1099DIV Department of the Treasury - Internal Revenue Service Sally Charles Jointly Qualifying dividends: Altus Inc. Buller Corp. Gene Corporation Interest: Porcine Bank River Bank City of New York Bonds $2,000 $350 $3,100 1,245 650 100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

SCHEDULE B Form 1040 Department of the Treasury Internal Revenue Service 99 Names shown on return Charles and Sally Heck Part I Interest See instructi...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Sally and Charles Heck received the following dividends and interest during 2012: Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 (on page 2-33) for them for the 2012 tax...

-

Sally and Charles Heck received the following dividends and interest during 2016: Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 for them for the 2016 tax year. Do not...

-

Kathy Kennedy (age 44) is a single taxpayer and she lives at 212 North Pine Way, Payson, AZ 85541. Her Social Security number is 467-98-9784. Kathy's earnings and income tax withholding as the...

-

You are looking at buying a piece of real estate and you intend to borrow as much as you possibly can from a bank to buy the property. The bank you are dealing with has a requirement that the LVR for...

-

The 2013 financial statements for Armstrong and Blair companies are summarized here: The companies are in the same line of business and are direct competitors in a large metropolitan area. Both have...

-

Find the value of t for which 2x 2 3x + t = 0 has exactly one solution.

-

Describe how the sodium-potassium pump works. Which step in the active transport of sodium and potassium ions requires ATP?

-

a. Enter the data in a spreadsheet. b. Create a scatter diagram of these data. c. Use regression to estimate the parameters for the following linear equation for the data. = b0 + b1X1 What is the...

-

you are helping a business owner who thinks that forecasting and budgeting isn't necessary because the expense of a business "is what it is" and profits cannot be impacted by the budget. Do you agree...

-

1. By changing the way his group talks about IT investments, CIO Tim Schaefer is trying to change the way the rest of the company sees IT. Why do you think this is necessary? What would be the...

-

Which of the following gifts would probably be held to be taxable to the person receiving the gift? a. One thousand dollars given to a taxpayer by his or her father b. An acre of land given to a...

-

Interest from which of the following types of bonds is included in taxable income? a. State of California bond b. City of New Orleans bond c. Bond of the Commonwealth of Puerto Rico d. U.S. Treasury...

-

Use the Substitution Formula in Theorem 7 to evaluate the integral. THEOREM 7-Substitution in Definite Integrals If g' is continuous on the interval [a, b] and f is continuous on the range of g(x) =...

-

Why has a profitable company like Clarkson had to borrow so much? Clarkson Lumber Case -- https://www.coursehero.com/file/34813703/Clarkson-Lumber-case-study-IA-answer-2018400621docx/ Clarkson Lumber...

-

Suppose an insect propels itself in a jump (projectile motion, no wings involved) at an angle of 46 degrees above the horizontal and reaches a maximum height of 0.342 m above the level ground. What...

-

The magnet has mass 9.40 kg, the force pulling it to the right is 198.1 N, the cord has length 0.96 m and the ceiling is 2.75 m above the floor. How far to the right of its start point will the...

-

d) What is dependency inversion principle? What should you do to follow this principle? Look at the following code snippet and explain what is wrong with it? public abstract class Account { boolean...

-

Diamond Home, a company in the household products industry, had a ROE of 45% last year. What does this number tell Diamond's investors?

-

Selected data derived from the statement of income and statement of financial position of Glennis Co. for a recent year are as follows: Income statement data (in thousands): Net...

-

Under what conditions is the following SQL statement valid?

-

Ellen's tax client is employed at a large company that offers medical flexible spending accounts to its employees. Tom must decide at the beginning of the year whether he wants to put as much as...

-

During the 2016 tax year, Brian, a single taxpayer, received $7,200 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he...

-

How are qualified dividends taxed in 2016? Please give the rates of tax which apply to qualified dividends, and specify when each of these rates applies.

-

Given no change to the 0.8 percent chance that any women have breast cancer, and given that positive mammogram effectiveness is increased from 90% , and given that the false positive rate is...

-

Mr. and Mrs smith plan to open an RESP sinking fund for their child. They figure they need to have $121,000 till their son is 18 years old. if their sinking fund has a semiannual interest rate of...

-

Solve the equation. 180x3 +144x2-5x-4=0

Study smarter with the SolutionInn App